Despite the non stop rally in the price of gold for over a decade, every normal pullback has been proclaimed as “the end of the gold bull market” by the mainstream media. Will gold eventually become an over-owned and overpriced asset? Yes – but that day will not arrive until gold is many thousands of dollars higher. Long term gold investors who have stayed with the primary trend have already outperformed every other asset class over the past decade as shown in this neat infographic from the Visual Capitalist.

Is Gold The Only Protection From The Fed’s Monetary Madness?

By Axel Merk

By Axel Merk

Investors are concerned about inflation. But how can investors attempt to inflation-proof their portfolios? Buy TIPS? Short Treasury bonds? Stocks? Real Estate? Commodities? Gold? Currencies? Or should investors regard those warnings about inflation as fear mongering?

Indeed, as the Federal Reserve (Fed) announced its latest round of quantitative easing (“QE3”), gauges of future inflation expectations spiked. In our assessment, the market reacted strongly as it became apparent that the Fed is moving away from its focus on inflation to a focus on employment. We believe the Fed wants to raise the price level so as to bail out millions of homeowners that are ‘under water’, i.e. owe more on their homes than they are worth. Fed Chair Bernanke considers a healthy housing market to be key to healthy consumer spending (see our Merk Insight Don’t worry, be Happy).

Judging from the market reaction to QE3, fears about future inflation are warranted. Having said that, market fears about looming inflation have calmed down a bit since the initial flare up. Could it be this calming of the market is due to the fact that the Fed is intervening in the TIPS market? TIPS are “inflation protected” Treasury securities that are linked to the Consumer Price Index. Investors buying TIPS do so in the hope that their purchasing power might be protected. When the Fed intervenes in the market to buy TIPS (or any other security for that matter), such securities are intentionally over-priced, raising doubt as to whether investors are truly “protected” from inflation. It’s not just investors that now have more limited access to measuring inflation expectations – it’s also the Fed itself. By managing the entire yield curve (short-term through long-term interest rates), we believe the Fed has blindfolded itself, as it has taken away one of the most important gauges about the health of the economy. Aside from the Fed’s intervention in the TIPS market, the government is free to change the inflation adjustment factor employed in TIPS before the securities mature. TIPS payouts are adjusted using the consumer price index (CPI), which has seen methodology changes many times. When the recent debt ceiling impasse was discussed, both Republicans and Democrats talked in favor of changing the CPI definition so that it would nominally live up to inflation linked entitlement promises while clearly eroding the purchasing power of such payouts. Even without such gimmickry, the CPI may not be reflective of the basket of goods and services consumed by investors as they approach retirement given, for example, that healthcare may comprise an ever-increasing part of one’s spending. Alas, much of investing is about trying to preserve purchasing power and, alas, buying TIPS may not provide adequate protection.

If one is negative about the inflation outlook, why not simply short Treasuries, either directly or through ETFs? While we are pessimistic about the long-term outlook of Treasuries, it can be very costly to short them, given that – as a short seller – one has to continuously pay the interest of the securities one shorts. If one buys an ETF shorting Treasuries, the cost of the ETF is to be added. Shorting Treasuries might make sense for investors that are good at market timing. However, calling the top in major bubbles is rather difficult, just reflect on former Fed Chair Alan Greenspan’s “irrational exuberance” speech years ahead of the stock market collapse in 2000; similarly, those that saw the bubble in the housing market coming didn’t necessarily get the timing right.

If TIPS don’t provide enough bang for the buck, and shorting Treasuries can be costly, what about buying stocks? Bernanke appears to use every opportunity possible to praise the benefits QE has on rising stock prices. While we agree that QE has pushed stock prices higher, it may be dangerous for the Fed to praise this link given that it raises expectations of more Fed easing whenever the markets plunge (see Merk Insight: Bernanke Put). For example, how many investors buy Cisco 1 shares because of the great management skills of CEO John Chambers as compared to those who buy because of QE3? We pose this question because stocks are rather volatile; not only are stocks volatile, but the volatility of stocks can be all over the place. Historically, the annualized standard deviation of the S&P 500 index hovers in the mid 20% range, with outbursts into the 40% range in 2008. So why are investors taking on the “noise” of the stock market, when the reason they invest is because of QE? Indeed, our analysis shows that investors appear to be ever more chasing the next perceived intervention by policy makers rather than investing based on fundamentals. That’s not only bad for capital formation (these misallocations are summarily referred to as “bubbles” these days), but also suggests that we might want to look for a more direct way to take a position on what we call the “mania” of policy makers.

Talking about policy makers: you might not agree with them, but if there is one good thing to be said about our policy makers, it is that they may be quite predictable.

