It was a dismal week for precious metals as prices declined across the board. Platinum declined by over 3%, palladium and silver by 2% and gold by 1.5%.

It was a dismal week for precious metals as prices declined across the board. Platinum declined by over 3%, palladium and silver by 2% and gold by 1.5%.

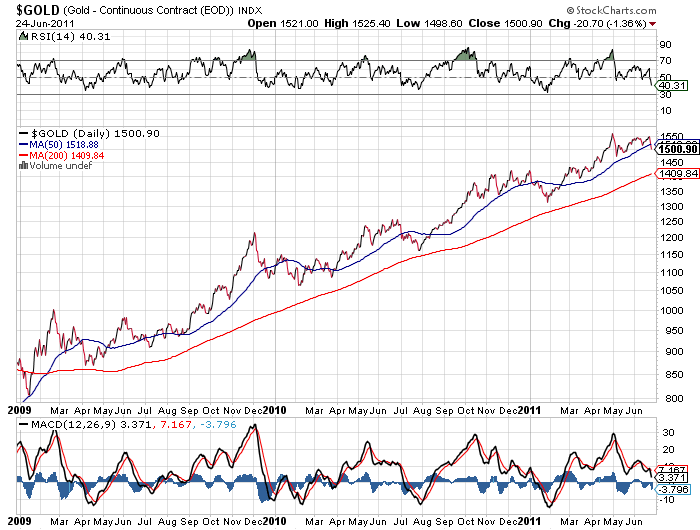

As measured by the London PM Fix Price, gold declined on the week by $22.75 after a gain of $8.25 last week. After closing Wednesday at $1,552.50 gold was hit by selling that drove the price down by $37.75 at Friday’s close. Gold has now dipped below its 50 day moving average as it has done on numerous occasions since early 2009 but remains solidly above the 200 day moving average. Since early 2009 the price trend of gold has remained in a solid uptrend and every sell off to the 200 day moving average was followed by significant upward price moves. The 200 day moving average for gold is currently at $1,410.

Silver declined modestly on the week, losing $0.66 and has remained in a tight trading range over the past two weeks between $36.22 and $34.68.

Platinum was down $55 on the week, closing at $1,751, after losing $78 in the previous week. Palladium was also weak, falling $15 to $739 after retreating $61 in the previous week. Both metals have large industrial uses and sold off as numerous economic indicators suggest a slowing world economy.

