Rep. Ron Paul, during a Subcommittee hearing on problems at the US Mint, linked the shortage of gold and silver coins to the “huge debasement” of the United States currency.

Rep. Ron Paul, during a Subcommittee hearing on problems at the US Mint, linked the shortage of gold and silver coins to the “huge debasement” of the United States currency.

The remarks came during a hearing by the House Financial Services Subcommittee on Domestic Monetary Policy, entitled “Bullion Coin Programs of the United States Mint: Can They Be Improved?” Four different coin and previous metals industry experts provided testimony on how to address ongoing problems with coin production and shortages.

After some lengthy discussion by witnesses and committee members regarding shortages of silver coin blanks and marketing and production problems at the US Mint, Rep. Paul focused on what he considered to be the primary reason why the US Mint was, at times, unable to meet public demand for gold and silver coins.

Listed below are highlights of Rep. Paul’s remarks at the Subcommittee hearing.

- It is “imperative” that the US Mint should be able to produce an adequate supply of coins to the U.S. public. According to Rep. Paul, investors are rushing to purchase gold and silver due to quantitative easing by the Federal Reserve.

- The US Mint should take the appropriate steps to source enough planchets to meet public demand for gold and silver coins. People are worried, stated Rep. Paul, and are trying to preserve their wealth through the purchase of gold and silver due to government policies that will lead to inflation and debasement of the currency. Rep. Paul stated that “If we had a sound currency” there would not be a shortage of gold and silver coins since demand by the public would be a non event.

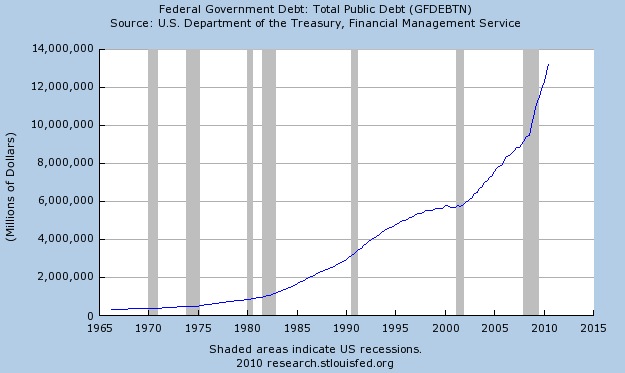

- Rep. Paul detailed the “horrendous huge debasement” that has occurred with the US currency. In the early 1930’s, when gold was on a fixed exchange rate with the US dollar, the dollar was worth 1/20 ounce of gold. It was subsequently devalued to 1/35 ounce of gold during the 1940’s, to 1/38 ounce of gold in the early 1970’s and to 1/42 in 1973. Once it became legal for US citizens to own gold and the dollar was based on market prices, the value of one dollar subsequently dropped to 1/1450 ounce of gold.

- Rep. Paul noted that total annual demand during 2011 for Silver Eagle bullion coins should reach 48 million ounces, but that total US silver production would amount to only 40 million ounces. The US Mint should take all necessary steps to ensure that adequate supplies of silver are available to meet public demand for silver coins.

Although not specifically addressed, the issue of whether the US government is making an effort to limit the sale of gold and silver coin to the public remains an open question. By law, the US Mint is required to produce coins “in quantities and qualities that the Secretary determines are sufficient to meet public demand”. There were no US Mint representatives present at the Subcommittee hearing to explain why the US Mint is unable to comply with production mandates specified by law.

