Silver was again the star performer in the precious metals group, hitting a new yearly high of $42.61. For the second week in a row, silver has added over $2 per ounce as measured by London PM Fix Price. After soaring $2.59 in the previous week, silver capped another standout week with a gain of $2.39.

Silver was again the star performer in the precious metals group, hitting a new yearly high of $42.61. For the second week in a row, silver has added over $2 per ounce as measured by London PM Fix Price. After soaring $2.59 in the previous week, silver capped another standout week with a gain of $2.39.

As a long time patient investor in silver, the moves over the past couple of years have been nothing less than amazing. In the early 1990’s, a one ounce silver eagle did not cost much more than $5 per coin. In just the past two weeks we have witnessed silver increase in value by $4.98 per ounce. Am I nervous about the rapid appreciation or worrying about a correction that the main stream press is calling for?

Not in the least – I am in silver for the long term and the policies of our government and central bank virtually guarantee much larger profits in the future (see Why Gold and Silver Have No Upside Limit, and Budget Fiasco Sends Wrong Message To Creditors and The Perfect Storm for Gold and Silver).

Any price corrections in the precious metals (and yes they will happen) should be viewed as opportunities to increase positions.

| Precious Metals Prices | ||

| Fri PM Fix | Since Last Recap | |

| Gold | $1,476.75 | +7.25 (+0.49%) |

| Silver | $42.61 | +2.39(+5.94%) |

| Platinum | $1,787.00 | -16.00 (-0.89%) |

| Palladium | $772.00 | -26.00 (-3.26%) |

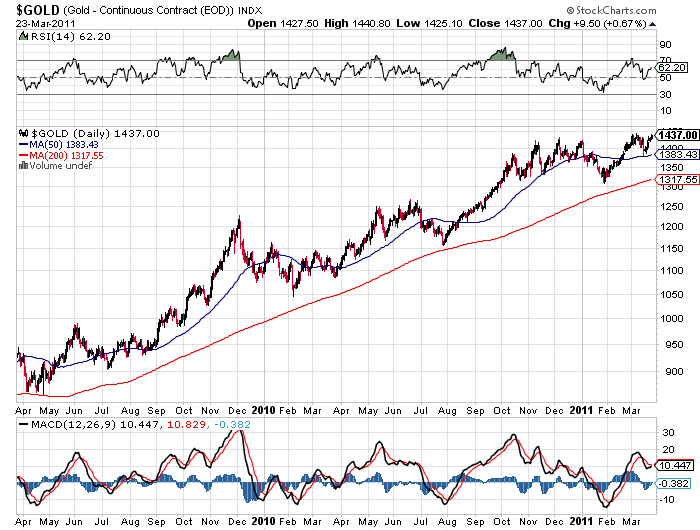

Gold, as measured by the closing London PM Fix Price, hit another all time high, closing at $1,476.75, up $7.25 on the week after running up $51.50 in the previous week. After breaking out of its base in the $1,450 range, gold could be getting ready for a substantial move upwards.

Paper money is all about confidence and, to anyone paying attention, last week’s “budget compromise” proved conclusively that our government is absolutely incapable of reducing spending. After threatening us with a government shutdown and terrifying half of the citizens of this Nation with a potential cutoff of entitlements, both political parties proclaimed victory with an inconsequential spending reduction of $38 billion. Keep in mind that this year’s deficit is almost 37 times the proposed spending cuts.

The problem with the “compromise cuts” is that both political parties lied to us and they were called out by the Congressional Budget Office (CBO) which said actual spending would be reduced by only a laughable $352 million. Futhermore, the CBO noted that when “emergency spending” and the cost of multiple wars is factored in, actual spending would actually be $3 billion higher than the 2011 budget forecast. It is not by accident that gold and silver have been soaring.

Ron Paul, one of the very few courageous and honest politicians that this country is lucky to have, said the following in a commentary about the latest events in Washington.

Last week, Congress and the administration refused to seriously consider the problem of government spending. Despite the fear-mongering, a government shutdown would not have been as bad as claimed.

A compromise was struck at the last minute, but until Democrats agree to rein in entitlement spending, and Republicans back off the blank checks to the military industrial complex, it all amounts to political gamesmanship.

Unfortunately, the compromises always seem to be just the opposite. Instead of the left agreeing to cut social spending and the right agreeing to cut military spending, the right agrees to more welfare and the left agrees to more warfare. In spite of all the rhetoric, we will go deeper in debt, the Fed will print more money, and the value of the dollar will continue to plummet. How long will it be before foreigners stop buying our debt, and hyperinflation arrives? Throughout history, empires have always overextended themselves through conquests and wealth transfers leading to eventual collapse, from the Roman Empire to the Soviet Union. We are headed in the same direction and it seems only the chaos of the collapse of the dollar will stop the spending spree. Arguing over funding for Planned Parenthood and NPR, though important, only shows that leadership in Washington either won’t face reality, or don’t understand how serious the problem is.

Of course, an actual government collapse would create serious problems for many people who have come to depend on government payments for healthcare, retirement income, their children’s education, and even food and housing. However, these so-called entitlement programs are unconstitutional to begin with and have engendered a culture of dependence on wealth transfer payments that is out of control. It concerns me greatly that instead of dealing seriously with our situation, so many in Washington would rather allow the chaos that will ensue when all of the dependent people are suddenly cut off. Better to look reality squarely in the face and tell people the difficult truth that government is simply not capable of managing people’s lives from cradle to grave as was foolishly promised. We face trillions in deficits with any of the budgets under consideration. Keeping those promises is, sadly, just not one of our options in the long run. Better to admit the nanny state is coming to an end and we are no longer working on “compromises” but a transition – to a sustainable way of life, one that respects the constitution, the rule of law and property rights.

In a sign that perhaps the economy may not be as strong going forward as some seem to think, industrial metals platinum and palladium both sold off on the week. Platinum ended down $16 at $1,787 while palladium lost $26 to $772.

Anything but paper dollars was the theme this week as investors rushed into anything of tangible value. Gold, silver, oil and commodities of all types have been skyrocketing since last August when the Federal Reserve announced its second round of quantitative easing.

Anything but paper dollars was the theme this week as investors rushed into anything of tangible value. Gold, silver, oil and commodities of all types have been skyrocketing since last August when the Federal Reserve announced its second round of quantitative easing.

Gold and silver prices rose to new highs today on continuing concerns over a weak U.S. dollar, the European debt crisis, growing conflicts in the MidEast and escalating doubts over the ability of the United States to avoid a debt crisis. The ongoing budget charade in Washington makes it perfectly clear that neither political party has the desire or ability to seriously address the exploding level of U.S. debt.

Gold and silver prices rose to new highs today on continuing concerns over a weak U.S. dollar, the European debt crisis, growing conflicts in the MidEast and escalating doubts over the ability of the United States to avoid a debt crisis. The ongoing budget charade in Washington makes it perfectly clear that neither political party has the desire or ability to seriously address the exploding level of U.S. debt.

The price of gold hit an all time highs for the second day in a row, while silver prices moved up to a new 31 year high.

The price of gold hit an all time highs for the second day in a row, while silver prices moved up to a new 31 year high.