What about real estate? In the U.S., depending on where one lives, the real estate market has bottomed out or appears to be bottoming out. With what appears to be the Fed’s razor sharp focus on real estate, it might be foolish to bet against the Fed. Indeed, yours truly bought a property in Palo Alto in late 2009. Unlike other real assets, keep in mind that real estate is often purchased with borrowed money; as such, it is prone to speculative bubbles such as the most recent episode. Investing in REITs might allow one to allocate a smaller share of one’s portfolio to real estate; a downside of REITs is that they tend to be highly correlated with equity markets. As policy makers steer equity prices, everything appears to be ever more highly correlated, investors may want to look for something that offers low correlation to other investments.

That brings us to commodities. In a world where policy makers appear to favor growth at just about any cost, commodity prices have been beneficiaries. As we have seen in recent weeks, it is not a one-way street, as dynamics within the market can be rather complex. The dynamics for commodities within agriculture differ from those in metals or energy. There are special considerations in storing and delivering many commodities, creating challenges for investors. We agree that commodities might do well in the long run, but urge investors to consider all the risks that come with investing in commodities. Notably, commodities can have stretches of low volatility, luring investors to jump in, only to be greeted with a jolt that can be rather hazardous to one’s wealth. As a simple rule of thumb: if you can’t sleep at night with your investment, you own too much of it.

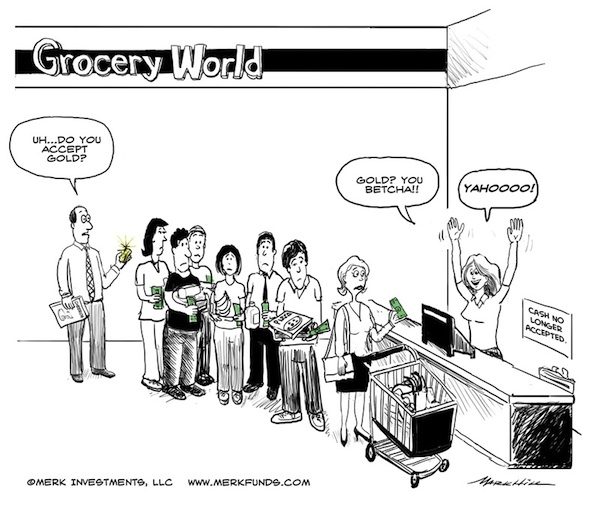

Gold is worth singling out as the one commodity that has arguably the least industrial use. Rather than writing gold off as a barbaric relic, we like gold: its relative simplicity might make it the investment purest in reflecting monetary policy. In the medium term, we believe gold may be a good inflation hedge. But, again, keep in mind that price movements can be rather volatile. Even staunch gold bugs rarely have all their assets in gold.

This leads us to currencies as a potentially attractive way to diversify beyond gold. The Chinese have long diversified their reserves to a basket of currencies, in an effort to mitigate their U.S. dollar exposure. Some say currencies are difficult to understand. We argue that it is far easier to understand the dynamics of ten major currencies, as well as others worth monitoring, than to understand the dynamics of thousands of stocks. Importantly, we believe the currency markets might be an ideal place to take a position on the mania of policy makers. Indeed, as we believe that the Fed might want to debase the U.S. dollar (Please see Fed may want to debase dollar), why not express that view in the currency markets? Unlike their reputation, currencies are far less volatile than equities: if one does not employ leverage, a move in the euro by 1 cent is rather small on a percentage basis. The U.S. dollar index has historically had an annualized standard deviation of returns in the low teens; in 2008, that volatility rose a tad, approaching the mid-teens. For investors looking for predictability on the risks in a portfolio, the currency markets have historically shown a far more consistent risk profile than equities or many other asset classes. A corollary is that during market downturns, unlevered currency strategies may offer some downside protection given the lower risk profile. This clearly doesn’t mean an investment in currencies is safe; but managed currency risk can be seen as an opportunity given the purchasing power risk taken by holding U.S. dollars.

If investors agree that the Fed: a) may want to have – or at least accept – higher inflation; and b) may not readily see the warning signs of higher inflation, then it appears to us prudent to take the risk of higher inflation into account. Indeed, for those managing money on behalf of others, it might be their fiduciary duty to take that risk into account. Those that ignore the risk of inflation might do so at their own peril. Many investors might feel they can take action once inflation is obvious. “Obvious” is in the eye of the beholder: just as we preferred to be early in warning about the crisis in 2008, it appeared rather challenging to reposition one’s portfolio in October 2008. Gold has gone up by a factor of about 7 since its lows. The dollar has fallen relative to a basket of currencies over the past 10, 30 and 100 years: in our assessment, we simply have the better printing press. Hedging inflation risk isn’t about being right about the future; it’s about the risk of being right.

