Is the day of reckoning finally arriving?

Is the day of reckoning finally arriving?

Financial markets are suddenly starting to take the debt crisis seriously. The sell off in global stock markets has intensified as investors rush to sell risk assets and flee to the safety of cash. The value of all US stocks as represented by the Wilshire 5000 lost $800 billion on Thursday’s selloff and an astounding $1.9 trillion since mid July.

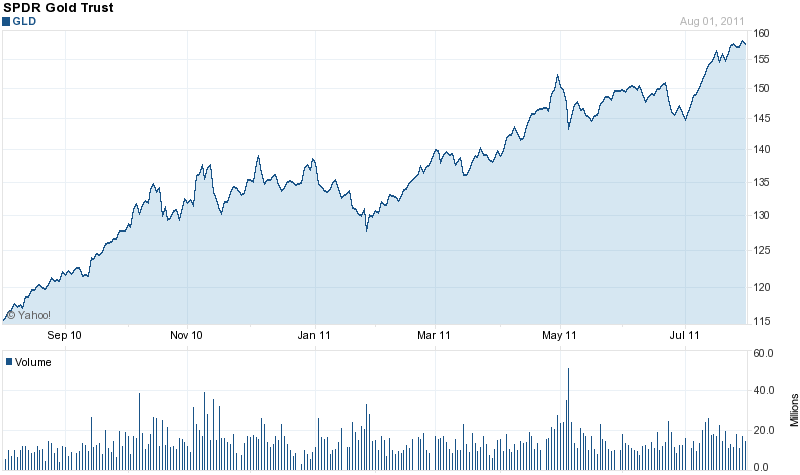

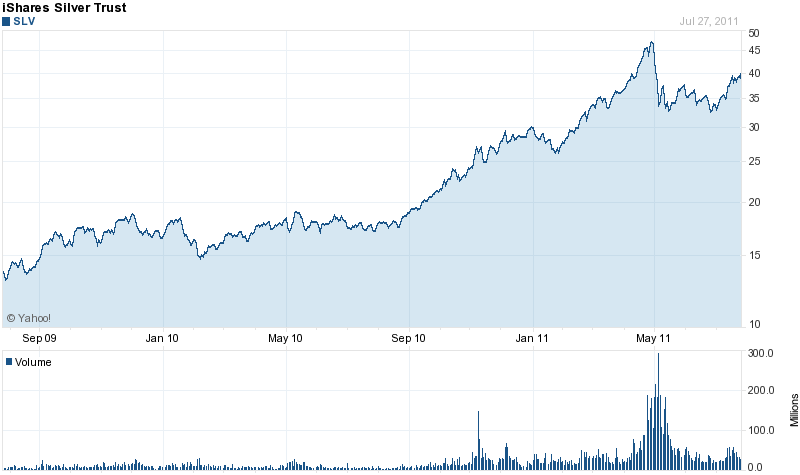

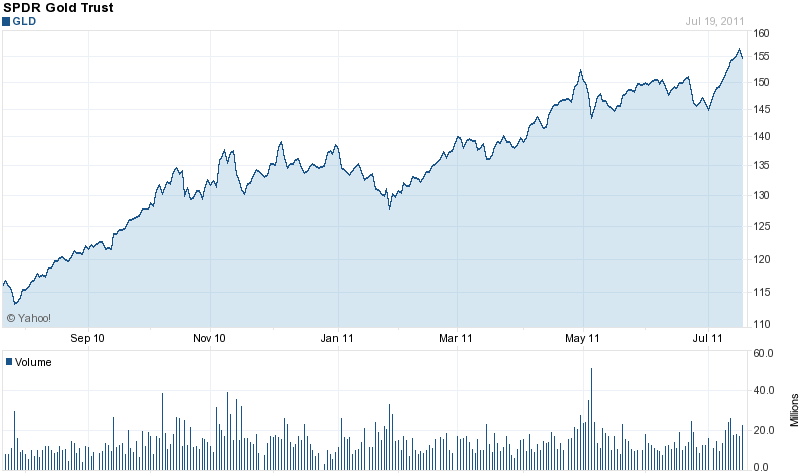

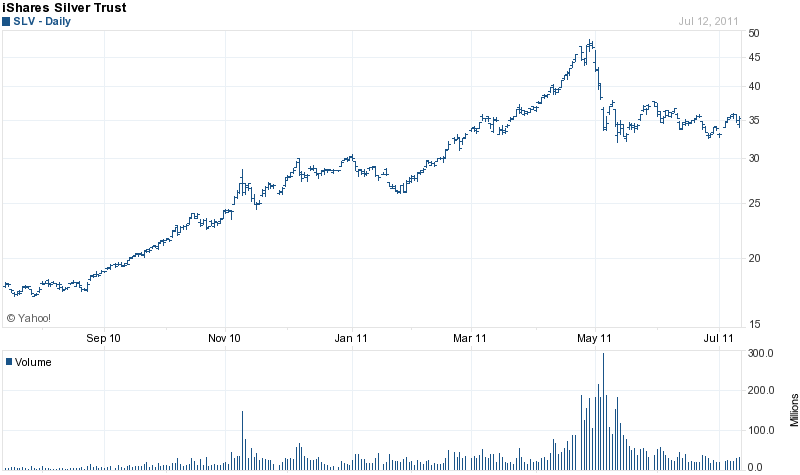

Gold also dipped in Thursday’s sell off to close in New York at $1,649.80 after trading as high as $1,683.30 in morning trading. The quick intraday reversal had many in the mainstream press proclaiming that gold was just another risk asset.

