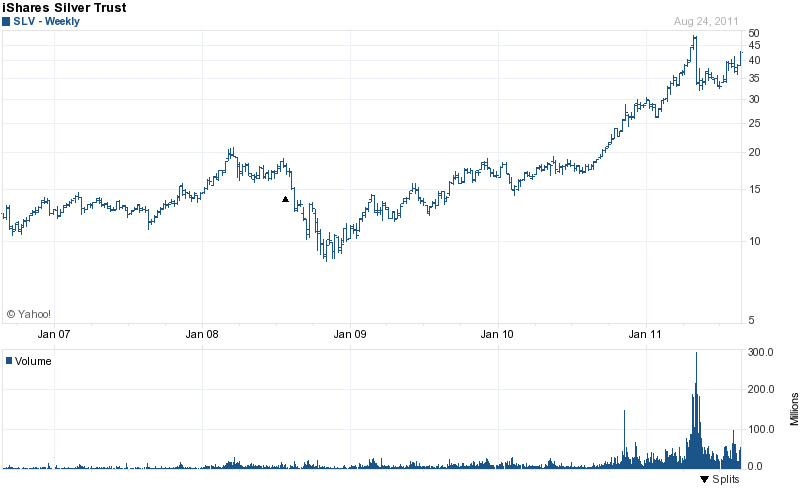

The September correction in the price of gold and silver resulted in a flood of bearish articles by the mainstream press, proclaiming that the “gold and silver bubbles” had burst.

The September correction in the price of gold and silver resulted in a flood of bearish articles by the mainstream press, proclaiming that the “gold and silver bubbles” had burst.

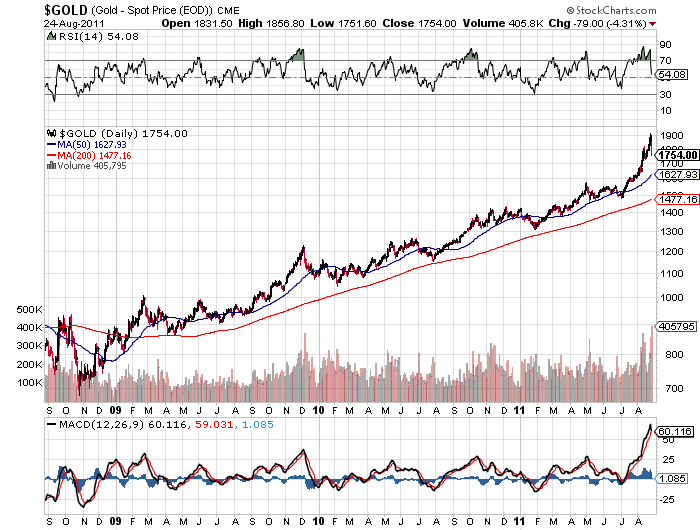

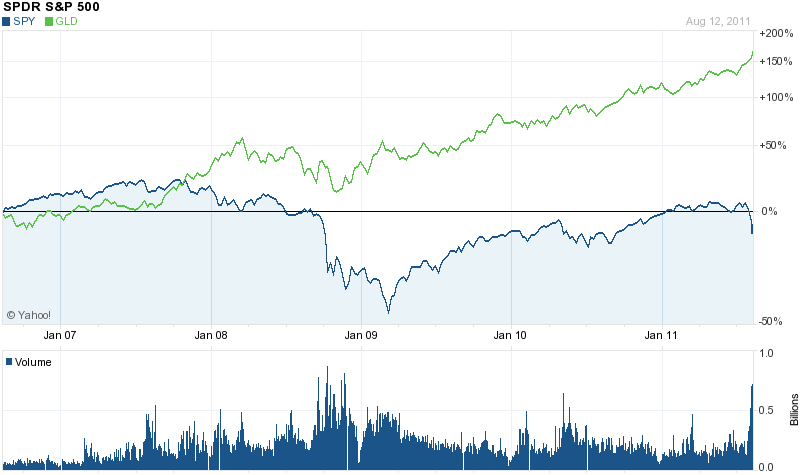

Since the mainstream press does not comprehend why precious metals have been in a bull market for the past ten years, the proclamation of the “end of the gold and silver bull markets” was, in reality, a contrarian bullish call.