Axel Merk

Axel Merk is President and Chief Investment Officer, Merk Investments

Merk Investments, Manager of the Merk Funds

$10,000 Gold Possible As Fed Ramps Up Money Printing

In the wake of the near death of the financial system in 2008, the Federal Reserve engaged in two rounds of quantitative easing and pumped trillions of dollars into banks and other financial institutions. Ben Bernanke insists that such drastic actions by the central bank were necessary to prevent a depression, a claim that economists will no doubt be debating for decades.

In the wake of the near death of the financial system in 2008, the Federal Reserve engaged in two rounds of quantitative easing and pumped trillions of dollars into banks and other financial institutions. Ben Bernanke insists that such drastic actions by the central bank were necessary to prevent a depression, a claim that economists will no doubt be debating for decades.

What may not be open to debate, however, is the wisdom of the Fed’s decision to engage in non stop money printing with the announcement of QE3. A policy tool previously applied to prevent a financial collapse has now become a routine operation in a desperate attempt to ramp up economic growth. The Federal Reserve seems oblivious to the fact that no nation in history has ever increased its wealth and real economic growth by resorting to the printing presses.

Three most probable outcomes of the Fed’s open ended money printing operations:

1. Continued decline in economic growth.

Following the Fed’s announcement of another round of permanent QE, Egan-Jones Cuts U.S. Rating.

Egan-Jones Ratings Co. cut its credit rating for the U.S. one level to AA-, citing the potential for the Federal Reserve’s third round of large-scale asset purchases to weaken the dollar and drive up inflation.

U.S. debt to gross-domestic-product has risen to 104 percent from 66 percent in 2006, Egan-Jones said today in a report. The firm lowered the U.S. to AA in April. Yields on 10- year Treasuries have fallen five basis points since the end of that month to 1.86 percent.

The Fed’s latest program will “stoke the stock market and commodity prices, but in our opinion will hurt the U.S. economy and, by extension, credit quality,” Egan-Jones said. “The increased cost of commodities will pressure profitability of businesses, and increase the costs of consumers, thereby reducing consumer purchasing power.”

The Fed yesterday announced its third round of large-scale asset purchases since 2008, saying it will buy $40 billion of mortgage debt a month. The central bank didn’t set any limit on the ultimate amount it would buy or the duration of the program. Policy makers also extended the prospect of near-zero interest rates until mid-2015 and said policy will stay accommodative “for a considerable time” even after the economy strengthens.

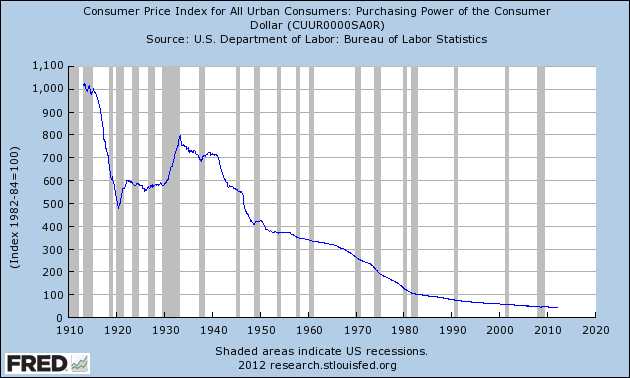

2. Continued destruction of the purchasing power of the U.S. dollar.

Federal Reserve policies have contributed to a dramatic decline in the purchasing power of the U.S. dollar for decades, resulting in a lower standard of living for Americans. Expanded money printing will accelerate this trend.

3. Continued increase in the price of gold.

The decade long rally in gold will dramatically accelerate. A Barron’s interview asks Could Fed Miscalculations Lead to $10,000 Gold?

These are times that try an asset manager’s soul. The world’s economy is a soft-paste porcelain vase set on a wobbly plant stand in the heart of an active earthquake zone. The Middle East is sending out foreshocks of war. The South China Sea is a smoking caldera of tension. Social unrest in the EU threatens tidal waves. And, according to the agitated rats and snakes of the financial press, China is headed into a recession.

Hedging against the most pessimistic case without crippling the upside potential of a better or even miraculous case appears to be as unsolvable as the proverbial Gordian knot. Alexander the Great “solved” the intellectually challenging knot riddle by severing it with his sword. Scott Minerd, chief investment officer of Guggenheim Partners, offers a more reasoned but equally simple solution to the hedging conundrum: gold. In extreme circumstances—like miscalculations regarding inflation by the Federal Reserve—the metal could hit $10,000 per troy ounce, he asserts. Thursday, after the Fed disclosed its latest financial-stimulus scheme, the metal rose about 2% to $1,768.

