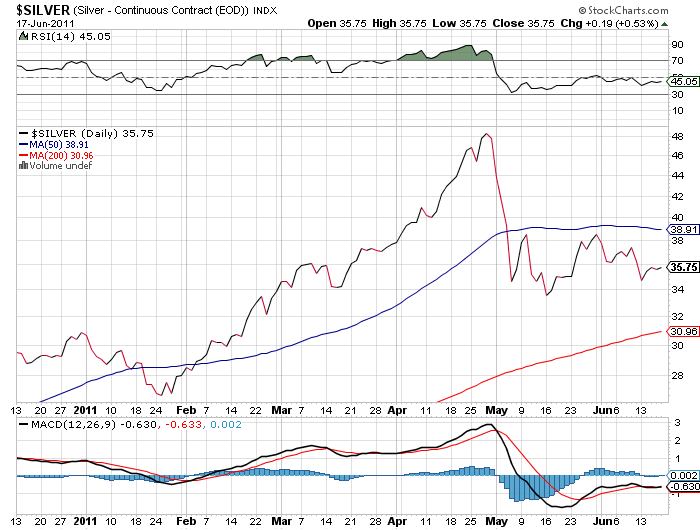

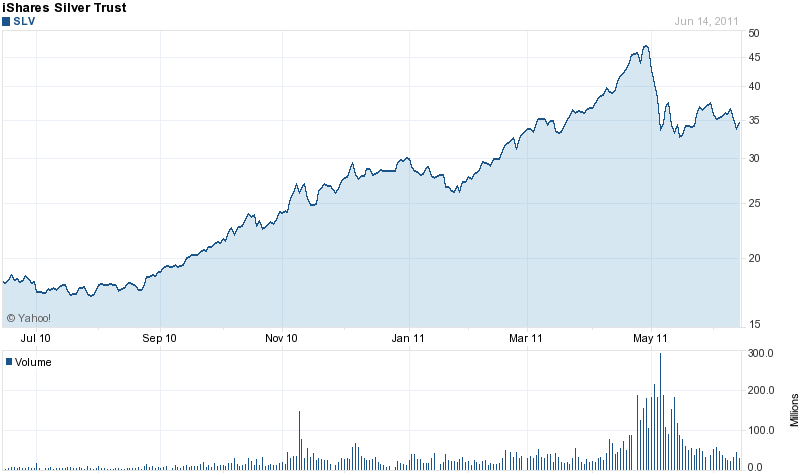

The iShares Silver Trust (SLV) showed a decline in holdings of 48.21 tonnes from the previous week, after rising by 21.23 tonnes in the previous week. The net outflow of the SLV since the start of the year now totals 1,389.17 tonnes.

The iShares Silver Trust (SLV) showed a decline in holdings of 48.21 tonnes from the previous week, after rising by 21.23 tonnes in the previous week. The net outflow of the SLV since the start of the year now totals 1,389.17 tonnes.

Silver opened the year at $30.67 per ounce and closed at $35.38 on July 6th. Despite the fact that silver has gained 15.4% since the start of the year, SLV holdings have declined by 12.7%. Although increases or decreases in iShares silver holdings can be a guide to silver demand, physical holdings of the SLV do not correlate exactly with the price movements on the underlying metal. This is due to the complex structure of the SLV which allows authorized participants to create or redeem shares in the SLV (see How Wall Street Made Profits On Silver ETF As Small Investors Sold).

There was, however, a close correlation between holdings of the SLV and the price of silver in late April. As silver prices surged to a high of $48.70 on April 28th, holdings of the iShares Silver Trust hit an all time high of 11,390.06 tonnes on April 25th.

The iShares Silver Trust currently holds 306.5 million ounces of silver valued at $10.84 billion. The all time high value of silver holdings by the SLV was reached on April 28th when the Trust held silver valued at $17.3 billion.

The SLV moved up on the week and is basing in the mid 30’s range.

