Rick Rule listed 10 key questions regarding today’s economy. They are:

Rick Rule listed 10 key questions regarding today’s economy. They are:

10 Questions for Precious Metals Investors

- Is the financial crisis in the Western world over?

- Have the G20 countries balanced their budget?

- Did the commercial banks manage to become solvent?

- Are (real) interest rates positive or negative?

- Is a global competitive devaluation to increase exports still ongoing?

- Is the European periphery still financially challenged?

- Do the Asian countries still have a cultural affinity with precious metals?

- Which are the US budgetary issues and solutions?

- Are the derivatives from large banks still a problem for economies and client portfolios?

- Can liquidity solve the issue of insolvency?

If these are the questions, then gold and silver are two good answers.

But, let’s approach these questions from a different direction.

- Have gold or silver ever defaulted?

- Do gold or silver have counter-party risk like EVERY paper investment?

- On January 1, 2000 the Dow was about 11,500, gold was priced at $289, and silver was priced at $5.41. As of May 24, 2013, those numbers were: Dow: 15,303, gold $1,386, silver $22.49. Which was the best investment?

- Gold fell (in 21 months) from over $1,900 to about $1,320. Does that mean the gold bull market is over? The Dow crashed from 14,100 (October 2007) to about 6,500 (March 2009), and then rallied back to new highs. Don’t exclude the possibility of new highs for gold and silver in the coming months.

- Why are Chinese businesses, individuals, and their central bank buying gold as rapidly as possible? Why does the Chinese government refuse to allow any gold to be exported? Why does China (world’s largest gold producer) additionally import a massive amount of gold every year?

- Ask the same for Russia, India, and much of Asia. What do they know about the VALUE of gold that the EU and the USA (who are selling gold) don’t understand?

Further:

- Gold and silver have gone up and down, when priced in unbacked paper currencies. The same is true for trucks, diamonds, the Dow Index, laundry detergent, gasoline, cigarettes, and wheat. Price increases and volatility will continue.

- Gold, silver, and the national debt have increased exponentially since Nixon severed the link between the dollar and gold in 1971. All three will continue to rise. Gold and silver will occasionally rally too far and crash, while the national debt will increase until politicians no longer enjoy spending other people’s money.

- Goldman Sachs (and many others) have said gold is in a bubble. The same individuals and groups probably did not see the bubble in Internet stocks and housing. Do you trust them or the 3,000 years of history during which gold and silver have been real money and a store of value?

- If JP Morgan (and others) can make huge profits using computers, complex mathematical algorithms, and High-Frequency-Trading, then they will. Often their trading temporarily drives the prices for gold and silver down. After the markets have been driven far enough down, the same trading process is used to drive the prices higher. Expect it!

- Silver has dropped from about $49 (April 2011) to just above $20 (May 2013) – almost a 60% drop in price. Does that mean it will continue to drop more – perhaps to $10? Silver has retained its value, on average, for 3,000 years but has fallen in price for two years. On the basis of price action in those two years, most individuals (based on sentiment measures) have chosen to trust unbacked paper currencies issued by an insolvent central bank and an insolvent sovereign government instead of silver. This is typical of market bottoms, even if it is not sensible.

- About 4.5 years ago (October 2008) silver crashed to a price bottom where “everybody felt” like it was hopeless to expect silver to rally again. About 4.5 years before that (May 2004), silver also crashed to a price bottom where “everybody felt” like it was hopeless to expect silver to rally again. But, in fact, the silver rally off the low in 2008 was over 450%, and the rally off the 2004 low was over 175%. Silver will rally again.

- We may not trust bankers and politicians to effectively run the country, but we can trust them to “print money” and to spend in excess of their revenues. Consequently, we should trust them to drive the prices, as measured in unbacked paper currencies, for gold and silver – MUCH higher.

GE Christenson

aka Deviant Investor

MOTIVE: The various governments of the world and their central banks produce and distribute a product – paper currencies. Those currencies are backed by confidence, faith, and credit, but not by gold, oil, or anything real. Those currencies are digitally printed to excess, since almost all governments spend more than their revenues. The UK, Japan, and the USA are prime examples.