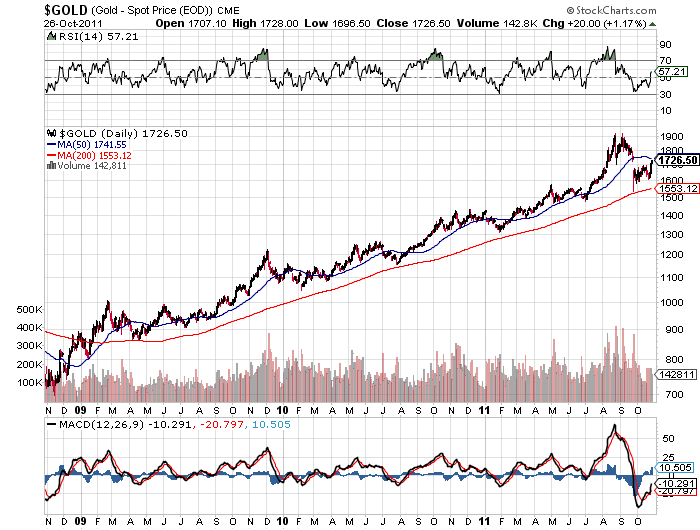

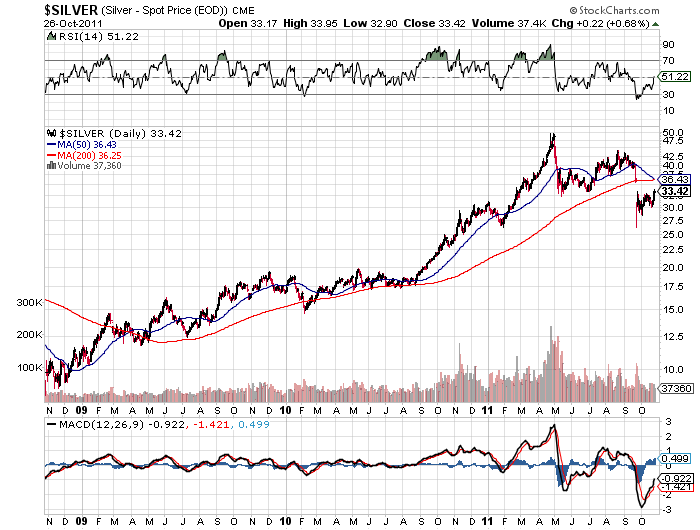

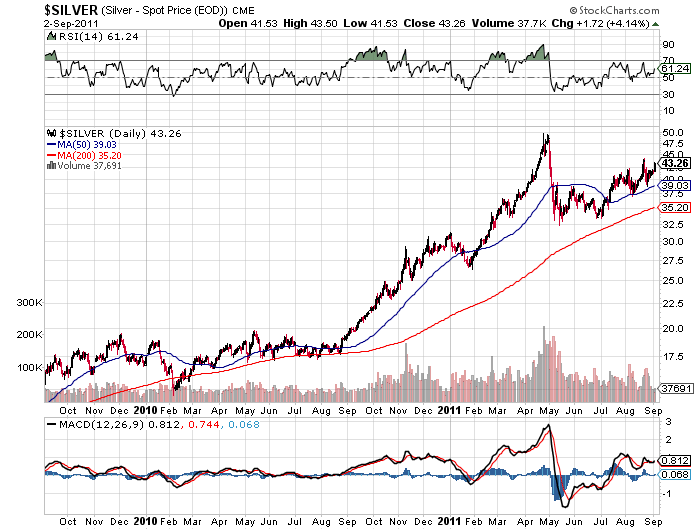

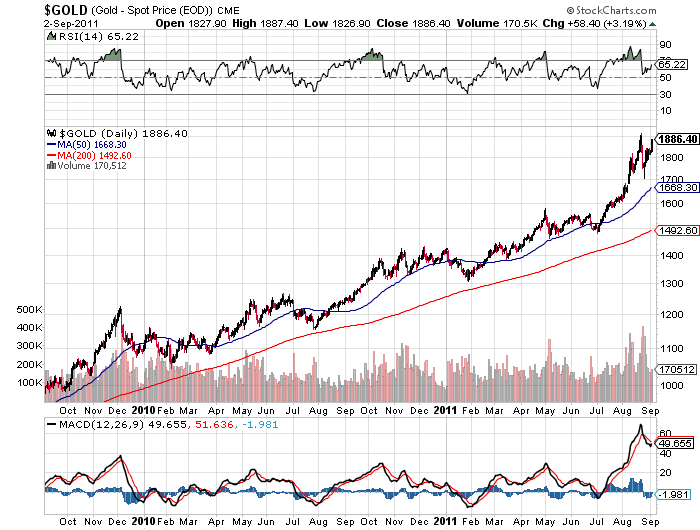

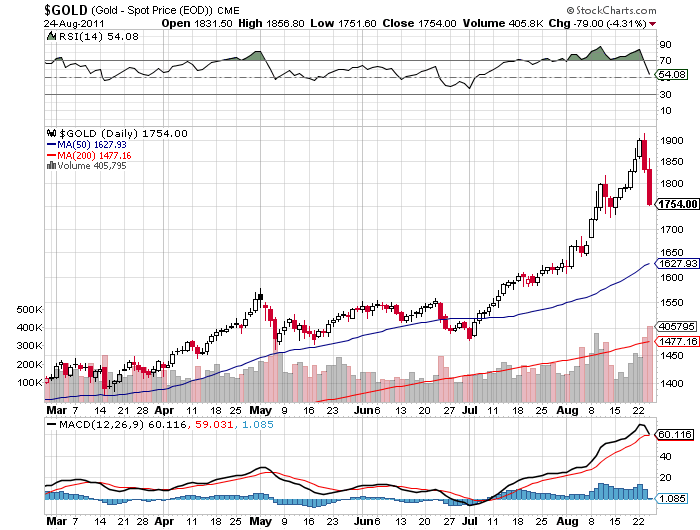

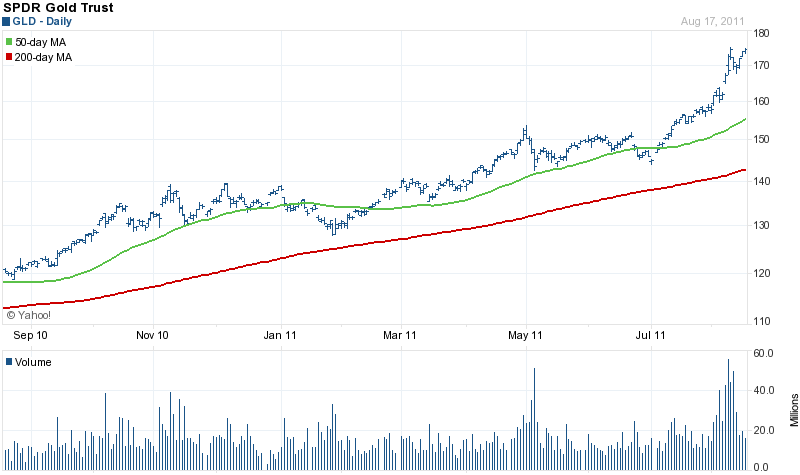

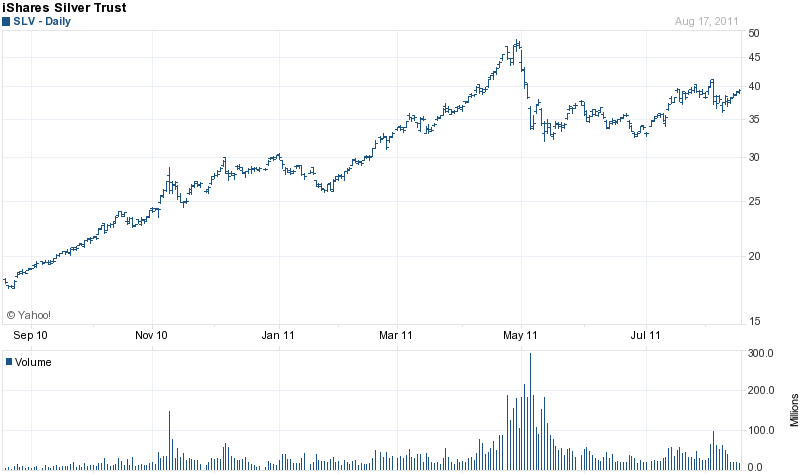

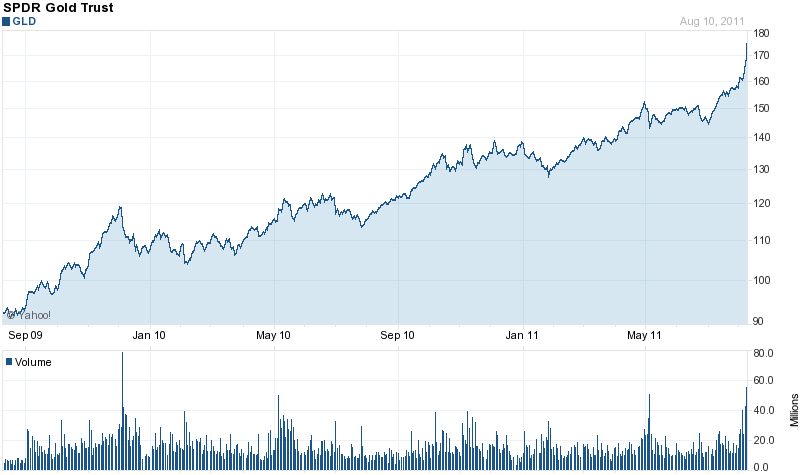

Every long term bull market has sharp sell offs and gold and silver are no exception to this rule. The sharp rise of gold prices during the summer attracted hot money from speculators and hedge funds who quickly liquidated positions based on short term technical sell signals, driving down the price of gold by over $300 per ounce.

