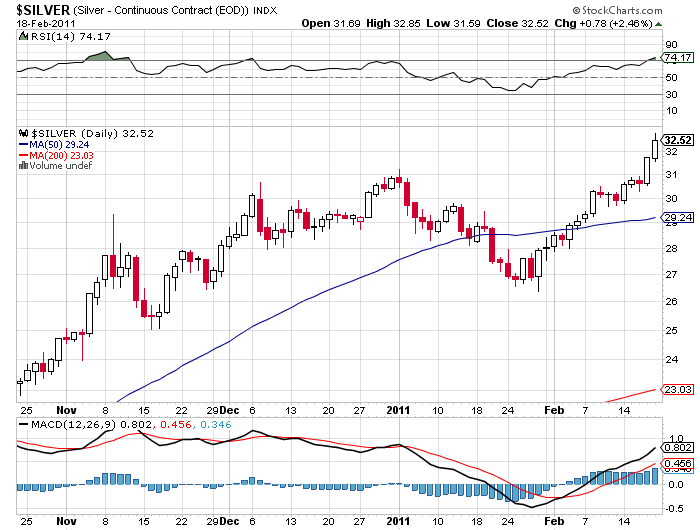

Many of us have been accumulating large positions in silver bullion and silver mining shares. Whether these positions have been held for decades or only for the past year, the recent explosive move up in the silver price has caused some to wonder if there is a way to protect gains from a possible pull back in silver prices.

Many of us have been accumulating large positions in silver bullion and silver mining shares. Whether these positions have been held for decades or only for the past year, the recent explosive move up in the silver price has caused some to wonder if there is a way to protect gains from a possible pull back in silver prices.

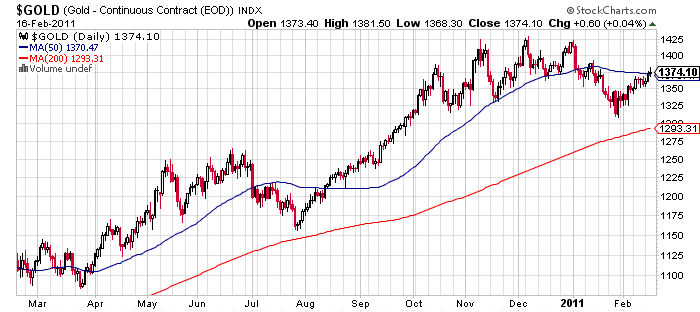

The bull market in silver has a long ways to go considering the perilous state of sovereign finances, surging commodity prices, and the risk of political and military turmoil in Saudi Arabia. Nonetheless, it is normal for every bull market to experience sharp price sell offs, such as the almost $300 per ounce drop in gold prices during 2008. An experienced investor with a long term view and fundamental understanding of the long term appeal of gold would have used this occasion to increase gold positions in a portfolio.

For investors who may be short term bearish and do not wish to see their portfolio take a steep dive, hedging against a significant short term sell off may make sense and increase overall portfolio returns.

Investors in silver sitting on a 400% gain since October 2008 and wishing to protect profits may consider the purchase of an offsetting position in the ProShares UltraShort Silver (ZSL) to protect profits. Investments in commodities or precious metals can exhibit very volatile price movements. In 2008, the price of silver dropped by 50% in four months, possibly prompting some investors to sell their positions and miss out on the explosive upward move that followed. Hedging volatility to protect large gains without reducing core silver holdings is possible for the average investor by purchasing the ZSL.

The Ultrashort Silver (ZSL) is an inverse ETF that seeks to produce twice (200%) the opposite investment result of the daily price movement in silver. An inverse ETF for silver is therefore a means of profiting from a downward move in silver as measured by the U.S. London fix price. In theory, a 10% drop in the price of silver would result in a 20% gain in the price of the ZSL.

The ZSL trades on the New York Stock Exchange and was launched by ProShares which offers the largest selection of leveraged and inverse ETFs. ProShares is part of the ProFunds Group which has $31 billion in ETF and mutual fund assets.

The ZSL does physically hold any position in silver bullion. In order to achieve a 200% inverse investment result of the price change in silver, the ZSL positions itself daily through the use of financial instruments whose value is based on the underlying silver price. The complex financial instruments used to achieve the ZSL’s investment objectives include swap agreements, forward contracts, futures contracts and option contracts.

ProShares states that the ZSL seeks achievement of the targeted returns for only a single day since investment returns beyond a day can be higher or lower than the 200% inverse investment return objective. According to ProShares, the four factors affecting the divergence between daily and long term investment results are the holding periods, index volatility, leverage and inverse multiples. An investment in the ZSL should be monitored daily since the return for longer periods of time can vary significantly from short term results.

For the investor who understands the risks associated with a double inverse ETF, the ZSL can be a valuable tool to manage the risk of a large investment in silver. The four most common uses of the ZSL (according to ProShares) is to help hedge a silver portfolio, obtain greater profits (or loss) through leverage, commit less cash investment for a specific level of silver exposure, and to reduce exposure to a silver position without a reduction of portfolio holdings.