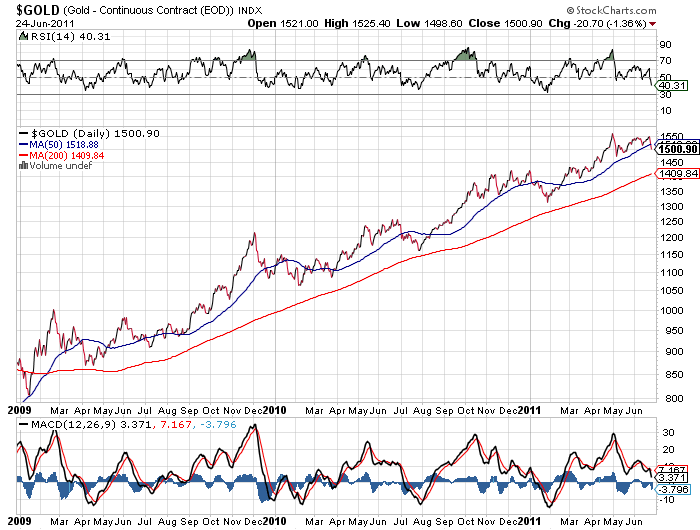

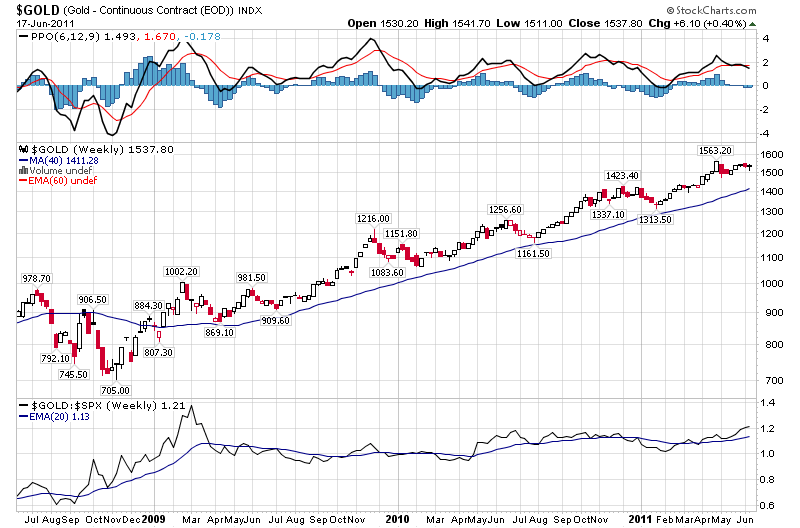

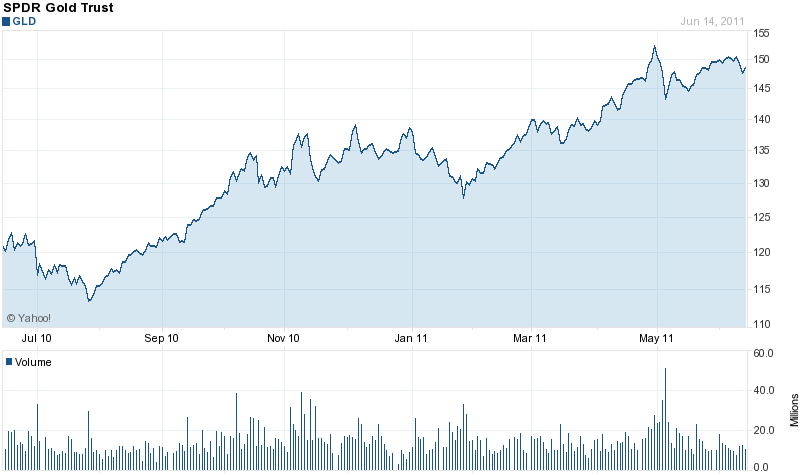

Holdings of the SPDR Gold Shares Trust (GLD) declined slightly on the week by 2.42 tonnes after a small decline in the previous week of .91 tonnes. The decline in GLD gold holdings since the beginning of the year totals 74.91 tonnes. The price of gold has increased 10% from $1388.50 at the beginning of the year to yesterday’s closing price of $1527.25.

The GLD currently holds 38.8 million ounces of gold valued at $59.2 billion.