Minerd frets about the Fed’s ability to reduce its swollen $2.9 trillion balance sheet if rates suddenly were to rise. Because the assets have longer-term durations, their market value immediately would tumble. If rates rose 1%, the Fed would have a $150 billion capital deficit, he says. This would have negative ramifications for the dollar. Minerd says the über-wealthy have been migrating toward hard assets like gold, real estate, and art. Every portfolio should be partially composed of such assets, he asserts. Is yours?

Gold and Silver Blog has long argued that gold would eventually advance to at least $5,000. The latest Fed actions make that price target seem conservative.

There Is “A Limited Amount of Gold, An Unlimited Amount of Paper Money”

Legendary bond king investor Bill Gross, who presides over the world’s largest bond funds makes a compelling case for owning gold in an interview with Bloomberg TV. Lead manager of influential Pacific Investment Management Company (PIMCO) since 1987, Bill Gross reputedly made $200 million in 2011.

Legendary bond king investor Bill Gross, who presides over the world’s largest bond funds makes a compelling case for owning gold in an interview with Bloomberg TV. Lead manager of influential Pacific Investment Management Company (PIMCO) since 1987, Bill Gross reputedly made $200 million in 2011.

The PIMCO Total Return fund has produced a fat 9.5% return for investors over the past five years, trouncing the returns on the S&P 500 and the vast majority of competing bond funds. Total funds managed by PIMCO total a staggering $1.8 trillion.

PIMCO’s success has in large part been due to Bill Gross’s ability to accurately assess the macroeconomic picture. Bill Gross’s bullish position on gold is not something to be lightly discounted by investors.

According to Bill Gross, the bullish outlook for gold rests on the endless expansion of credit by central banks. Gold has a considerable store of value that paper money does not and there is a “limited amount of gold, an unlimited amount of paper money.”

When world central banks engage in a long term period of money printing and start writing checks in the trillions, it is best to have something that’s tangible and can’t be reproduced like gold. Gross expects that central banks, which have trillions of dollars in reserves, will continue to expand their holdings of gold rather than invest in 10 year government bonds that pay a paltry 1% interest.

Gold and Silver Bullion Coin Sales Jump 25% In August, San Francisco Silver Eagle Set Sold Out

The latest sales figures from the U.S. Mint for August show a significant increase in sales of both gold and silver bullion coins.

The latest sales figures from the U.S. Mint for August show a significant increase in sales of both gold and silver bullion coins.

Sales of gold bullion coins during 2012 have varied dramatically from month to month with a high of 127,000 ounces in January to a low of only 20,000 ounces in April. Monthly gold bullion sales through August have averaged 51,625 ounces.

Monthly sales of silver bullion coins have been more consistent during 2012. The U.S. Mint sold over 6 million ounces of silver bullion coins in January, but the monthly pace has tapered off to under 3 million ounces. The average monthly sales of silver bullion coins through August is 2,817,500.

American Eagle Gold Bullion Coin Sales

Total sales of the American Eagle Gold bullion coins during August totaled 39,000 ounces, up 27.9% from July’s total of 30,500 ounces. Total sales of gold bullion coins by the U.S. Mint through August totaled 413,000 ounces, valued at approximately $700 million based on today’s closing gold price.

On an annualized basis, the U.S. Mint will sell almost 620,000 ounces of gold bullion to investors this year valued at $1.0 billion if the price of gold remains at $1,692. During 2009, the peak year of gold bullion coin sales by the U.S. Mint, investors purchased 1,435,000 ounces valued at $1.4 billion based on the average price of gold of $972 per ounce.

Investors who have reduced gold bullion purchases due to the increased cost per ounce will no doubt regret this decision as the price of gold continues to increase. The value of gold should be viewed in the context of the reduced purchasing power of the dollar – as the Federal Reserve constantly destroys the purchasing power of the U.S. dollar, the “dollar cost” of gold will naturally increase. The price of gold is merely reflecting the fact that paper dollars are worth less and less every day.

As the Fed continues to do what it does, expect the bull market in gold to continue.

