How many of the countries best financial advisors are telling their customers to invest in gold? Despite the fact that gold has gone up for the past eleven years, a Barron’s survey shows that gold remains distinctly out of favor by mainstream investment advisors.

How many of the countries best financial advisors are telling their customers to invest in gold? Despite the fact that gold has gone up for the past eleven years, a Barron’s survey shows that gold remains distinctly out of favor by mainstream investment advisors.

Barron’s interviewed 51 of the countries most successful investment advisors from each of the fifty states plus the District of Columbia. Although investment returns were not disclosed, Barron’s selected the best investment pros based on the amount of assets managed, revenues generated, gain in the number of clients and the quality of their practices.

The 51 pros selected by Barron’s are the best in the business, work hard, serve wealthy sophisticated clients and manage hundreds of billions of dollars of wealth. According to the survey, the most common investment strategy of the top financial advisors was to generate income flows and potential capital gains by owing high quality blue chip stocks. Most of the advisors were optimistic, predicting that dividend paying stocks would outperform government securities on which yields have plunged to all time lows.

Of the 51 advisors interviewed, only two specifically recommended a small portfolio allocation into gold. The investment advisor from Iowa recommended that clients make “sure 3% to 5% of their portfolios are in gold” and the investment pro from Nebraska suggested a 10% position in gold mining stocks.

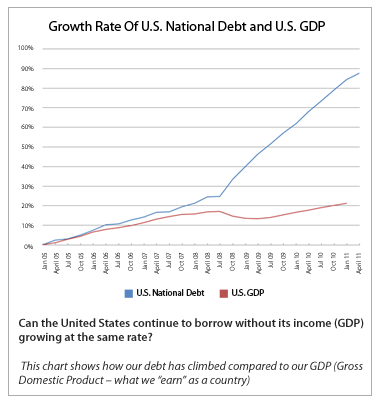

The number of investment pros recommending gold was surprising low, especially after considering the potential for another financial meltdown precipitated by sovereign debt crises, rampant money printing by central banks and towering levels of debt that threaten to crush the world economy.

Gold has proven to be a vehicle for wealth preservation over thousands of years and is insurance against financial disaster. Has the increase in gold since 2000 already fully discounted the worst possible economic and financial scenarios?

Barron’s smart money pros apparently think that gold’s run is over. Are gold investors nuts to argue with the world’s best money managers, especially after an almost 7 fold increase in the price of gold since 2000? What do you think?

More on this topic: Gold Bull Market Could Last Another 20 Years With $12,000 Price Target

Despite recent volatility, gold and silver prices continue to push to new highs. After a brief pullback on earlier this week, silver rebounded strong and once again approaches the $50 level. Gold, which has lagged the price gains in silver, recently rose to a fresh all time high and remains solidly above the $1,500 level.

Despite recent volatility, gold and silver prices continue to push to new highs. After a brief pullback on earlier this week, silver rebounded strong and once again approaches the $50 level. Gold, which has lagged the price gains in silver, recently rose to a fresh all time high and remains solidly above the $1,500 level.

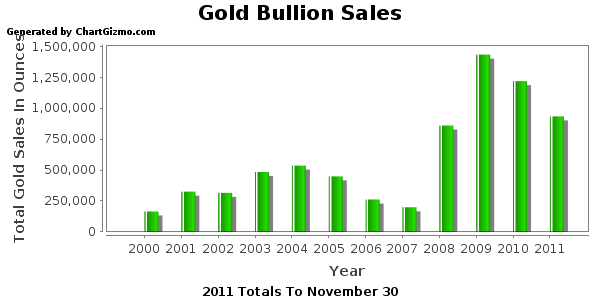

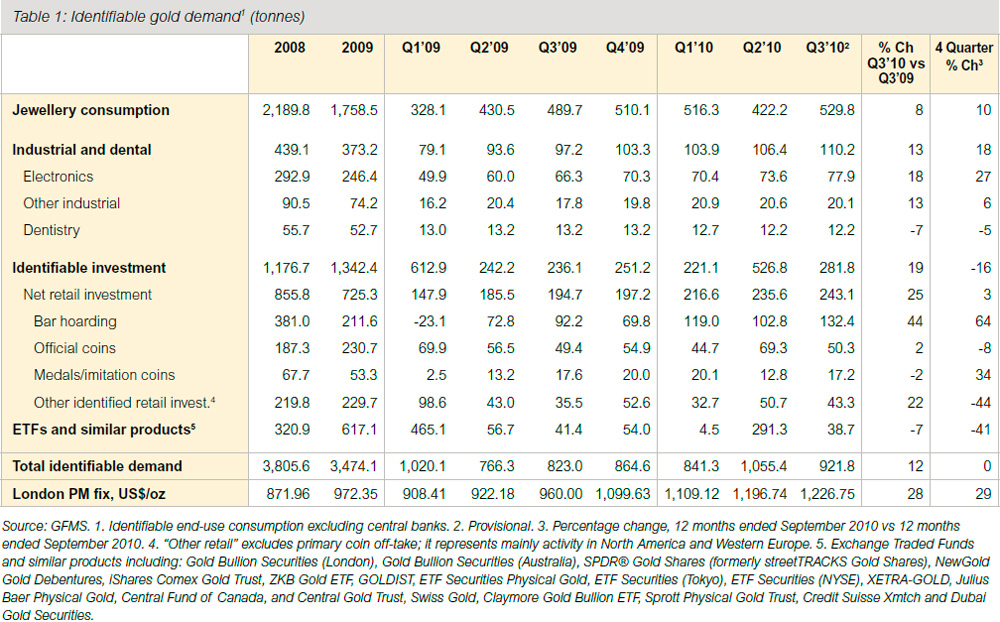

Total identifiable gold demand for the third quarter showed an increase of 12% above year ago levels at 921.8 tonnes. Increases in demand from jewelry consumption, industrial sectors, and net retail investment more than offset a decline in demand from electronically traded funds, according to information published by the

Total identifiable gold demand for the third quarter showed an increase of 12% above year ago levels at 921.8 tonnes. Increases in demand from jewelry consumption, industrial sectors, and net retail investment more than offset a decline in demand from electronically traded funds, according to information published by the

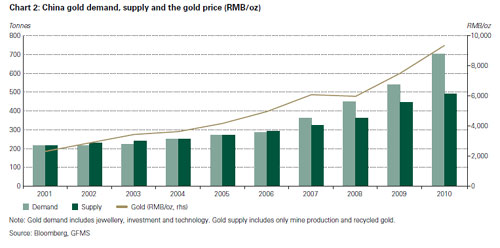

Not surprisingly, gold demand for the second quarter of 2010 was up significantly compared to the year ago period, according to the recently released Gold Demand Trends report from the

Not surprisingly, gold demand for the second quarter of 2010 was up significantly compared to the year ago period, according to the recently released Gold Demand Trends report from the