| Precious Metals Prices | ||

| PM Fix | Since Last Recap | |

| Gold | $1,514.75 | -22.75 (-1.48%) |

| Silver | $34.73 | -0.66(-1.86%) |

| Platinum | $1696.00 | -55.00 (-3.14%) |

| Palladium | $739.00 | -15.00 (-1.99%) |

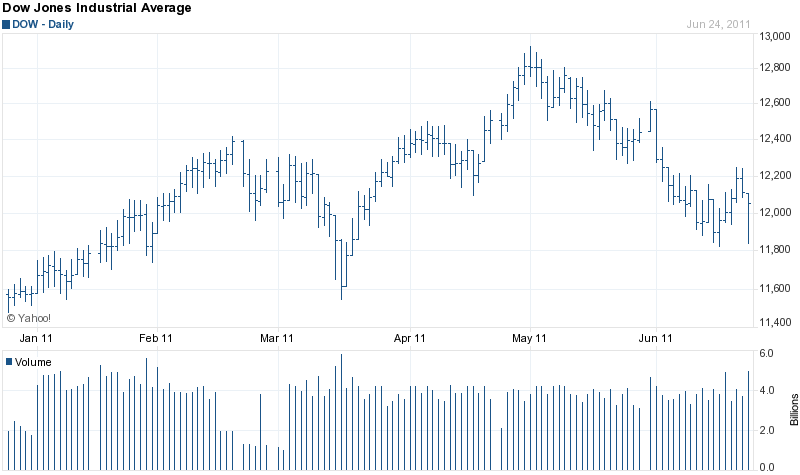

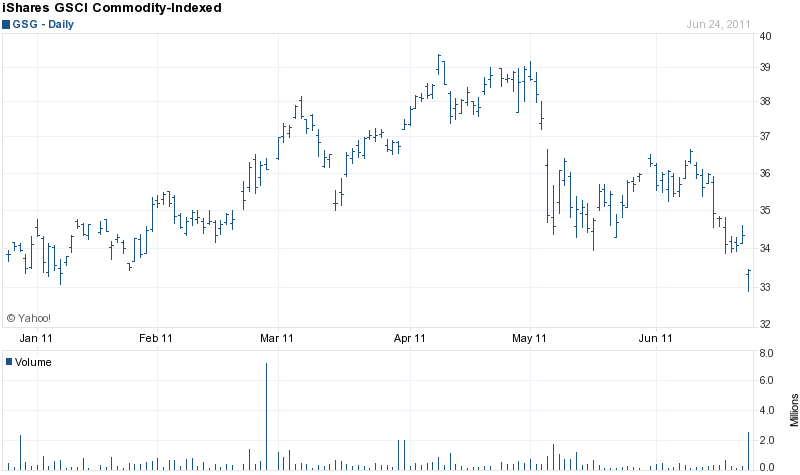

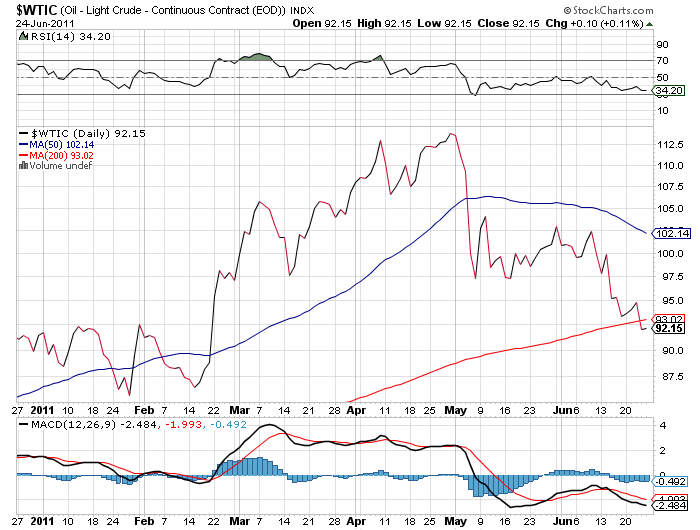

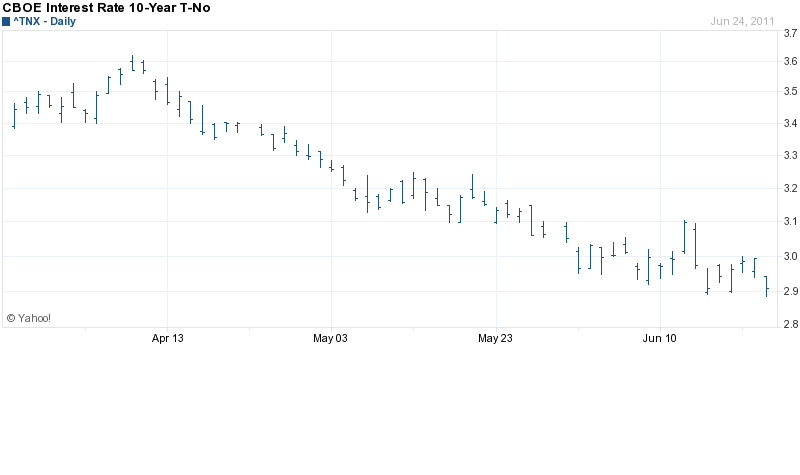

Markets had been positioned for an improving economy, higher interest rates, higher inflation and additional monetary stimulus by the world’s central banks. Since early May, the consensus has reversed considerably. Commodity prices have declined substantially and U.S. interest rates, contrary to the expectations of many, have declined sharply. Contributing to the sell offs in equity and precious metal markets were midweek comments by Fed Chairman Bernanke that, despite lower expectations for economic growth, the central bank had no plans for QE3. Markets, confronting the loss of both fiscal and monetary stimulus along with slower economic growth, sold off sharply.

The Dow Jones has plunged over 900 points since early May.

Commodities have tanked by 16%.

Oil, after peaking in early May at over $112 per barrel, has declined to the low $90’s.

Interest rates, expected to soar after QE2 ended, have declined substantially with the 10 year Treasury note dropping from 3.6% to 2.9%.

The massive amounts of debt in the system can no longer be supported by economic growth. Bernanke knows this which is why he is terrified of deflation. The collapse of asset bubbles have resulted in debt that is now unsupported by collateral value, threatening the solvency of banks and countries.

As the current market sell offs turn into a rout, the Fed will again turn to the only option left – money printing on a scale that will dwarf QE2. As reported by Bloomberg, former Fed Governor Lyle Gramley said, “The hurdle for QE3 is obviously high. But if large downside risks materialize and the economy slows enough so that the unemployment rate starts to increase again, QE3 would have to be considered.”

The Federal Reserve can’t create jobs, increase incomes, reduce unemployment or maintain the integrity of the dollar. The one thing the Fed can and will do is produce dollars in infinite quantities to prevent a 1930’s type debt induced deflationary depression.

Speak Your Mind