Gold ends nearly $14 lower in broad metals pullback

Gold ends nearly $14 lower in broad metals pullback

Maybe gold hasn’t quite decoupled from stock markets and other commodities yet. Quote from the article: “The trade now, if you believe the market is due to fall further, is surprisingly short gold.”

Has a “black market” developed for precious metals? It’s not as ridiculous as it sounds.

From the article, “A black market occurs when the State mandates a price for a commodity that cannot be produced, bought, sold or had for that price – usually a ploy to make state-reported economic figures look better. The inexorable result is that the price of the commodity will rise beyond the official price to the point where producer and consumer are willing to do business in the shade.”

More details emerge on the huge increase in the silver short positions by two major US banks just as the price collapsed.

December deliveries at the Comex

I keep hearing more and more about the looming default at the Comex for gold and silver deliveries next month.

Nearly All Gold and Platinum Products No Longer Available

The US Mint has abruptly halted sales of nearly all collectible gold and platinum coins. The coins will supposedly go back on sale later this week at lower prices. Let’s hope there’s not something else going on…

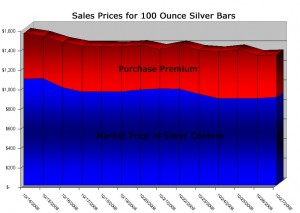

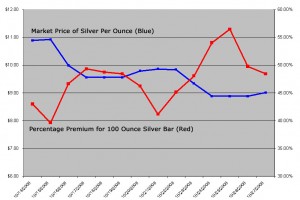

There has been much recent coverage of the rising premiums being paid to purchase physical gold and silver bullion. This has been cited as a consequence of the extreme demand for precious metals and evidence of the growing disconnect between market prices and physical prices.

There has been much recent coverage of the rising premiums being paid to purchase physical gold and silver bullion. This has been cited as a consequence of the extreme demand for precious metals and evidence of the growing disconnect between market prices and physical prices.