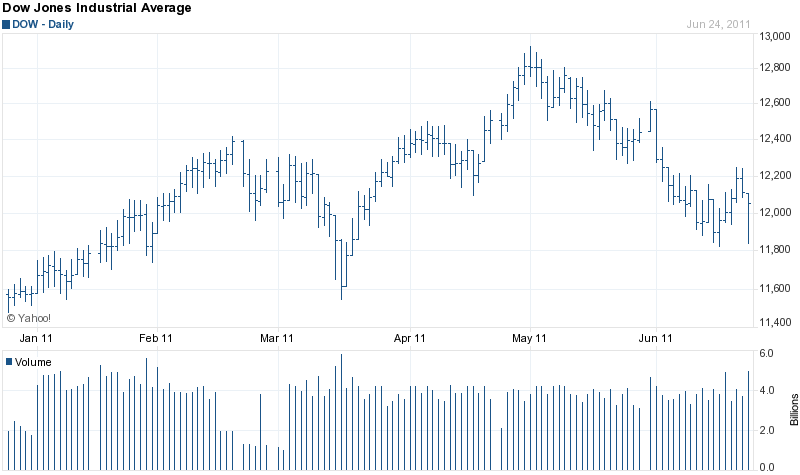

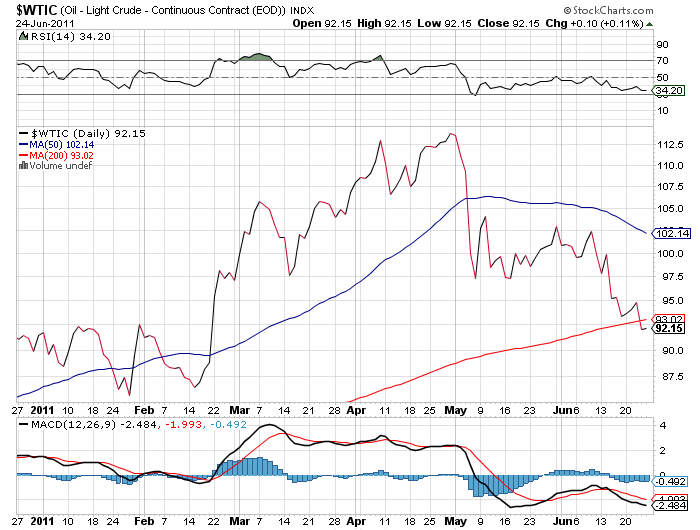

Gold moved up $32.25 this week after dipping below $1,500 last week. As measured by the closing London PM Fix Price, gold closed on Wednesday at $1527.25. Gold has refused to give up its gains this year as distrust of paper money continues to justifiably expand. The inevitable default by multiple member states of the European Union will require massive monetary support for insolvent banks holding trillions of dollars of sovereign junk debt. The European Central Bank is desperately trying to maintain the facade of a successful debt restructuring by issuing more loans to insolvent nations.

Bloomberg this week discusses the looming debt crisis in Italy which has over 2 trillion in Euro denominated debt.

Italy, though, has close to 2 trillion euros in debt outstanding. It’s inconceivable that Germany or the IMF could provide a rescue to protect its creditors. Such a package would have to involve loans and guarantees of at least 500 billion, and possibly 1 trillion, euros to impress the markets. This would be a significant fraction of Germany’s gross domestic product of about 2.5 trillion euros. With a debt-to-GDP ratio of about 80 percent, Germany’s ability to take on new debt is limited.

The Netherlands, Finland and Austria, combined with Germany, have a GDP of about 3.5 trillion euros. France adds 2 trillion more, but its debt, already 85 percent of output, is expected to grow over the next several years.

It all adds up to one sobering fact: Europe does not have enough fiscal firepower to handle an Italian crisis — at least in such a way as to protect creditors completely. Beyond the difficult numbers, why would Germany or other EU countries lend to Italy, particularly when its politicians show no sign of coming to grips with their new reality?

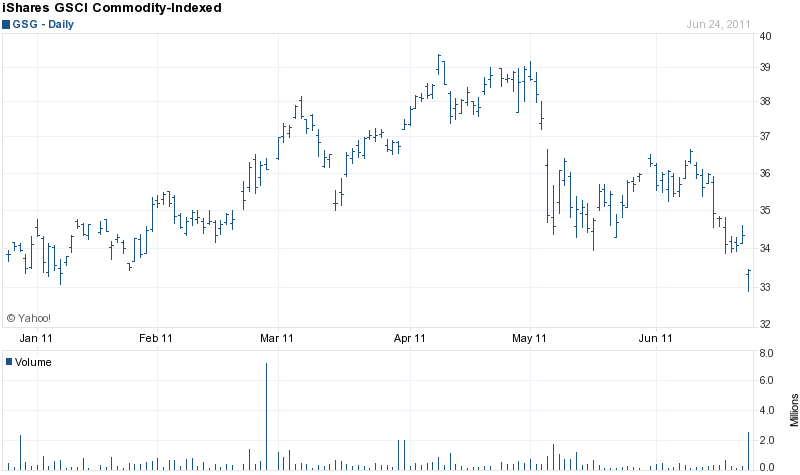

The slow motion collapse of overly indebted countries in Europe is picking up speed. Rising gold prices reflect the coming financial crisis which equity and debt markets have not yet fully discounted. Expect to see gold prices soar as the debt crisis moves into high gear.

GLD and SLV Holdings (metric tonnes)

| July 6-2011 | Weekly Change | YTD Change | |

| GLD | 1,205.81 | -2.42 | -74.91 |

| SLV | 9,532.40 | -48.21 | -1,389.17 |