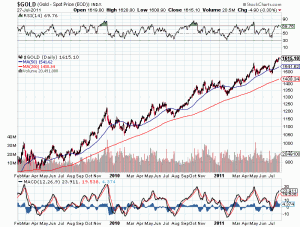

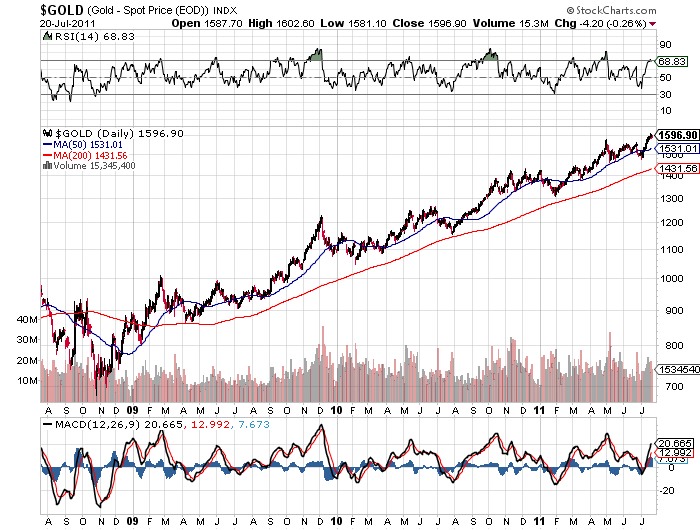

Gold continued its winning ways this week. As measured by the closing London PM Fix Price, gold gained $26.50 to close the week at all an time high of $1,628.50.

Gold continued its winning ways this week. As measured by the closing London PM Fix Price, gold gained $26.50 to close the week at all an time high of $1,628.50.

Gold has closed higher for the past four consecutive weeks. The rally that began at the beginning of the month has pushed gold higher by $145.50 or 9.8% since July 1st. Investors worried about the solvency of sovereign states in Europe have now switched their focus to the United States.

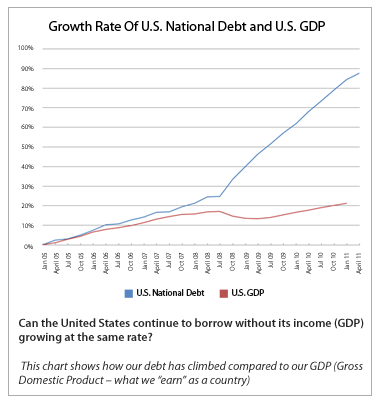

The impasse over raising the US debt limit has morphed into a crisis of confidence over the ultimate value of the US dollar. There is no clear consensus on how the debt limit negotiations in Washington will be resolved. The only certainty is that, regardless of how the debt limit crisis ends, confidence in the “full faith and credit” of the United States will be greatly diminished.

China and Russia, two large holders of US debt, have watched in horror as the US deliberately debases its currency value through money printing and a parabolic increase in debt. At a time when the US needs to borrow trillions of dollars in new debt, there is likely to be a greatly diminished appetite to purchase additional US debt.

The global debt crisis and a lack of confidence in paper money has resulted in a steady increase in the price of gold. Will gold continue to soar if global economies start collapsing or will gold be drawn into the deflationary abyss along with all other asset values? Opinions vary but here are some good thoughts on the matter.

-John Browne of Euro Pacific Capital warns that gold could be subject to a price pullback based on the deflationary impact of a global recession or short term optimism over the US avoiding default.

–Decision Point’s Carl Swenlin wonders if gold is too much of a “sure thing” investment and ponders the fate of gold in a deflationary collapse.

-A Citigroup analyst speculates that gold could quickly reach $5,000 based on a “worst case scenario for Euro sovereign debt and USA fiscal problems”.

Confidence is vital in a fiat money based world. The ongoing global debt crisis may be the trigger that ultimately destroys faith in paper currencies.

| Precious Metals Prices | 7/29/11 | ||

| PM Fix | Since Last Recap | ||

| Gold | $1,628.50 | +$26.50 | +1.65% |

| Silver | $39.63 | -$0.04 | -0.10% |

| Platinum | $1,779.00 | -$14.00 | -0.78% |

| Palladium | $824.00 | +$17.00 | +2.11% |

Silver and platinum were essentially unchanged on the week after posting strong advances since the beginning of July. Palladium advanced by $17 or over 2% on the week and is up $74 since July 1st.