Commodity and precious metal prices tumbled this week, with gold and silver prices snapping a streak of four consecutive weekly increases. Following the recent run up in prices, there had been some anticipation of a correction. In addition, there were concerns that the Fed’s announcement of the end of QE2 would result in an end to the flood of cheap money which has fueled the rise of commodities.

Commodity and precious metal prices tumbled this week, with gold and silver prices snapping a streak of four consecutive weekly increases. Following the recent run up in prices, there had been some anticipation of a correction. In addition, there were concerns that the Fed’s announcement of the end of QE2 would result in an end to the flood of cheap money which has fueled the rise of commodities.

In the precious metals group, silver was the biggest loser with a drop of almost 30% from last Thursday’s closing London PM Fix Price. (The London markets were closed on Friday, April 28th.) The losses in silver far outpaced the declines in other precious metals and many place the blame squarely on the rapid fire multiple margin increases by the COMEX for trading silver futures (See How The COMEX Crashed The Silver Market).

Gold, platinum and palladium also had a tough week with respective price declines of 3.19%, 2.51% and 7.21%.

| Precious Metals Prices | ||

| PM Fix | Since Last Recap | |

| Gold | $1,486.50 | -49.00 (-3.19%) |

| Silver | $34.20 | -14.50(-29.77%) |

| Platinum | $1,789.00 | -46.00 (-2.51%) |

| Palladium | $721.00 | -56.00 (-7.21%) |

Precious metals have had previous serious declines without affecting the long term upward move in prices (see Measuring Declines From The High For Gold and Silver). Overextended markets will correct but the fundamental forces pushing precious metal prices higher have not changed. While dollars and other paper currencies can be produced in infinite quantity, the supply of gold, silver and commodities are finite.

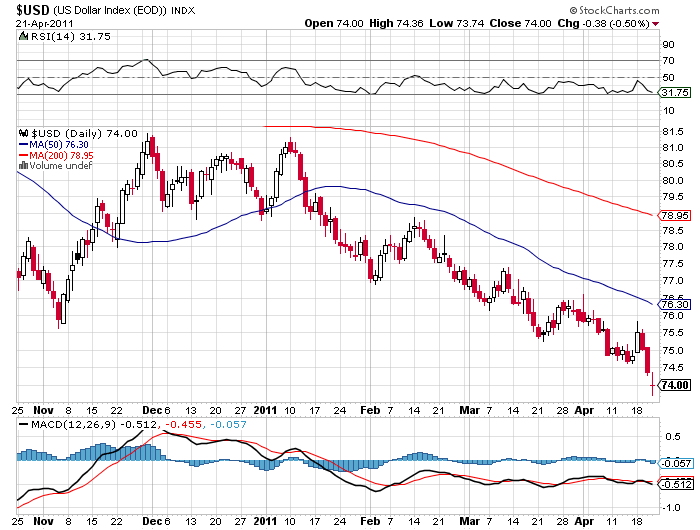

Despite the Fed’s promise to stop printing money and its pledge of supporting a “strong dollar”, the dollar has had only a feeble recovery and is close to its all time lows. The markets clearly have no confidence in Chairman Bernanke’s words and the weak dollar proves it. Every bull market experiences temporary pullbacks and the precious metals are no exception. Long term investors should view the latest price consolidation as another potential opportunity to increase positions.

On Tuesday, May 3rd, the COMEX raised margin requirements for trading silver futures contracts. This was the third increase in the past week.

On Tuesday, May 3rd, the COMEX raised margin requirements for trading silver futures contracts. This was the third increase in the past week. As predicted on Monday, the Federal Reserve policy meeting and subsequent press conference by Fed Chief Ben Bernanke had the potential to cause an explosive move up in the precious metal markets. (see