Should we be worried about the price of gold sliding into the abyss along with stocks? The answer is no. Gold’s modest pullback came after a run up of almost $200 since July 1st while stocks were in the midst of a severe sell off. To see some profit taking and liquidity driven selling by gold traders on a 500 point down day in the Dow is not surprising. The fundamental factors driving gold higher are not only still valid but have intensified as the debt crisis ultimately puts the value of all paper assets at risk.

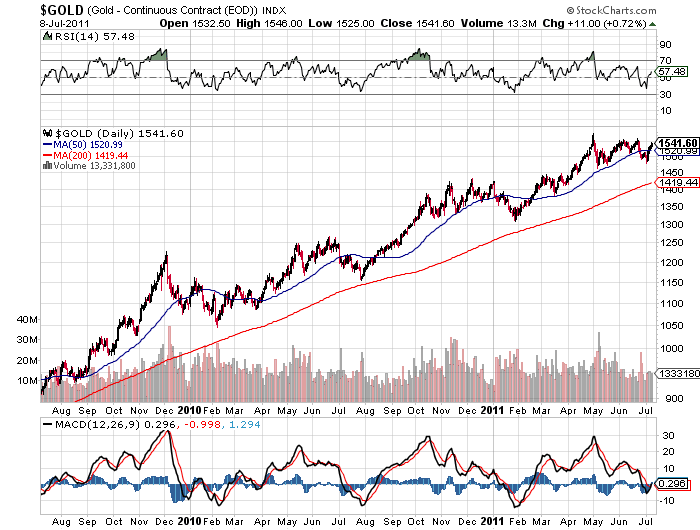

The bullish trend in gold remains intact. The biggest pullback in gold during the last decade occurred during the financial meltdown of 2008 when gold declined by $250 but quickly recovered thereafter. To long term gold investors, the decline in 2008 is hardly noticeable on the long term charts. While gold dropped by 25%, numerous other asset classes saw losses up to three times as large.

Gold is at the upper end of its trading channel and a pullback of $50 or $100 to the lower band of the trading channel would merely be another small correction in the long term uptrend. If investors lose confidence that governments and central banks are no longer capable of containing the debt crisis, gold will begin a rapidly accelerated price move with $100 up days becoming routine.

The debt crisis, which has been building for decades, seems to be reaching a super critical stage.

The massive sell off in global equity markets is based on the realization that we are approaching the financial nightmare of defaulting sovereign states, a looming recession, massive debt levels, a slowing world economy, a disastrous reduction in tax receipts and declining income growth. The end of QE2 along with austerity measures and spending cuts now being discussed in Congress leaves the Federal Reserve as the last firewall against a collapse into depression.

The clumsy and uncoordinated efforts of the ECB to contain the Greek debt crisis resulted in the government imposing losses on bondholders. The realization by investors that they will not be protected from losses on holdings of other weak sovereign debt was the trigger that set off the rush to sell risk assets and move to cash. Financial stress in European banks is rising steadily and many are already experiencing a classic run on the bank as depositors withdraw funds and move to (ironically) dollar assets.

It may be too late for the US to attempt a move to fiscal conservatism and austerity measures. Despite the worries about exploding government deficits, an abrupt end to government deficit spending would probably tip the US economy into a full blown depression with massive job losses and a downward spiral in wage growth. Politicians don’t think long term – they are worried about the next election. As unemployment grows along with declining wages and home values, the public pressure on politicians to “do something” will become intense.

The Wall Street Journal recently reported that three former top fed officials are already arguing for a third round of quantitative easing if the economy weakens. We already have a weak economy. Both the public and the politicians, oblivious to the dangers of unsustainable deficit spending, will demand that the government “do something.” Once the Fed has political support, the floodgates of money printing will become wide open. Open ended quantitative easing may produce the inflation necessary to reduce the real value of sovereign debts, but it will also decimate the purchasing value of paper money.

In the end, the government will continue to administer the same medicine to the dying patient – zero interest rates and fiscal and monetary stimulus. The arguments will also be the same – these are temporary measures to get the economy growing and buy some time, similar to what the Japanese have been doing since 1990. Japan has put off the day of reckoning with zero interest rates, money printing and massive fiscal stimulus – the result is a debt to GDP ratio twice that of the United States. Wasn’t it Thomas Aquinas who said that “problems are not solved, they are survived”?

Many emerging nations experiencing high inflation (due in part to Fed money printing) are turning to gold in a big way as an alternate form of currency and to diversity reserve holdings. The central banks of emerging nations have already bought almost 180 tonnes of gold this year, more than double the amount purchased for all of last year.

Any price corrections in gold should be viewed as an opportunity to add to positions. The biggest risk to investors is to be under allocated in gold. (see also Smart Money Sees Perfect Storm for Gold and Silver and Why There Is No Upside Limit For Gold).