As measured by the closing London PM Fix Price, precious metals staged impressive gains this week, rallying across the board. Ongoing concerns about the sovereign debt crisis in Europe, the debt limit ceiling stalemate in the U.S. and a weak dollar all contributed to continued fundamental demand for the metals.

As measured by the closing London PM Fix Price, precious metals staged impressive gains this week, rallying across the board. Ongoing concerns about the sovereign debt crisis in Europe, the debt limit ceiling stalemate in the U.S. and a weak dollar all contributed to continued fundamental demand for the metals.

After the London close, precious metals continued to gain in New York trading with gold at $1,537.00, silver at $38.15, platinum at $1,805.00 and palladium at $766.00.

The star of the week was silver which gained $2.89 per ounce for a gain of 8.3% on the week. Although the correction of silver in early May was dramatic, the sharp pullback has provided long term investors with an opportunity to add to positions. Silver fundamentals remain strong as detailed in a recent report by the Silver Institute in which it was noted that demand remained robust despite higher prices. In addition, although higher prices has lead to increased mine exploration and production, new silver production during 2010 rose by only 2.5%.

| Precious Metals Prices | ||

| PM Fix | Since Last Recap | |

| Gold | $1,533.00 | +42.25 (+2.83%) |

| Silver | $37.69 | +2.89(+8.30%) |

| Platinum | $1,786.00 | +19.00 (+1.08%) |

| Palladium | $757.00 | +23.00 (+3.13%) |

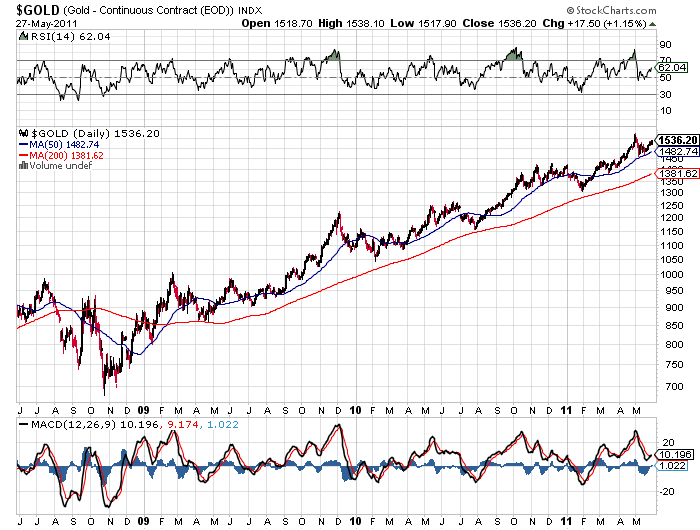

Gold has recovered nearly all of its early May price correction and is now only $8 off its high of $1,541.00 as measured by the London PM Fix Price. The trend in gold remains solidly bullish and any price corrections should be viewed as a buying opportunity.

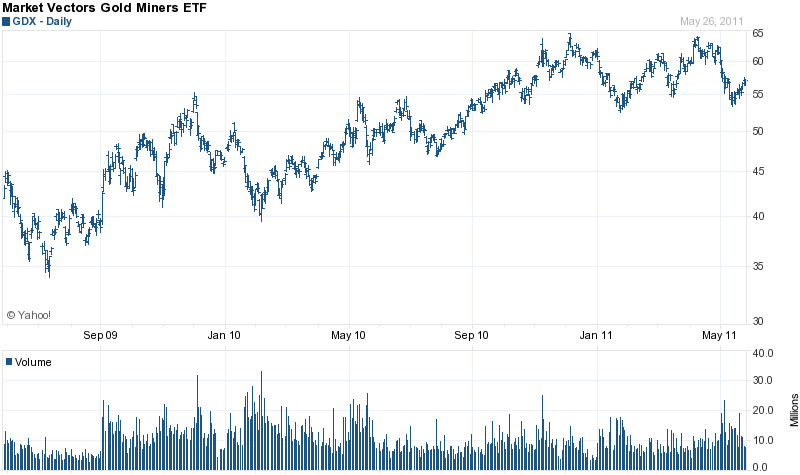

Gold stocks, many of which have trailed the returns of gold bullion, may also be viewed as attractive at this point. As measured by the Market Vectors Gold Miners ETF (GDX), gold stocks are moving up after making multiple bottoms at the $55 support level.

Many of the gold mining stocks are selling at steep discounts to their gold reserves and represent solid values. Earlier this week, Kinross Gold, which sells at the equivalent of $250 per ounce, was a featured story. Value investor David Steinberg of DLS Capital Management, has a price target on Kinross of $27 per share. Kinross closed today at $16.11.

This blog is very much informative about different metals. The graphical representation really helps to understand the blog much more easily. Thanks for such a great info. Keep blogging.