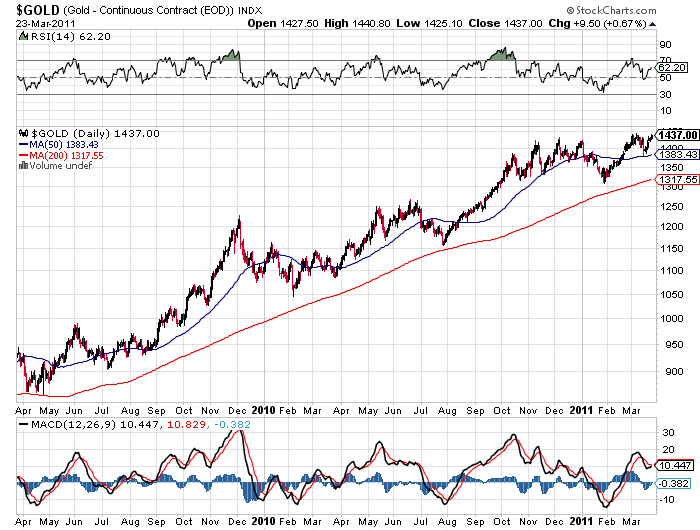

Gold soared to new all time highs in Asian markets and silver pierced the $40 per ounce level as new demand continues to drive precious metal prices higher.

Gold soared to new all time highs in Asian markets and silver pierced the $40 per ounce level as new demand continues to drive precious metal prices higher. Gold and silver prices rose to new highs today on continuing concerns over a weak U.S. dollar, the European debt crisis, growing conflicts in the MidEast and escalating doubts over the ability of the United States to avoid a debt crisis. The ongoing budget charade in Washington makes it perfectly clear that neither political party has the desire or ability to seriously address the exploding level of U.S. debt.

Gold and silver prices rose to new highs today on continuing concerns over a weak U.S. dollar, the European debt crisis, growing conflicts in the MidEast and escalating doubts over the ability of the United States to avoid a debt crisis. The ongoing budget charade in Washington makes it perfectly clear that neither political party has the desire or ability to seriously address the exploding level of U.S. debt.

Gold and silver prices, as measured by the London PM Fix Price, were largely unchanged on the week. Gold slipped by $18 per ounce while silver declined modestly by $.05

Gold and silver prices, as measured by the London PM Fix Price, were largely unchanged on the week. Gold slipped by $18 per ounce while silver declined modestly by $.05

Gold trusts have probably been a decisive factor in promoting the ownership of gold and expanding the market to investors who would otherwise not participate in the market. Prior to the establishment of the gold trusts, investors had two primary options for investing in gold, both of which had drawbacks. Gold investors could purchase the shares of gold mining companies or physically purchase gold coins or bars.

Gold trusts have probably been a decisive factor in promoting the ownership of gold and expanding the market to investors who would otherwise not participate in the market. Prior to the establishment of the gold trusts, investors had two primary options for investing in gold, both of which had drawbacks. Gold investors could purchase the shares of gold mining companies or physically purchase gold coins or bars.

As measured by the London PM Fix price, gold and silver prices gained on the week after declining approximately 1% each in the previous week. Gold gained $8.50 per ounce on the week to $1,420.00. Silver was the stand out gainer on the week with a 3% or $1.05 per ounce gain. As the situation in Japan and Libya stabilized somewhat, the recent panic selling in financial markets subsided as bargain hunters moved in, although in late trading, stocks gave up much of their gains. Gold and silver also pulled back slightly in New York trading with gold at $1417.80 and silver at $35.10.

As measured by the London PM Fix price, gold and silver prices gained on the week after declining approximately 1% each in the previous week. Gold gained $8.50 per ounce on the week to $1,420.00. Silver was the stand out gainer on the week with a 3% or $1.05 per ounce gain. As the situation in Japan and Libya stabilized somewhat, the recent panic selling in financial markets subsided as bargain hunters moved in, although in late trading, stocks gave up much of their gains. Gold and silver also pulled back slightly in New York trading with gold at $1417.80 and silver at $35.10.

In the view of many, recent world events should have resulted in soaring gold prices as investors flocked to gold, the ultimate safe haven investment. Oddly enough, major sell offs in world stock markets due to turmoil in the Middle East and a massive earthquake in Japan did nothing to push gold above its all time closing high of $1,440 hit in early March.

In the view of many, recent world events should have resulted in soaring gold prices as investors flocked to gold, the ultimate safe haven investment. Oddly enough, major sell offs in world stock markets due to turmoil in the Middle East and a massive earthquake in Japan did nothing to push gold above its all time closing high of $1,440 hit in early March.