Silver holdings of the iShares Silver Trust (SLV) declined for the week by 27.12 tonnes after being unchanged in the previous week. The price of silver, as measured by the closing London PM Fix Price has declined by $1.73 or 4.6% since June 1st.

Silver holdings of the iShares Silver Trust (SLV) declined for the week by 27.12 tonnes after being unchanged in the previous week. The price of silver, as measured by the closing London PM Fix Price has declined by $1.73 or 4.6% since June 1st.

After reaching a high of $48.70 per ounce on April 28th, silver has declined by $12.48 or 25.6% based on today’s closing price. From the low of $32.50 on May 12, silver has seen a price recovery of $3.72.

The iShares Silver Trust has seen a substantial reduction in silver holdings of 1,007.36 tonnes since the beginning of the year when silver traded at $30.67. The decline in holdings by the SLV from late April have been even more dramatic. The SLV hit an all time high for silver holdings on April 25, 2011 of 11,390.06 tonnes. The decline in SLV holdings from the all time high registers at 1,448.73 tonnes or 46.6 million ounces of silver valued at $1.7 billion.

The iShares Silver Trust currently holds 318.7 million ounces of silver valued at $11.5 billion. On April 27th, the value of silver held by the SLV was $16.1 billion.

At today’s closing price of $36.03, shares of the SLV traded at a premium of $0.71 or 2.0% to the net asset value of the Trust. Since the beginning of the year, the SLV has gained 20.2% and over the past year has increased by 115.4%. For a discussion on why silver prices may see a quick recovery to all time highs see – How Soon Will Silver Hit New Highs?

GLD and SLV Holdings (metric tonnes)

| June 8-2011 | Weekly Change | YTD Change | |

| GLD | 1,211.57 | -1.30 | -69.15 |

| SLV | 9,914.21 | -27.12 | -1,007.36 |

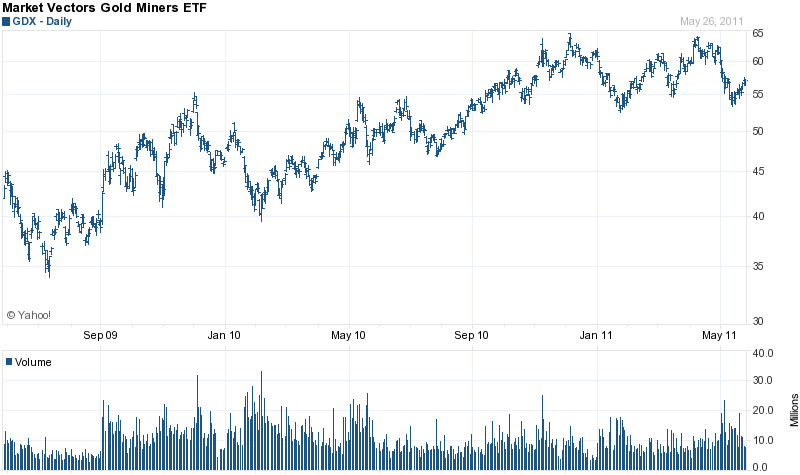

Holdings of the SPDR Gold Shares Trust (GLD) were little changed on the week, declining by 1.3 tonnes, after a decline of 1.21 tonnes in the previous week. The GLD currently holds 38.95 million ounces of gold valued at $59.9 billion. Holdings of the GLD hit at all time record high of 1,320.47 tonnes on June 29, 2010.