Ironically, the ZSL was launched near the bottom of the silver market in late 2008 and the investment results have been catastrophic for a buy and hold investor in ZSL. The split adjusted price of ZSL has dropped from $1100 to the mid $20’s as the price of silver soared. Leverage works on both the upside and downside to magnify investment results and in this regard the ZSL was successful. During 2010, the ZSL had a 77% loss and has declined even further during 2011.

Whether or not the ZSL will be a profitable investment in the future is unknown but it is one investment strategy that can be used to hedge a potential drop in silver prices.

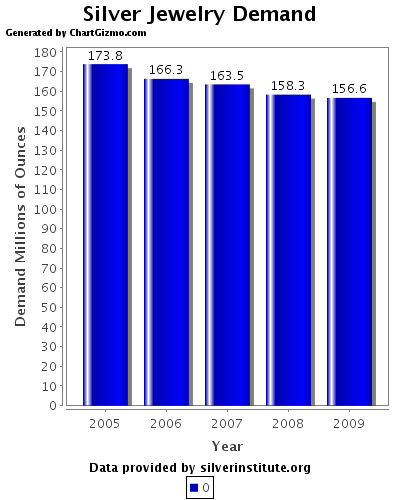

Demand for silver jewelry hit new records in 2010 according to The Silver Institute. A survey of 340 retail jewelers conducted in February by Nielsen/National Jeweler shows that 87% of retail jewelers experienced sales increases. The retail jewelers surveyed operate 4,000 stores.

Demand for silver jewelry hit new records in 2010 according to The Silver Institute. A survey of 340 retail jewelers conducted in February by Nielsen/National Jeweler shows that 87% of retail jewelers experienced sales increases. The retail jewelers surveyed operate 4,000 stores.

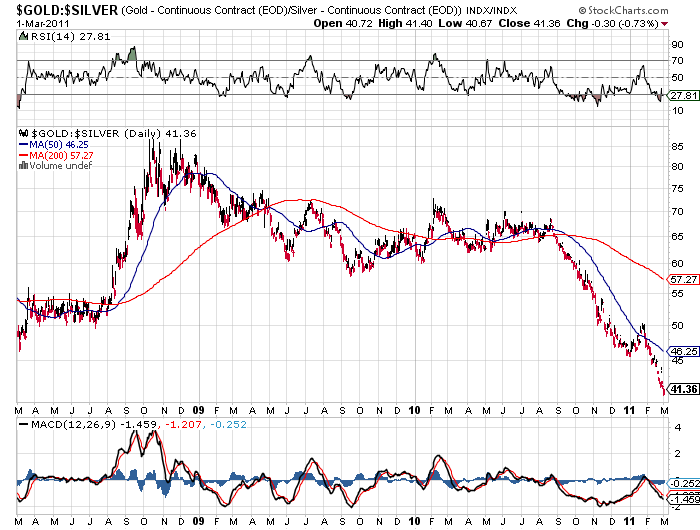

The gold silver ratio chart below shows the dramatic fashion in which silver has been outperforming gold since last August. The gold silver ratio is calculated by dividing the price of gold by the price of silver. A declining gold silver ratio indicates that silver has been outperforming gold. The gold silver ratio has declined from 65 last summer to a current level of 41.

The gold silver ratio chart below shows the dramatic fashion in which silver has been outperforming gold since last August. The gold silver ratio is calculated by dividing the price of gold by the price of silver. A declining gold silver ratio indicates that silver has been outperforming gold. The gold silver ratio has declined from 65 last summer to a current level of 41.

