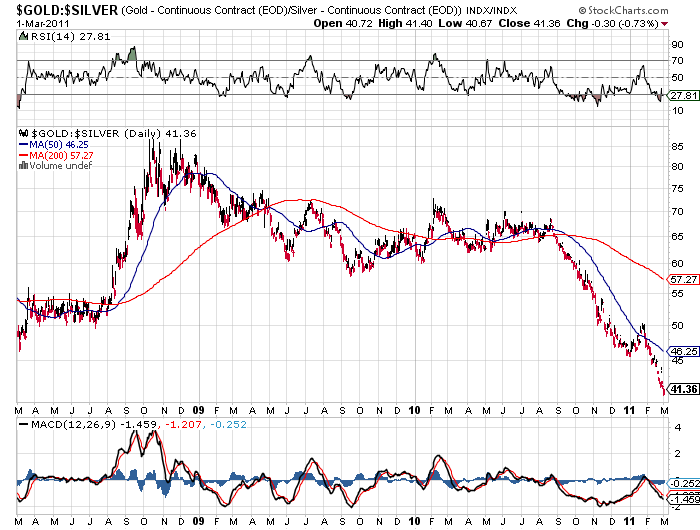

The gold silver ratio chart below shows the dramatic fashion in which silver has been outperforming gold since last August. The gold silver ratio is calculated by dividing the price of gold by the price of silver. A declining gold silver ratio indicates that silver has been outperforming gold. The gold silver ratio has declined from 65 last summer to a current level of 41.

The gold silver ratio chart below shows the dramatic fashion in which silver has been outperforming gold since last August. The gold silver ratio is calculated by dividing the price of gold by the price of silver. A declining gold silver ratio indicates that silver has been outperforming gold. The gold silver ratio has declined from 65 last summer to a current level of 41.

Since August 2010 gold has moved up 22% from the $1,175 level while silver has soared 92% from the $18 range. Does the declining gold silver ratio indicate that silver prices are due for a correction or is this a fundamental change in the price relationship?

The gold silver ratio has averaged around 60 since the mid 1970’s. In January 1980, as silver hit its peak price of $48.70, the gold silver ratio briefly hit 16, but rapidly rose as the Hunt brother’s attempt to corner the silver market came undone and silver prices collapsed.

Gold Silver Ratio - Courtesy Stockcharts.com

Will the current decline in the gold silver ratio continue? From a very long term historical perspective, a gold silver ratio in the 16 range has been the norm. Since ancient times, it has typically taken 16 ounces of silver to purchase one ounce of gold. Interestingly, the earth’s reserves of silver exceeds that of gold by roughly 16 times. If this ultra long term relationship were to reassert itself, silver would sell for approximately $90 per ounce based on the current price of gold. With gold at $2,500 per ounce, silver would have a value of $156 per ounce at the historical gold silver ratio of 16.

The fundamental reason that may drive the gold silver ratio back to the 16 range is growing demand by small investors. Silver, known as the poor man’s gold has seen a huge surge of public demand, as evidenced by record sales of the Silver Eagles.

Increasing public recognition of the need to preserve wealth against paper currencies will continue to propel silver to historic highs. Simply put, silver is more affordable to the average buyer who cannot afford the higher priced Gold Eagles. Silver has a lot of catching up to do and we are probably in the early stages of a fundamental reversion to a lower gold silver ratio which will send silver prices soaring past $100 per ounce.