Triple tops are a well known chart formation that signal the potential for a price trend reversal. A classic triple top occurs over a period of three to six months during which prices decline after hitting a series of multiple equal highs. For the reversal pattern to register a definitive sell signal, the price must break below support levels.

Triple tops are a well known chart formation that signal the potential for a price trend reversal. A classic triple top occurs over a period of three to six months during which prices decline after hitting a series of multiple equal highs. For the reversal pattern to register a definitive sell signal, the price must break below support levels.

A triple top has certain characteristics, each of which must be analyzed.

- The three highs must be within reasonable price points of each other and spaced over equal time periods.

- A previous long term uptrend must have occurred which established a definitive uptrend.

- Volume levels tend to decrease during the formation of a triple top. If volume increases on a pullback from the third top, more significance must be given to the potential for a significant trend reversal.

- A triple top is not completed unless the price level breaks a key support level which would be the lowest price point on previous pullbacks from the intermittent tops.

- A triple top chart pattern is not considered bearish unless support levels are decisively broken

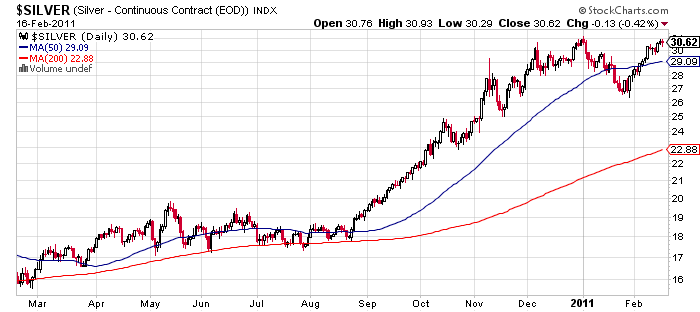

Examining the chart for silver before the recent move up, we could see a pattern developing with characteristics of a triple top. The critical support level for silver was at the $27 level. Silver’s inability to break resistance at the $30 level would have been at best a neutral signal and a break below $27 would have forecast further price declines. The strong upward price movement in silver last week as it soared past the $30 area is extremely bullish and tells us that the bull market in silver is intact.

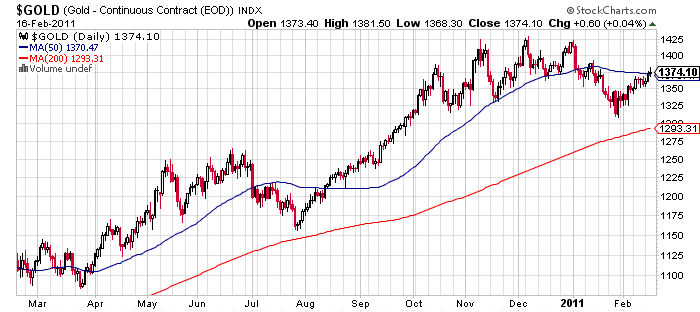

Viewing the chart of gold, we can see that the same potential for a triple top exists.

Gold has been turned back three times at the $1425 level, the tops are equally spaced over a period of almost 4 months and gold has been in an established uptrend for an extended period of time. In the case of gold, a drop below support at $1320 would be a bearish signal and reason to take a defensive posture.

Considering the strong fundamentals supporting gold, we may soon see a breakout in the price of gold similar to what we have just witnessed with silver.