Platinum is one of the rarest earth elements with the vast majority of deposits found in only one place on earth. Annual platinum production is only 30 tonnes per year compared to approximately 2,800 tonnes for gold and 23,000 tonnes for silver.

Platinum is one of the rarest earth elements with the vast majority of deposits found in only one place on earth. Annual platinum production is only 30 tonnes per year compared to approximately 2,800 tonnes for gold and 23,000 tonnes for silver.

Roughly 80% of annual platinum production comes from only three mines in South Africa. Siberia and other geographically scattered locations provide the balance of annual platinum production.

Investment demand for platinum constitutes only 10% of annual demand . Since 90% of platinum demand comes from jewelry and industrial users, the price of platinum can be very volatile. During an economic downturn,car sales plunge and jewelry is a very discretionary purchase. During the 2008 financial meltdown, platinum plunged by nearly two thirds of its value compared to a drop of only one third in the price of gold.

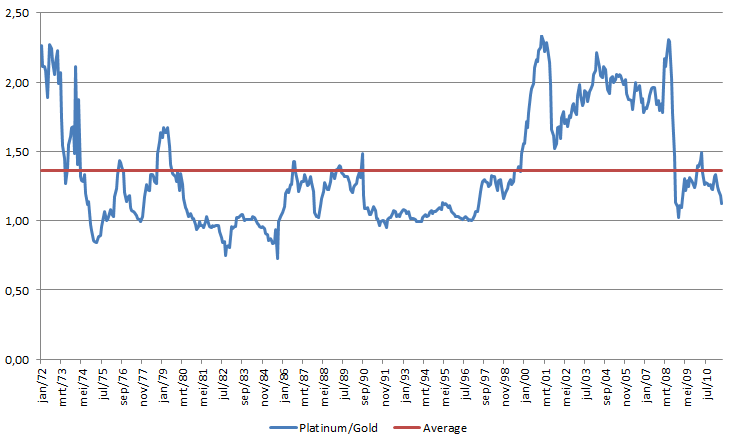

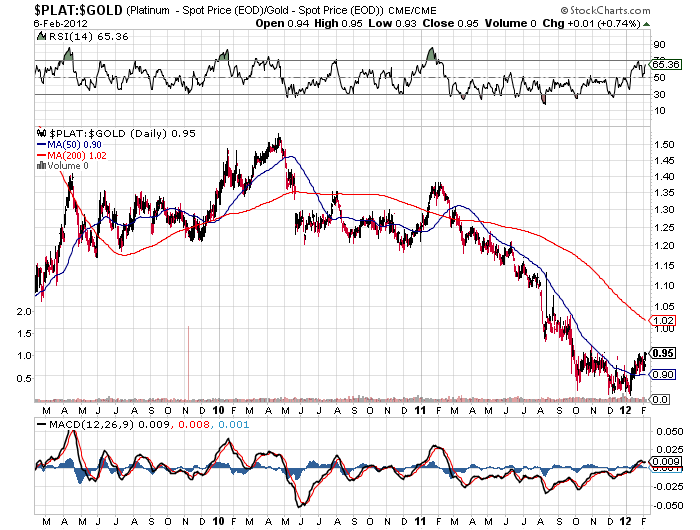

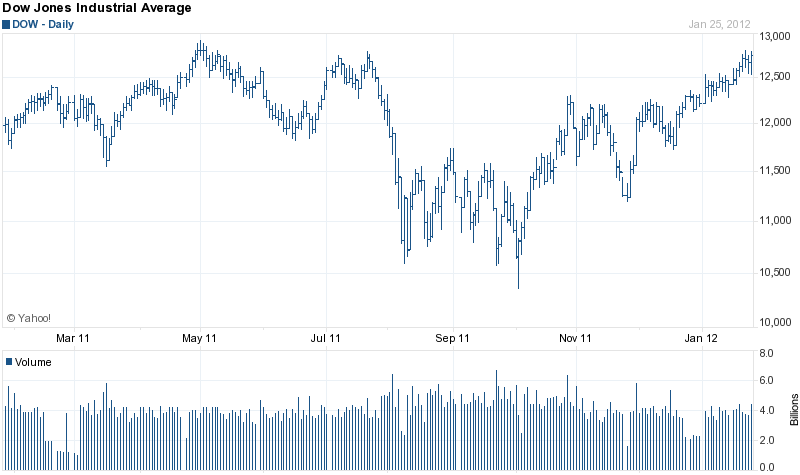

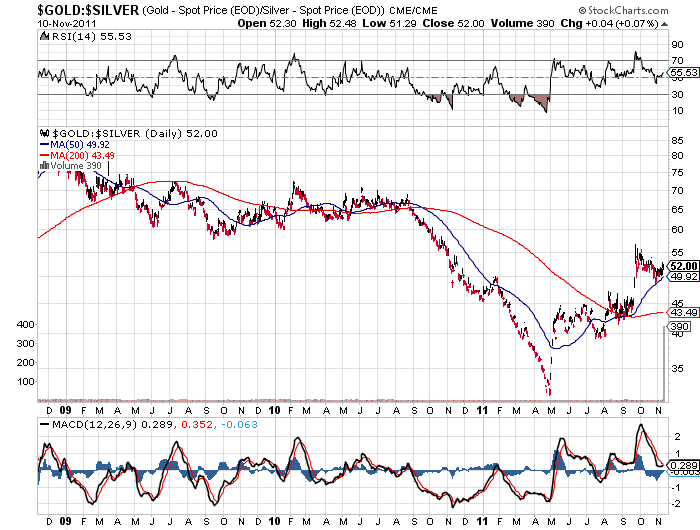

The ongoing economic turmoil in Europe has contributed to a large drop in the price of platinum. Last year, platinum declined from $1,887 in August to $1,354 at 2011 year end, a drop of $533 per ounce. Although platinum has recovered to $1,609, it is considerably undervalued when viewed through the lens of the platinum to gold ratio. A platinum to gold ratio below 1.0 is historically a signal that platinum is selling at a bargain price. The platinum to gold ratio is currently at .95, a level not seen since 1986.