MOTIVE: The various governments of the world and their central banks produce and distribute a product – paper currencies. Those currencies are backed by confidence, faith, and credit, but not by gold, oil, or anything real. Those currencies are digitally printed to excess, since almost all governments spend more than their revenues. The UK, Japan, and the USA are prime examples. April was a brutal month for precious metal investors. Gold ended the month down almost 8% and silver prices tumbled almost 13%. The sell off continued in May with gold down another $60 per ounce to $1,412 and silver down $1.55 to $22.87 per ounce at mid month.

April was a brutal month for precious metal investors. Gold ended the month down almost 8% and silver prices tumbled almost 13%. The sell off continued in May with gold down another $60 per ounce to $1,412 and silver down $1.55 to $22.87 per ounce at mid month.

Large scale liquidation of gold backed exchange-traded products (ETP) sent gold prices into a tailspin during April. Billionaire investor George Soros, who had sold 55% of his holdings in the SPDR Gold Shares (GLD) during the last quarter of 2012, further reduced his gold positions during the first quarter. Soros is a legendary trader and investor who has made billions moving ahead of the crowd.

Large scale liquidation of gold backed exchange-traded products (ETP) sent gold prices into a tailspin during April. Billionaire investor George Soros, who had sold 55% of his holdings in the SPDR Gold Shares (GLD) during the last quarter of 2012, further reduced his gold positions during the first quarter. Soros is a legendary trader and investor who has made billions moving ahead of the crowd. The exploding demand for physical gold and silver has become a worldwide phenomenon. Shortly after the price plunge of early April buyers rushed in to take advantage of bargain prices. Dealers and mints worldwide have reported off the charts demand for physical gold and silver.

The exploding demand for physical gold and silver has become a worldwide phenomenon. Shortly after the price plunge of early April buyers rushed in to take advantage of bargain prices. Dealers and mints worldwide have reported off the charts demand for physical gold and silver. Don’t precious metal investors read newspapers? Despite proclamations from the mainstream press that the bull market in gold and silver is over, a buying frenzy in precious metals is occurring worldwide. The gold rush mentality to buy gold and silver at bargain prices has resulted in stock out conditions for many retail sellers of precious metals, including

Don’t precious metal investors read newspapers? Despite proclamations from the mainstream press that the bull market in gold and silver is over, a buying frenzy in precious metals is occurring worldwide. The gold rush mentality to buy gold and silver at bargain prices has resulted in stock out conditions for many retail sellers of precious metals, including  Kyle Bass recently summed up the thoughts of many gold investors when he said “the largest central banks in the world, they have all moved to unlimited printing ideology. Monetary policy happens to be the only game in town. I am perplexed as to why gold is as low as it is. I don’t have a great answer for you other than you should maintain a position.”

Kyle Bass recently summed up the thoughts of many gold investors when he said “the largest central banks in the world, they have all moved to unlimited printing ideology. Monetary policy happens to be the only game in town. I am perplexed as to why gold is as low as it is. I don’t have a great answer for you other than you should maintain a position.”

You know the world is changing when the head of the world’s biggest bond fund recommends gold as his first asset choice.

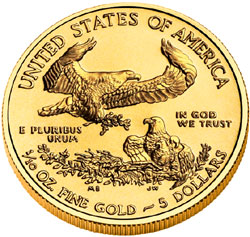

You know the world is changing when the head of the world’s biggest bond fund recommends gold as his first asset choice. Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012. According to the latest U.S. Mint report, sales of the American Eagle Gold bullion coins for December 2012 totaled 76,000 ounces, up 16% from December 2011 when 65,500 ounces were sold. Sales for the month were down 44.3% from November sales which totaled 136,500 ounces.

According to the latest U.S. Mint report, sales of the American Eagle Gold bullion coins for December 2012 totaled 76,000 ounces, up 16% from December 2011 when 65,500 ounces were sold. Sales for the month were down 44.3% from November sales which totaled 136,500 ounces.