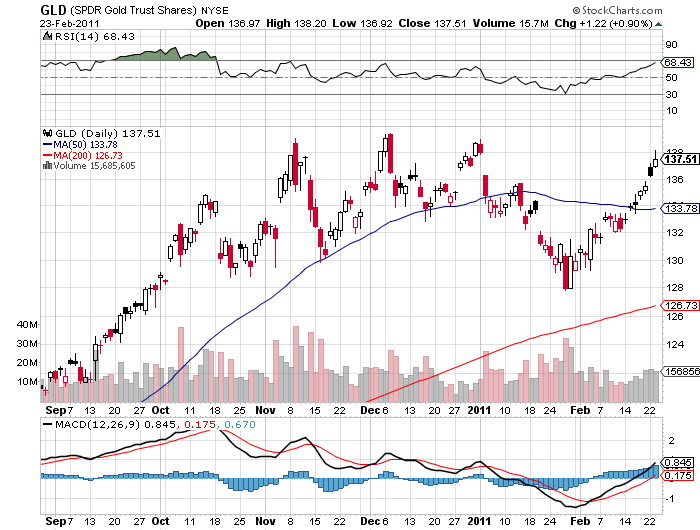

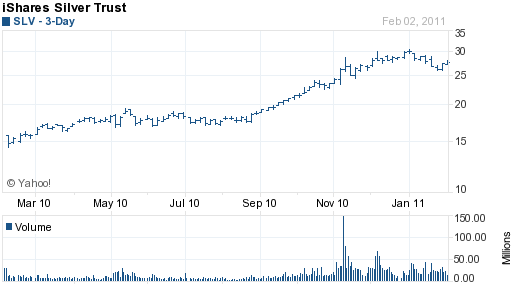

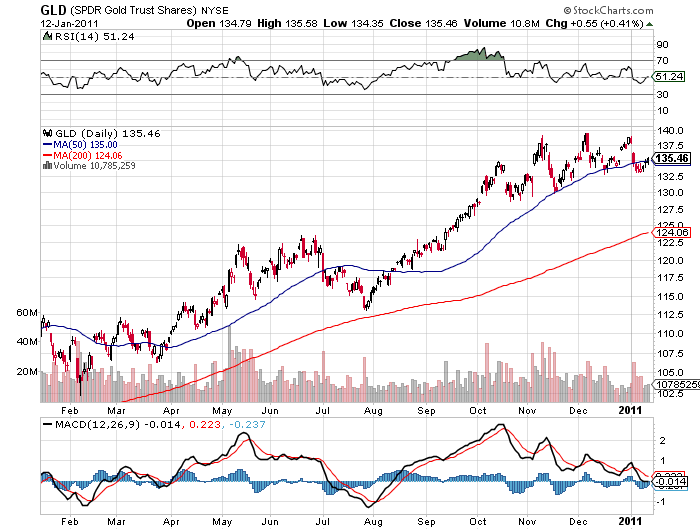

The SPDR Gold Shares Trust (GLD) holdings declined slightly on the week, while the iShares Silver Trust (SLV) increased its holdings by a substantial 164 metric tonnes

The SPDR Gold Shares Trust (GLD) holdings declined slightly on the week, while the iShares Silver Trust (SLV) increased its holdings by a substantial 164 metric tonnes

Triple tops are a well known chart formation that signal the potential for a price trend reversal. A classic triple top occurs over a period of three to six months during which prices decline after hitting a series of multiple equal highs. For the reversal pattern to register a definitive sell signal, the price must break below support levels.

Triple tops are a well known chart formation that signal the potential for a price trend reversal. A classic triple top occurs over a period of three to six months during which prices decline after hitting a series of multiple equal highs. For the reversal pattern to register a definitive sell signal, the price must break below support levels.

Another Precious Week

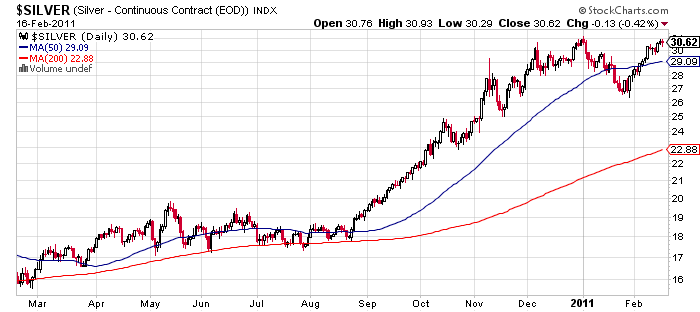

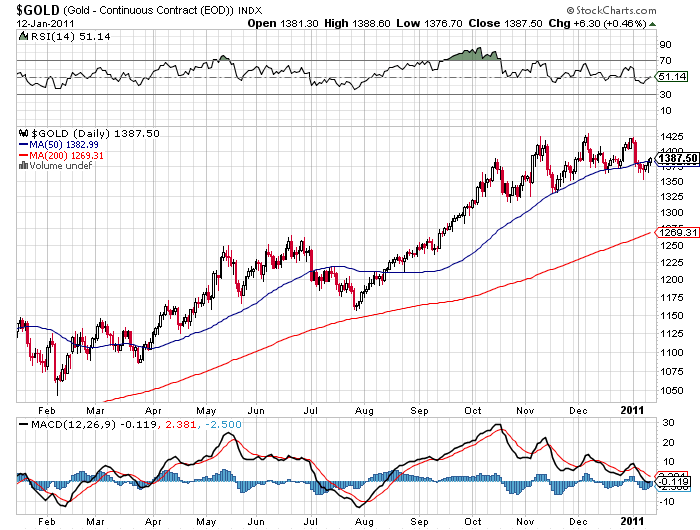

Another Precious Week Gold just had an amazing year, in which it reached a new all time high, rising about 25%. Silver provided an even more stellar performance, with a gain of about 75% and counting. It’s no wonder then, that more and more investors are becoming interested in the potential offered by silver.

Gold just had an amazing year, in which it reached a new all time high, rising about 25%. Silver provided an even more stellar performance, with a gain of about 75% and counting. It’s no wonder then, that more and more investors are becoming interested in the potential offered by silver.