Has the long term historical significance of the platinum to gold ratio lost its relevance? If the world plunges into a deflationary depression, platinum may wind up becoming a much greater bargain at a later date. The more likely scenario is that a new pricing metric is not being established and that the multi-decade low in the platinum to gold ratio is a major buy signal for platinum.

The central banks of the world have made it abundantly clear that they will print and inflate their way out of the debt crisis. Ownership of a precious metal such as platinum is one method of maintaining a store of value against depreciating currencies.

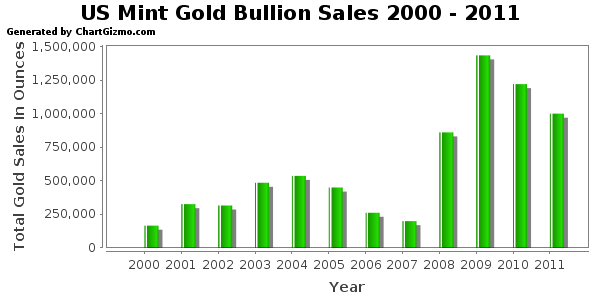

Numismatic versions of the platinum coin can be purchased by investors directly from the U.S. Mint. The 2011 Proof Platinum Eagle has been available since May 26, 2011 with a maximum mintage of 15,000 pieces. The current price to purchase the 2011 American Eagle one ounce platinum proof coin from the U.S. Mint is $1,892.00 with no order limit. No sales tax is charged on the purchase and a credit card can be used to pay for the coins.

According to coinupdate.com, the United State Mint may bring back the American Platinum Eagle bullion coins. The U.S. Mint has not minted the bullion versions of the platinum coin since 2008. Production of the American Platinum Eagle is not required by law, as is the case for the American gold and silver eagles. Production of the platinum coins are at the discretion of the Secretary of the Treasury. The 2008 and earlier bullion version of the one ounce American Platinum Eagle coins are available from coin dealers and are currently priced at around $1,860 each.