As previously discussed, the fundamental reasons for owning gold and silver have not changed – in fact, they have grown stronger. The September sell off in precious metal prices was simply another fantastic opportunity for long term investors to increase positions at bargain prices.

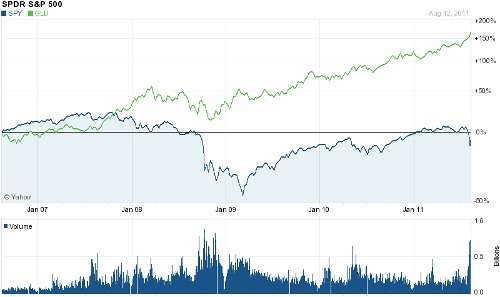

Long term investors in precious metals have outperformed virtually every asset class for the past ten years. Even after the panic selling of September, gold still held gains of over 20% on the year from a price of $1,405 at the start of 2011. Silver, despite a very volatile year, also remains above its price of $30.67 at the beginning of the year.

Both gold and silver remain in established long term up trends and remain at oversold, bargain level prices.

One strong fundamental factor providing support for further price gains in gold and silver comes from Mark Hulbert, whose Hulbert Financial Digest measures newsletter sentiment on the gold market. Recent readings of the Hulbert Gold Newsletter Sentiment Index (HGNSI) (tracked by the Hulbert Financial Digest) revealed that at the end of last week gold timers were extremely bearish on gold.

The HGNSI readings dropped to the most bearish level in two and a half years, with gold market timers recommending a 13% short allocation in gold portfolios. Hulbert’s research shows that gold usually rises when gold timers are very bearish. Hulbert notes that gold timers have not been this bearish since March of 2009 – a level from which gold prices subsequently doubled.