Gold and silver prices rose to new highs today on continuing concerns over a weak U.S. dollar, the European debt crisis, growing conflicts in the MidEast and escalating doubts over the ability of the United States to avoid a debt crisis. The ongoing budget charade in Washington makes it perfectly clear that neither political party has the desire or ability to seriously address the exploding level of U.S. debt.

Gold and silver prices rose to new highs today on continuing concerns over a weak U.S. dollar, the European debt crisis, growing conflicts in the MidEast and escalating doubts over the ability of the United States to avoid a debt crisis. The ongoing budget charade in Washington makes it perfectly clear that neither political party has the desire or ability to seriously address the exploding level of U.S. debt.

Gold hit a new all time high of $1463.70 and silver reached a 31 year high at $39.79. Prices of both metals eased in early afternoon trading with the New York Spot Price for gold at $1456.70 and silver down fractionally at $39.33. The limit on future increases in precious metals prices has effectively been removed due to the absolute inability of Congress to address the looming debt crisis.

With the United States facing a $1.5 trillion dollar deficit on a projected budget of $3.6 trillion, politicians are threatening to shut down the Government over their inability to agree on whether spending should be cut by $40 or $60 billion. Does anyone really believe that Congress is capable of coming to terms with the reality of an exploding deficit and spiraling national debt when agreement cannot be reached on $20 billion – a mere one half of one percent of total government spending?

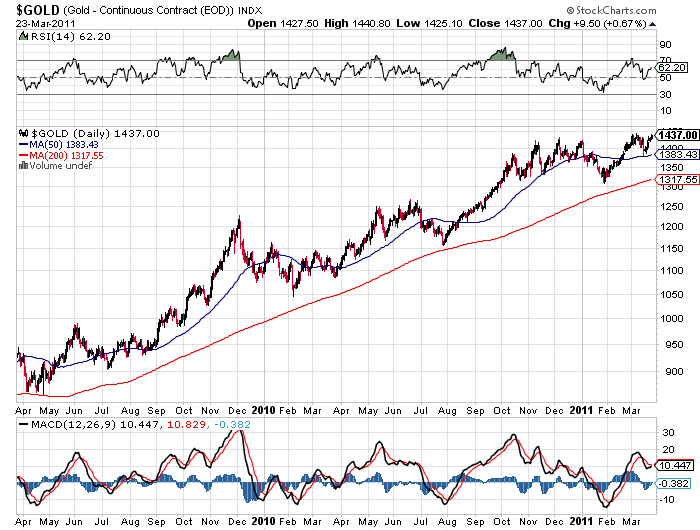

The surge in gold prices reflects the realization that the nation is on the fast track to higher interest rates, a spiraling increase in the cost of living and a continued debasement of the U.S. dollar (see Why There Is No Upside Limit To Gold and Silver Prices).

Meanwhile, as the threat of a Government shutdown looms, Treasury Secretary Geithner warned of dire consequences if the U.S. is not allowed to borrow more money by raising the debt ceiling above its current limit of $14.3 trillion. At a meeting with a Senate Appropriations subcommittee Secretary Geithner forecast that a U.S. default would lead to much higher interest rates, the failure of hundreds of thousands of businesses, payment cuts to senior citizens and a financial crisis worse than that of 2008 – 2009.

Geithner’s prediction of Armageddon, unfortunately, comes with no prescription on how to reign in out of control Government financial policies which are the fundamental threat to the country’s economic future. It’s not just this year’s or last year’s multi trillion dollar deficits that are the root of concern, but rather the massive long term structural deficits that are now built into Government spending budgets.

The debt limit will eventually be raised and both political parties will claim victory. America’s creditors will ponder the increasing risk of U.S. Treasury debt and ultimately conclude that the U.S. has no will to fix a financial system on the brink of insolvency. The ultimate day of financial Armageddon, alluded to by Secretary Geithner, will not be forestalled by our unworkable political process. The final reckoning and hard choices will be made only when forced upon us by markets that refuse to finance additional U.S. borrowing.

The price of gold hit an all time highs for the second day in a row, while silver prices moved up to a new 31 year high.

The price of gold hit an all time highs for the second day in a row, while silver prices moved up to a new 31 year high.