Precious metal prices traded in a narrow range this week. As measured by the closing London Fix Price, gold, platinum and silver declined slightly while palladium gained $16 per ounce.

Precious metal prices traded in a narrow range this week. As measured by the closing London Fix Price, gold, platinum and silver declined slightly while palladium gained $16 per ounce.

After the London close, prices of precious metals rose across the board in New York afternoon trading. Gold closed at $1,514.50 up $19.70, silver at $35.26 up $.12, platinum at $1,775 up $8 and palladium at $739 up $8. Buying in the precious metals may have been prompted by late day worries over the downgrade of Greek debt by Fitch Ratings as well as concerns over the worsening state of public finances in Spain, Portugal and Italy.

Yields of 25% on short term debt Greek debt imply that the markets are are pricing in a very high probability of default by Greece. What markets do not seem to have priced in is the contagion risk of Greek default and what impact that would have on investor confidence, world financial markets and the global banking system.

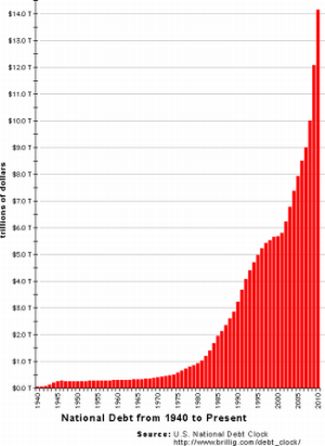

Meanwhile the U.S. debt crisis continues to brew as the debt ceiling limit was reached with no indication of a resolution by Congress. If the past is any guide, Congress will let the debt bomb/deficit crisis simmer until the last minute when the debt ceiling will be raised yet again under the guise of “future fiscal restraint” and the deficit spending and borrowing will continue as usual.

Ignoring the eroding financial condition of the U.S. today only ensures that the inevitable financial crisis will be more devastating than one might chose to contemplate. The timing may be uncertain but the outcome is not.

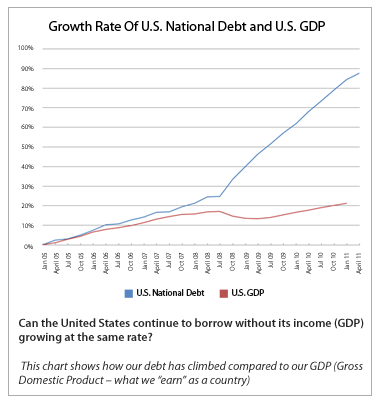

The American Precious Metals Exchange (APMEX) included a chart in one of its latest email newsletters that depicts the gap between the growth of U.S. GDP and debt. The chart graphically illustrates the extent to which the U.S. has been living beyond its means and using trillions in deficit financing to do so.

APMEX also notes that “If there is no resolution (of the budget ceiling) by August 2nd, there could be disastrous ramifications for the U.S. and the global economy. The U.S. will be in default on its promises to pay. The value of the dollar could drop dramatically.”

| Precious Metals Prices | ||

| PM Fix | Since Last Recap | |

| Gold | $1,490.75 | -15.00 (-1.00%) |

| Silver | $34.80 | -1.40(-3.87%) |

| Platinum | $1,767.00 | -7.00 (-0.39%) |

| Palladium | $734.00 | +16.00 (+2.23%) |

Precious metals, silver in particular, have been undergoing corrective price action during May, but the fundamental reasons for owning precious metals grows stronger by the day. Demand for precious metals remains strong. The World Gold Council’s latest report shows that global demand for gold increased by 11% in the first quarter, while buying by Chinese investors reached all time highs. The trend is still your friend in the precious metals markets and price weakness should be viewed as an opportunity to increase long term positions.

A broad sell off in commodity prices triggered by a Goldman Sachs prediction of a “substantial pullback” in oil prices had little impact on the strong uptrend in gold and silver prices. Based on the London closing PM Fix Price, gold ended Tuesday off only $19 or 1.3% from Friday’s all time close. Silver, meanwhile, the absolute star of the precious metals group, closed Tuesday at $40.44, up 22 cents from Friday’s 31 year closing high. After the recent huge run up in both gold and silver prices, the very modest price declines suggests that the bulls are on the right side of the trade.

A broad sell off in commodity prices triggered by a Goldman Sachs prediction of a “substantial pullback” in oil prices had little impact on the strong uptrend in gold and silver prices. Based on the London closing PM Fix Price, gold ended Tuesday off only $19 or 1.3% from Friday’s all time close. Silver, meanwhile, the absolute star of the precious metals group, closed Tuesday at $40.44, up 22 cents from Friday’s 31 year closing high. After the recent huge run up in both gold and silver prices, the very modest price declines suggests that the bulls are on the right side of the trade.