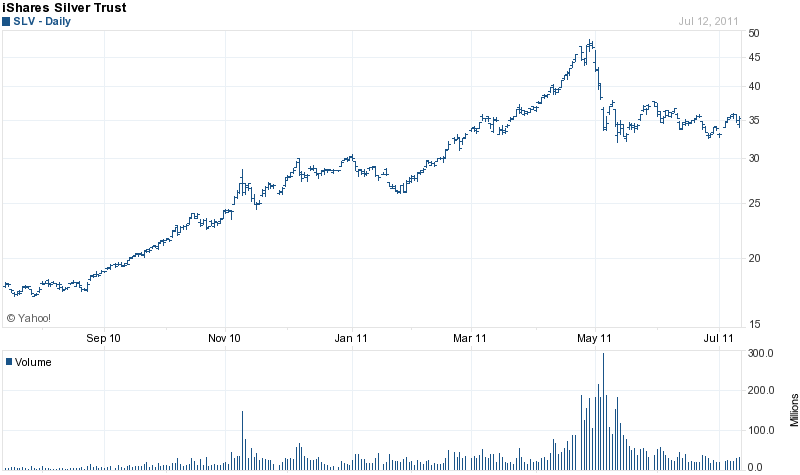

The iShares Silver Trust (SLV) showed a gain in holdings of 101.55 tonnes on the week after declining by a modest 48.21 tonnes in the previous week. A decline from record holdings of 11,390.06 tonnes on April 25th paralleled the sell off in the silver market that occurred in early May. Since mid June, holding of the SLV have stabilized in the range of 9,500 to 9,600 tonnes.

The iShares Silver Trust (SLV) showed a gain in holdings of 101.55 tonnes on the week after declining by a modest 48.21 tonnes in the previous week. A decline from record holdings of 11,390.06 tonnes on April 25th paralleled the sell off in the silver market that occurred in early May. Since mid June, holding of the SLV have stabilized in the range of 9,500 to 9,600 tonnes.

Silver has surged in price since the lst of July when silver closed at $33.85. Today’s closing New York price of $38.33 gives silver a gain of $4.48 or 13.2% through July 13th. The price of silver surged today after Fed Chairman Bernanke, mere days after the end of QE2, announced that he was ready to “come to the rescue” of the American financial system again with another round of quantitative easing. Bernanke’s continued policy of dollar debasement may not do much to revive the economy, but it is certain to send gold and silver prices to all time highs.

The SLV Trust now holds 309.7 million ounces of silver valued at $11.4 billion dollars. The all time high in the value of silver holdings by the Trust occurred on April 28th at $17.3 billion.

After basing in the $35 range since early May, the SLV looks ready to begin challenging its all time high. The SLV closed today at $37.23 up $2.03.

GLD and SLV Holdings (metric tonnes)

| July 13-2011 | Weekly Change | YTD Change | |

| GLD | 1,225.41 | +19.60 | -55.30 |

| SLV | 9,633.95 | +101.55 | -1,287.62 |

Holdings of the SPDR Gold Shares Trust (GLD) gained 19.60 tonnes last week after small drops in the previous two weeks. The price of gold has retained virtually all of its price gains this year even as sell offs hit stocks, commodities and other precious metals. Gold opened the year at $1,388.50 and has steady increased in value.

As it became clear that the deficit talks in Washington would resolve nothing and with easy Ben Bernanke ready to put the printing presses into overdrive, the price of gold soared to all time highs. The continuing debt crisis in Europe will only get worse, eventually forcing the European Central Bank to engage in its own money printing operations on a massive scale.

As measured by the London PM Fix Price, gold opened the month at $1483.00 and closed in New York trading today at $1,583.60 for a gain of $100.60 or 6.8%. In later trading in Asian markets, gold continued to soar, climbing another $6.10. James Turk, a highly respected analyst with a superb track record is forecasting a gold price of between $5,000 and $8,000 before 2015. Given the pace at which debt trapped countries are tipping over, I suspect that those price targets may be reached much sooner.

The GLD currently holds 39.4 million ounces of gold valued at $62.2 billion.

Speak Your Mind