After major upward price movement during the later half of 2010, both the SLV and GLD continue their sideway price action.

As gold and silver prices continue to consolidate, gold holdings in the SPDR Gold Shares Trust (GLD) and silver holdings in the iShares Silver Trust (SLV) both declined.

The iShares Silver Trust, the largest exchange traded fund back by silver, has a market value of $10.2 billion. After a one year return of almost 80%, the SLV showed a weekly decline of 191.46 metric tonnes from the previous week. The SLV now holds a total of 10,725.73 metric tonnes of silver or 344.840 million ounces.

The holdings in the GLD declined by 1.21 metric tonnes in the past week to 1,271.47. The record high holdings of 1,320.47 tonnes in the GLD was reached last year on June 29 when gold bullion was trading in the $1250 range.

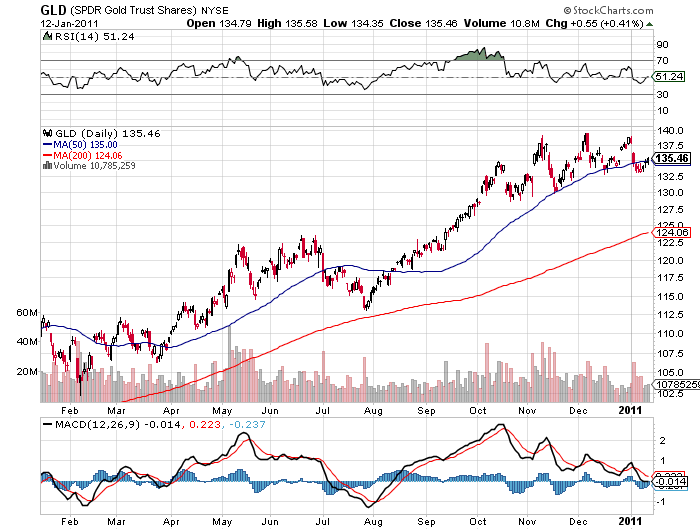

Despite the lack of correlation between gold prices and gold holdings of the GLD, investing in the GLD has produced approximately similar returns to owning bullion, disregarding transaction costs. The price gain during 2010 was approximately 28% for both gold bullion and the GLD. For those who choose to avoid holding the physical metal, the GLD was an excellent substitute choice for gold bullion in 2010.

GLD and SLV Holdings (metric tons)

| Jan 12, 2011 | Weekly Change | YTD Change | |

| GLD | 1,271.47 | -1.21 | -9.25 |

| SLV | 10,725.73 | -191.46 | -195.84 |

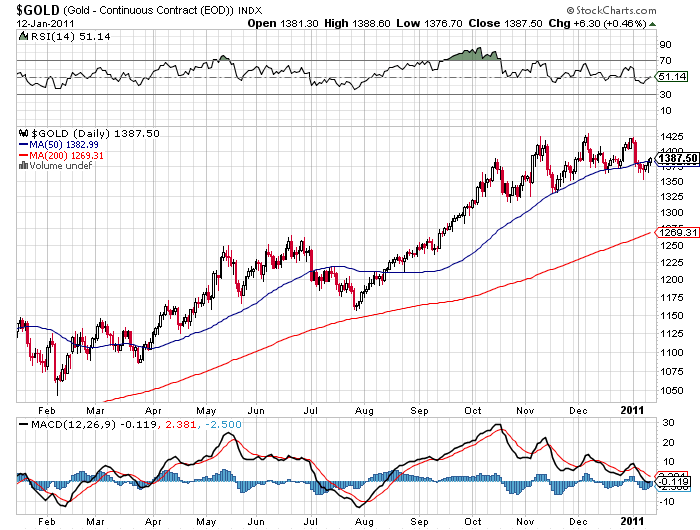

GOLD - COURTESY STOCKCHARTS.COM

GLD - COURTESY STOCKCHARTS.COM

Another Precious Week

Another Precious Week Investors and analysts alike are looking at the record prices of gold last year and trying to predict the future. Last year the price of gold rose by more than 27%, contributing to an increase of more than 400% over the past decade.

Investors and analysts alike are looking at the record prices of gold last year and trying to predict the future. Last year the price of gold rose by more than 27%, contributing to an increase of more than 400% over the past decade. The United States Mint sold less gold bullion during 2010 than the previous year, as measured in ounces. Across their offerings of American Gold Buffalo and American Gold Eagle bullion coins, sales reached 1,429,500 in the current year compared to 1,625,000 in the prior year.

The United States Mint sold less gold bullion during 2010 than the previous year, as measured in ounces. Across their offerings of American Gold Buffalo and American Gold Eagle bullion coins, sales reached 1,429,500 in the current year compared to 1,625,000 in the prior year. Gold just had an amazing year, in which it reached a new all time high, rising about 25%. Silver provided an even more stellar performance, with a gain of about 75% and counting. It’s no wonder then, that more and more investors are becoming interested in the potential offered by silver.

Gold just had an amazing year, in which it reached a new all time high, rising about 25%. Silver provided an even more stellar performance, with a gain of about 75% and counting. It’s no wonder then, that more and more investors are becoming interested in the potential offered by silver. In its quest to determine the best way to make money from investing in gold, the Wall Street Journal recently took an in depth look at four different gold investment strategies. Each was represented by a preeminent investor, one whose method has seen some success recently.

In its quest to determine the best way to make money from investing in gold, the Wall Street Journal recently took an in depth look at four different gold investment strategies. Each was represented by a preeminent investor, one whose method has seen some success recently.

There’s a new exhibit in town at The Field Museum. This exhibit, arranged by the American Museum of Natural History, New York and the Huston Museum of Natural Science, Chicago, focuses on the sheer allure of this very precious metal. It is also the last stop on the exhibition’s tour.

There’s a new exhibit in town at The Field Museum. This exhibit, arranged by the American Museum of Natural History, New York and the Huston Museum of Natural Science, Chicago, focuses on the sheer allure of this very precious metal. It is also the last stop on the exhibition’s tour.