Listed below are yearly sales figures for the American Eagle gold bullion coins since 2000. Sales for 2012 are through August 31st.

| Gold Bullion U.S. Mint Sales By Year | ||

| Year | Total Sales Oz. | |

| 2000 | 164,500 | |

| 2001 | 325,000 | |

| 2002 | 315,000 | |

| 2003 | 484,500 | |

| 2004 | 536,000 | |

| 2005 | 449,000 | |

| 2006 | 261,000 | |

| 2007 | 198,500 | |

| 2008 | 860,500 | |

| 2009 | 1,435,000 | |

| 2010 | 1,220,500 | |

| 2011 | 1,000,000 | |

| 2012 | 413,000 | |

| Total | 7,662,500 | |

American Eagle Silver Bullion Coin Sales

Sales of the American Eagle Silver bullion coins by the U.S. Mint during August totaled 2,870,000 ounces, up 25% from the July total of 2,278,000 ounces. Investor demand for silver has remained strong, with many investors taking the opportunity to purchase additional silver below the highs reached during 2011. Sales of the silver bullion coins remain near record levels and total sales for 2012 should be well in excess of 30 million ounces for the third consecutive year.

Total annual sales by the U.S. Mint of the silver bullion coins since 2000 are shown below. Sales for 2012 are through August.

| American Silver Eagle Bullion Coins | ||

| YEAR | OUNCES SOLD | |

| 2000 | 9,133,000 | |

| 2001 | 8,827,500 | |

| 2002 | 10,475,500 | |

| 2003 | 9,153,500 | |

| 2004 | 9,617,000 | |

| 2005 | 8,405,000 | |

| 2006 | 10,021,000 | |

| 2007 | 9,887,000 | |

| 2008 | 19,583,500 | |

| 2009 | 28,766,500 | |

| 2010 | 34,662,500 | |

| 2011 | 39,868,500 | |

| Jul-12 | 22,540,000 | |

| TOTAL | 220,940,500 | |

U.S. Mint Numismatic American Eagle Gold and Silver Coins

Both the American Eagle gold and silver bullion coins can only be purchased from the U.S. Mint by Authorized Purchasers who in turn resell the coins to other dealers and the general public. The numismatic versions of the American Eagle series coins can be purchased directly from the U.S. Mint.

Many of the numismatic silver coins produced by the U.S. Mint attract strong demand and often times, the coins will sell at a premium in the secondary market. A recent example of this is the 2012 San Francisco Silver Eagle Set. According to the Mint News Blog:

The 2012 San Francisco Silver Eagle Set was one of the United States Mint’s most anticipated product releases of the year. Each set contained one 2012-S Proof Silver Eagle and one 2012-S Reverse Proof Silver Eagle.

Product sales began on June 7, 2012 at 12:00 Noon ET with pricing of $149.95 per set. Rather than establishing a maximum product limit, as had been done for similar products in the past, the US Mint would accept orders during a four week ordering window and produce the sets to meet the total demand. A sales odometer which was updated daily gave collectors an indication of the progress of the offering. Sales officially closed on July 5, 2012 at 5:00 PM ET. The last indicated sales total was 251,302 sets.

On the secondary market, prices for the sets remain above the issue price. A quick survey of eBay auctions completed within the past few days show the prices realized for raw sets mostly falling into a range of $180 to $190, compared to the issue price of $149.95.

Sets which have been graded by PCGS or NGC and received the top grade of Proof-70 have sold for premiums above raw sets. Sets with the two coins graded PCGS PR70DCAM and PR70 have recently sold for prices around $425 to $450. Sets with the two coins graded NGC PF 70 Ultra Cameo and PF 70 have sold for prices around $300 to $325.

By Axel Merk

By Axel Merk By

By

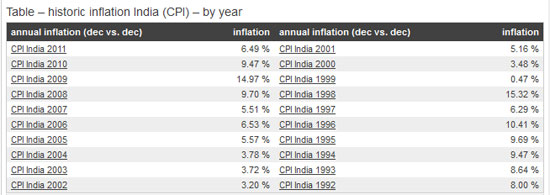

India may increase the import tax on gold for the third time this year in an attempt to shore up the weak rupee. Purchases of gold and silver account for a huge 12.5% of all Indian imports and are contributing to a record current-account deficit according to

India may increase the import tax on gold for the third time this year in an attempt to shore up the weak rupee. Purchases of gold and silver account for a huge 12.5% of all Indian imports and are contributing to a record current-account deficit according to

By Axel Merk

By Axel Merk

Yahoo Finance ran a story today entitled “Gold, Silver & Copper Are All Heading Lower.” Nothing worth discussing about the specifics of the article – the real story here is that this a classic contrary headline seen at market bottoms, not tops.

Yahoo Finance ran a story today entitled “Gold, Silver & Copper Are All Heading Lower.” Nothing worth discussing about the specifics of the article – the real story here is that this a classic contrary headline seen at market bottoms, not tops.