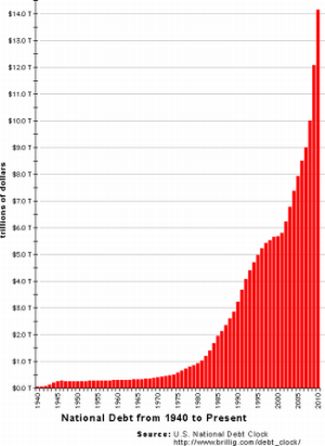

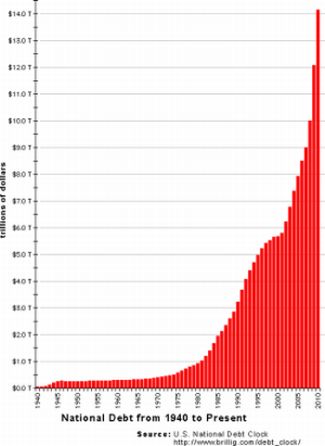

As predicted on Monday, the Federal Reserve policy meeting and subsequent press conference by Fed Chief Ben Bernanke had the potential to cause an explosive move up in the precious metal markets. (see  As government spending spirals out of control and the Federal Reserve perpetuates a deliberate strategy of currency debasement, precious metals prices continued to soar. Gold, as measured by the London PM Fix Price, closed at $1504.00, up $27.25 on a shortened four day trading week .

As government spending spirals out of control and the Federal Reserve perpetuates a deliberate strategy of currency debasement, precious metals prices continued to soar. Gold, as measured by the London PM Fix Price, closed at $1504.00, up $27.25 on a shortened four day trading week .

To many investors with a sense of history, the four most dangerous words are “this time it’s different”. The phrase is usually evoked in an attempt to justify why a huge price gain in a particular asset class can continue to defy common sense and historical valuation norms. A surfeit of explanations on why “this time is different” is usually enough to send seasoned investors to the exits.

To many investors with a sense of history, the four most dangerous words are “this time it’s different”. The phrase is usually evoked in an attempt to justify why a huge price gain in a particular asset class can continue to defy common sense and historical valuation norms. A surfeit of explanations on why “this time is different” is usually enough to send seasoned investors to the exits.

On April 25, 2011, the United States Mint will make the first of the 2011-dated America the Beautiful Silver Bullion Coins available for purchase. This year’s release and distribution of the 5 ounce silver bullion series is expected to be much different than experienced for the previous year.

On April 25, 2011, the United States Mint will make the first of the 2011-dated America the Beautiful Silver Bullion Coins available for purchase. This year’s release and distribution of the 5 ounce silver bullion series is expected to be much different than experienced for the previous year. Silver was again the star performer in the precious metals group, hitting a new yearly high of $42.61. For the second week in a row, silver has added over $2 per ounce as measured by London PM Fix Price. After soaring $2.59 in the previous week, silver capped another standout week with a gain of $2.39.

Silver was again the star performer in the precious metals group, hitting a new yearly high of $42.61. For the second week in a row, silver has added over $2 per ounce as measured by London PM Fix Price. After soaring $2.59 in the previous week, silver capped another standout week with a gain of $2.39. Silver prices continued streaking higher today on fears of a plunging dollar, rampant money printing by central banks, and talk in Europe of a looming debt restructuring (default) by Greece.

Silver prices continued streaking higher today on fears of a plunging dollar, rampant money printing by central banks, and talk in Europe of a looming debt restructuring (default) by Greece.

A broad sell off in commodity prices triggered by a Goldman Sachs prediction of a “substantial pullback” in oil prices had little impact on the strong uptrend in gold and silver prices. Based on the London closing PM Fix Price, gold ended Tuesday off only $19 or 1.3% from Friday’s all time close. Silver, meanwhile, the absolute star of the precious metals group, closed Tuesday at $40.44, up 22 cents from Friday’s 31 year closing high. After the recent huge run up in both gold and silver prices, the very modest price declines suggests that the bulls are on the right side of the trade.

A broad sell off in commodity prices triggered by a Goldman Sachs prediction of a “substantial pullback” in oil prices had little impact on the strong uptrend in gold and silver prices. Based on the London closing PM Fix Price, gold ended Tuesday off only $19 or 1.3% from Friday’s all time close. Silver, meanwhile, the absolute star of the precious metals group, closed Tuesday at $40.44, up 22 cents from Friday’s 31 year closing high. After the recent huge run up in both gold and silver prices, the very modest price declines suggests that the bulls are on the right side of the trade.