In May of this year, the very first gold vending machine in the world was installed and used. That’s right, a vending machine where a customer can purchase gold bars was put into place. It’s located in Abu Dhabi’s Emirates Palace hotel—a luxurious place that is frequented by billionaires and even royalty—and apparently, it’s been a success. Gold to Go, the company that owns and operates the machine has recently announced that it has plans to consider a US installation.

In May of this year, the very first gold vending machine in the world was installed and used. That’s right, a vending machine where a customer can purchase gold bars was put into place. It’s located in Abu Dhabi’s Emirates Palace hotel—a luxurious place that is frequented by billionaires and even royalty—and apparently, it’s been a success. Gold to Go, the company that owns and operates the machine has recently announced that it has plans to consider a US installation.

Gold to Go

According to the company’s statements, “Gold to Go is a trading and sales concept which facilitates selling gold bars and coins independently from shop-based display and sales locations.”

Their vending machine in Abu Dhabi, sometimes referred to as a gold ATM, is actually covered in 24-carat gold. The machine works by dispensing gold in discrete black packaging. You can choose to purchase your gold in a number of different forms and weight. A small one-ounce bar is being offered as well as six different coins and 1, 5, and 10 gram bar options. Each is engraved to reflect the unique nature of the gold’s origin. The bars are stamped with the Emirates Palace logo while the coins bear the symbols of gold producing locales like Canada, Australia, and South Africa.

Where is it Headed?

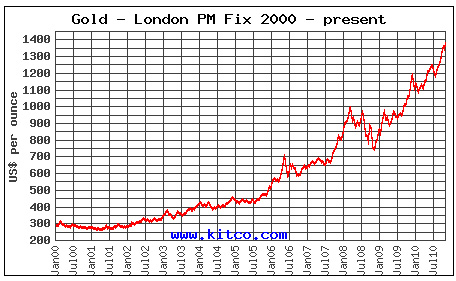

Gold to Go intends their product to target two different audiences. The first is the potential investor. Buying gold this way demystifies the precious metal, they claim. The vending machine can facilitate a private investment for those who would like to take advantage of the metal’s recent market popularity. It also makes a good souvenir for those travelers who can afford it.

The gold vending machines may be available to the public in the United States as early as next year. Currently, it is slated to have locations in both Las Vegas and Florida.

At a recent media briefing,

At a recent media briefing,

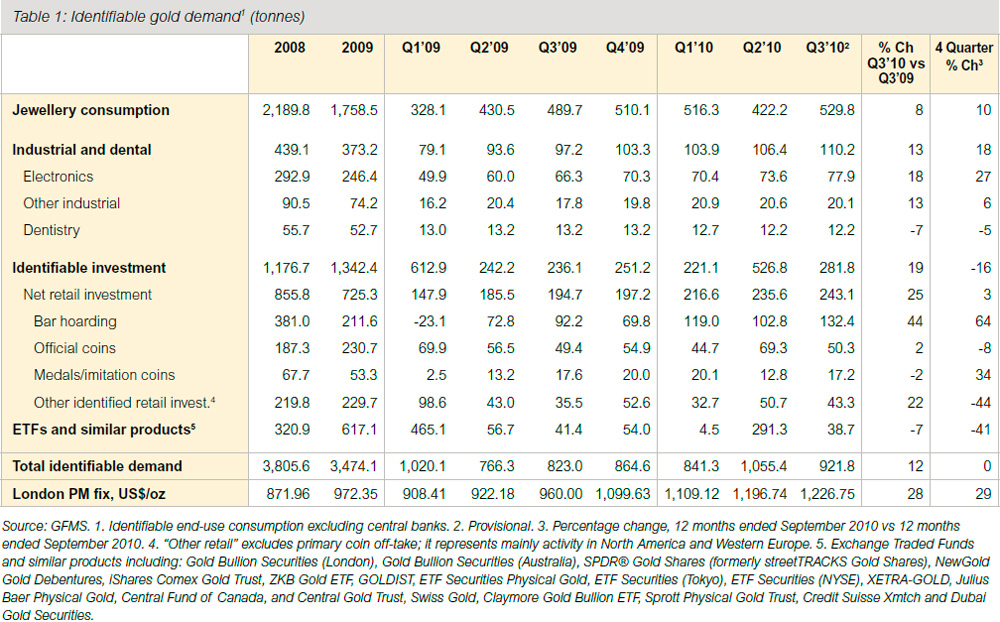

Total identifiable gold demand for the third quarter showed an increase of 12% above year ago levels at 921.8 tonnes. Increases in demand from jewelry consumption, industrial sectors, and net retail investment more than offset a decline in demand from electronically traded funds, according to information published by the

Total identifiable gold demand for the third quarter showed an increase of 12% above year ago levels at 921.8 tonnes. Increases in demand from jewelry consumption, industrial sectors, and net retail investment more than offset a decline in demand from electronically traded funds, according to information published by the

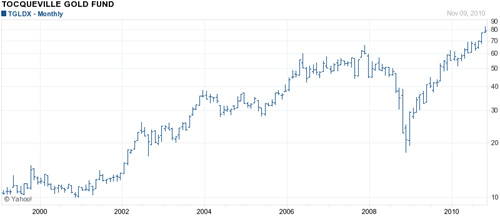

Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.

Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.

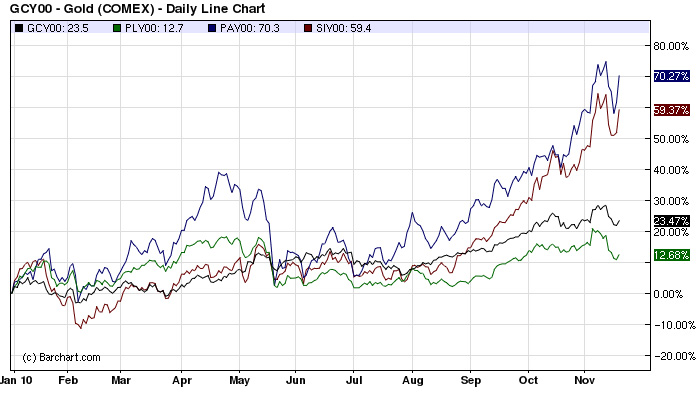

Although gold and silver are experiencing a sharp decline today, they recorded strong performance during the second quarter of 2010. Platinum and palladium both posted declines for second quarter, but maintain gains for the year to date.

Although gold and silver are experiencing a sharp decline today, they recorded strong performance during the second quarter of 2010. Platinum and palladium both posted declines for second quarter, but maintain gains for the year to date. During May 2010, the United States Mint’s gold and silver bullion sales levels reached their highest level in a decade or more for the two most popular offerings. This heavy

During May 2010, the United States Mint’s gold and silver bullion sales levels reached their highest level in a decade or more for the two most popular offerings. This heavy  The

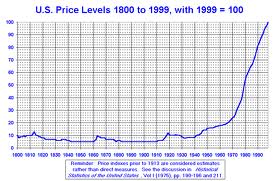

The  There have been numerous recent reports about the surging demand for physical gold. It has been mostly concentrated in Europe, but there have also been signs of new waves of demand hitting the U.S.

There have been numerous recent reports about the surging demand for physical gold. It has been mostly concentrated in Europe, but there have also been signs of new waves of demand hitting the U.S.