During his almost 20 year reign as Chairman of the Federal Reserve, Alan Greenspan’s easy money policies seemed to work like magic. Ever lower interest rates and easy bank lending resulted in vast asset price inflation of both stocks and housing. Flipping stocks and houses became the national past time as the asset bubbles continued to grow. The average American envisioned a cushy retirement buoyed by ever rising housing values.

During his almost 20 year reign as Chairman of the Federal Reserve, Alan Greenspan’s easy money policies seemed to work like magic. Ever lower interest rates and easy bank lending resulted in vast asset price inflation of both stocks and housing. Flipping stocks and houses became the national past time as the asset bubbles continued to grow. The average American envisioned a cushy retirement buoyed by ever rising housing values.

In 2004 George Bush nominated Alan Greenspan for an unprecedented fifth term as Chairman of the Federal Reserve, convinced that the “maestro” would continue to ensure a permanent national prosperity. By the time Greenspan retired in January 2006, he had attained rock star cult status. Who would have thought that a mere two years later, the 20 year Greenspan cycle of false “prosperity”, engineered through excessive borrowing, consumption and leverage would explode, hurtling the world into financial chaos?

Even worse, who would have thought that the same failed policies would be continued by Greenspan’s successor? Bernanke’s attempts to re-inflate the burst bubbles of a past era are being defeated as a debt choked system crashes asset values as it deleverages. Bernanke has proven himself to be equally maladroit at recognizing both housing bubbles and liquidity traps.

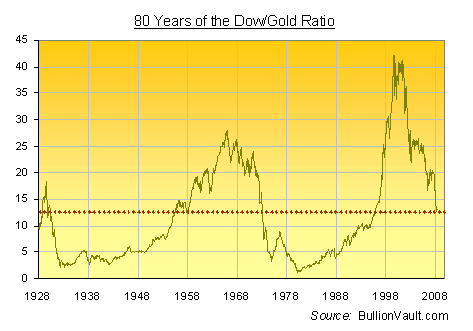

Meanwhile, the debt laden sovereign nations of the Eurozone are waking up to discover that their credibility in the bond markets has been vaporized. How will it all end? Some see hyperinflation in our future, others an all encompassing deflationary crash. Either way, Vin Maru at TDV Golden Trader sees the Dow/gold ratio moving towards 1:1.

The Dow/gold Ratio Will Move Towards 1:1, Are You Positioned To Profit From It?

After spending the last month consolidating (around 8:1) the Dow/gold ratio broke down on Friday to close at 7.47. This is a major shift, as the upward trend line in favour of the Dow since September has been broken with a significant drop. This is a significant event that should trigger the selling of the boarder equity sector as money moves out of the Dow and S&P and into gold and related equities. Gold has once again become a safe haven as uncertainties around the Euro and fiat paper currencies persist. In addition, the growing consensus of a global economic slowdown and possibly a recession in the U.S. in the coming quarters, is bullish for gold.

Gold is on the rise, especially compared to the Dow, as we move from a 7.5 ratio (Dow at 12,000 and gold at $1600) towards a 5:1 ratio and lower in the coming year. Within a few years, we wouldn’t be surprised to see a Dow to Gold ratio of 1:1. History tells us that this ratio should be revisited again in the coming years. If the longer term chart of the Dow/gold ratio is any indication of how quickly it will happen, it will be sooner rather than later. If you are invested in the broader stock market or mutual funds, this is the time to act and protect your wealth. Once the final waterfall on the Dow develops and gold begins rising, it can move very quickly. By all indications on the charts and given the current market conditions, we believe it has already started.

HOW DO WE REACH THE DOW/GOLD RATIO OF 1:1?

The Inflationary Path

With the Dow now slightly above 12,000 and gold around $1620, the ratio is contracting fast as we move towards and below 5:1 in the coming years. How this will manifest itself is anyone’s guess at the moment. If the Dow remains at 12,000, in an inflationary environment, gold will gravitate towards to the 1:1 ratio as it moves to a fair market value based on the outstanding debts and currency units floating around in the system. In the coming years, if the central bankers continue the path of papering over the financial mess that they have created, gold can easily reach $10K+. During a currency event, gold could climb to that price objective and it will take silver along with it. If we return to the historical gold/silver ratio of 15:1, we could easily see silver at over $650 per ounce. Silver has been trading at around 55:1, and a currency event could move it towards the 15:1 ratio. At today’s price, silver has a lot of upside compared to gold.

Under this scenario, this assumes that currency inflation remains constant and that the financial markets continue to leave the Dow at 12,000.

The Deflationary Path

A deflationary spiral that unwinds debt around the world and leads to revaluations of paper currencies could also be in the cards. The unravelling of the Euro could cause just such an environment. In this case, central bankers will not be able to stop the deflationary spiral that ensues as individuals start opting out of the paper/debt based system. The bankers are pulling out all the stops and printing endless amounts of money to prevent this, but psychological forces can easily overwhelm this; economic law has a way of correcting imbalances created by man. Under this scenario, the Dow will crash in a deflationary spiral towards gold’s price and possibly meet somewhere in the middle or at the lower end of gold’s trading range.

WATCH FOR 1:1

Either way, history has shown us that we are moving towards a long term cycle of low stock prices and higher gold prices; this should play out in the next few years, as it has already has started. Trying to predict the price of gold is futile, what is most important is the Dow/gold ratio if 1:1. Once we reach that objective or close to it, it will be time to get out of gold and move to other undervalued asset classes such as the Dow, until then stay long gold and short the Dow.

Once a trend based on fundamentals is in motion, it is very difficult to stop, as much as the masters of the paper universe would like to maintain control. If a loss in confidence by the population of the world in purchasing power of fiat currency and the value of the assets based on that paper price starts, (something we think has already started) then the there is no stopping this trend. All the bankers can do is try and maintain the illusion of control, but eventually their efforts will fail. The gold market senses this. As a result gold and gold related equities will outperform every other paper market and asset class moving forward for the next few years. The price action on June 1, 2012 is just the beginning for the golden days ahead; just make sure your financial survival kit contains a percentage of gold, it may be the only thing that maintains its value as the paper currencies and paper assets around the world devalue compared to gold.

STRATEGY FOR HEDGING YOU PAPER ASSETS

Many of our readers already have a long position in physical gold and positions in several key mining companies and juniors. We have kept a core position in the gold sector and will continue to add on additional weakness. We are also evaluating potential gold producers and precious metals juniors/explorers which will have significant upside in the coming years as the nominal value of gold rises compared to other asset classes.

If you are looking for ideas and strategies for protecting your wealth and trading opportunities in the precious metals sector, please visit our site and sign up for our regular updates and blog posts. We regularly provide technical analysis on the price of gold and the HUI index which can help you identify good entry and exit points for trading.

It is no secret that the price of gold has been declining since reaching almost $2,000 per ounce last year. After rallying in the early part of the year, gold prices have now fallen to $1,556, representing a decline of $42 per ounce or 2.6% below the closing price on the first trading day of 2012.

It is no secret that the price of gold has been declining since reaching almost $2,000 per ounce last year. After rallying in the early part of the year, gold prices have now fallen to $1,556, representing a decline of $42 per ounce or 2.6% below the closing price on the first trading day of 2012.