Most people under the age of 50 have probably never seen government currency backed by a tangible asset such as silver. The $1 dollar Silver Certificates, last produced in 1963, were backed by silver on deposit in the US Treasury and payable in silver to “the bearer on demand”.

The promise to redeem Silver Certificate dollars for silver was withdrawn by the US Government and holders of such dollars had to be satisfied that the value of their dollar was now backed by the “full faith and credit” of the US Government. Redemption of Silver Certificates for silver coin ended in 1964 and redemption of Silver Certificates for silver bullion was ended in 1968.

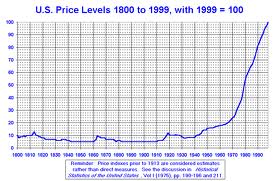

The era of currency backed by real money such as gold or silver ended and the dawn of a fiat currency system began. The result for holders of currency backed by nothing more than promises has been disastrous as the value of paper dollars has seen its purchasing power virtually disappear.

- Chart: dollardaze.org

As the quantity of dollars has grown exponentially, their value has correspondingly diminished, leading to a large increase in general price levels.

- Chart pbs.org

Despite the obvious increase in prices and the collapse of the value of the dollar, the Federal Reserve tells us they now need to engage in money printing quantitative easing in order to create inflation to help the economy. Fed Chairman Bernanke ensures us that the Fed is committed to keeping inflation low.

“Although asset purchases are relatively unfamiliar as a tool of monetary policy, some concerns about this approach are overstated. Critics have, for example, worried that it will lead to excessive increases in the money supply and ultimately to significant increases in inflation. Our earlier use of this policy approach had little effect on the amount of currency in circulation or on other broad measures of the money supply, such as bank deposits. Nor did it result in higher inflation. We have made all necessary preparations, and we are confident that we have the tools to unwind these policies at the appropriate time. The Fed is committed to both parts of its dual mandate and will take all measures necessary to keep inflation low and stable.”

The Fed has not succeeded at keeping inflation low in the past and now seems obsessed with inflating asset values to prop up a weak economy. It’s all about trust with fiat money, and the Fed Chairman seems to be losing credibility.

The price movements in gold and silver are strong indicators that no one is being fooled by the Fed Chairman’s words. Investors are watching “what they do – not what they say”. Expect gold and silver prices to be dramatically higher over time, with an initial objective of $5,000/oz for gold.

Well it looks like the G20 worked. Talk of ending

Well it looks like the G20 worked. Talk of ending