On March 1, 2011, the Perth Mint of Australia introduced a new platinum investment coin to complement the gold and silver offerings of their official bullion program. The Perth Mint has not offered a platinum investment coin since the withdrawal of the Platinum Koala in 2000, however they do produce certain platinum numismatic coins.

The Australian Platinum Platypus contains one troy ounce of 99.95% platinum. The design features the native aquatic mammal diving beneath the water. Above the scene is the inscription “Australian Platypus” with the date of issue, bullion weight, and purity indicated below. The other side of the coin features a portrait of Elizabeth II with the legal tender face value of “100 Dollars”.

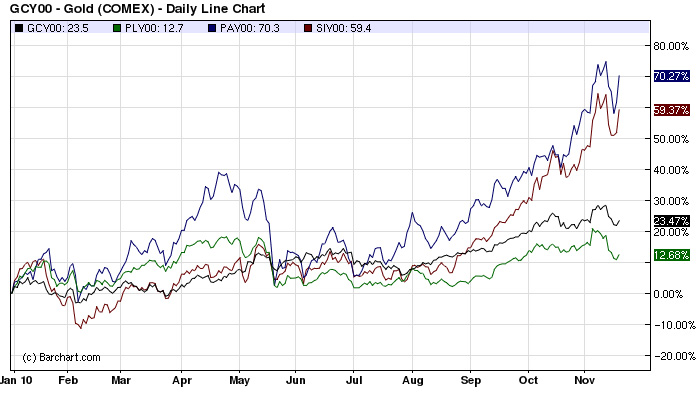

The current market price of platinum is $1,835 per troy ounce. Last year the price of platinum rose by 18.08%, under performing gold, silver, and palladium. For the year to date, platinum has risen about 6%. This compares to gains of 1.24% for gold, 15.25% for silver, and 1.77% for palladium.

A maximum of 30,000 Platinum Playpus coins will be issued by the Perth Mint during 2011. All future annual releases will carry the same limit.

Other world mints that offer platinum bullion coins include the Royal Canadian Mint with their Platinum Maple Leaf offering. In the past, the United States Mint has American Platinum Eagle bullion coins, however these have not been issued since 2008. Initially, production was halted in an effort to deal with surging demand for gold and silver bullion coins.

Precious metals delivered another year of strong performance, with double digit percentage gains for gold, silver, platinum, and palladium.

Precious metals delivered another year of strong performance, with double digit percentage gains for gold, silver, platinum, and palladium.