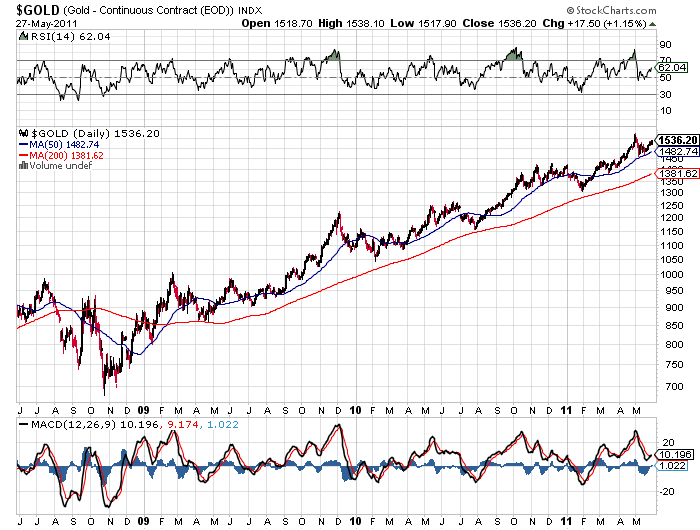

Gold prices gained slightly on the week, closing up $4.00 per ounce from the June 1 close. Gold has now gained $149.25 since the beginning of the year, up 10.75%. Gold has remained in a narrow trading range for several months, consolidating its early year gains. Gold has remained above the $1,500 level since May 20th when it closed at $1490.75 per ounce.

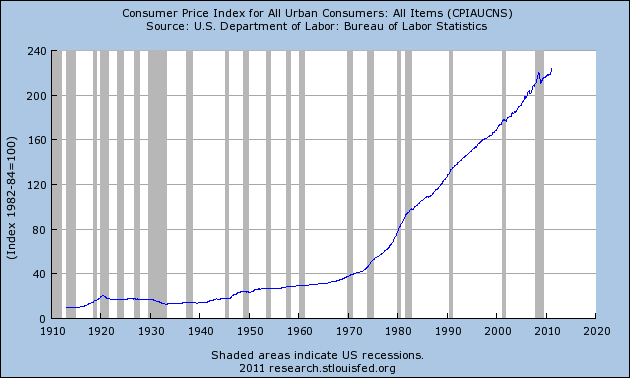

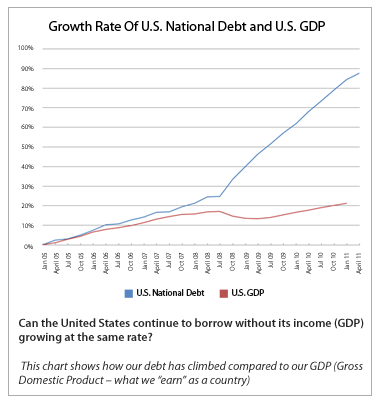

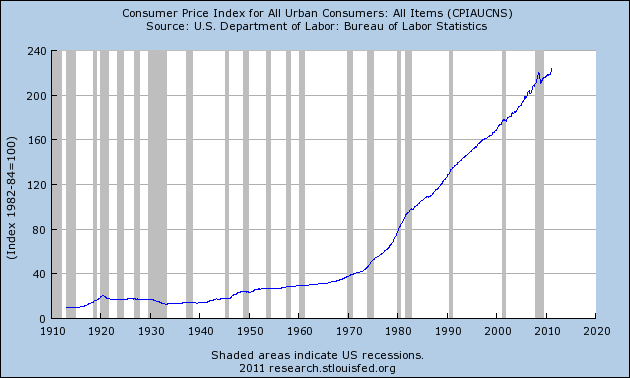

In his press conference on April 27, 2011, Federal Reserve Chairman Bernanke dismissed inflation worries, stating that “Our expectation is that inflation will come down and towards a more normal level”. Should we believe him? Not if you want to preserve your wealth and here’s why.

In his press conference on April 27, 2011, Federal Reserve Chairman Bernanke dismissed inflation worries, stating that “Our expectation is that inflation will come down and towards a more normal level”. Should we believe him? Not if you want to preserve your wealth and here’s why.

The holdings of the iShares Silver Trust (SLV) declined slightly on the week by 53.10 tonnes as silver prices continued to consolidate after the sharp sell off of early May.

The holdings of the iShares Silver Trust (SLV) declined slightly on the week by 53.10 tonnes as silver prices continued to consolidate after the sharp sell off of early May.