Holdings of the SPDR Gold Shares Trust (GLD) gained 20.60 tonnes on the week after increasing by 19.60 tonnes in the previous week.

Holdings of the SPDR Gold Shares Trust (GLD) gained 20.60 tonnes on the week after increasing by 19.60 tonnes in the previous week.

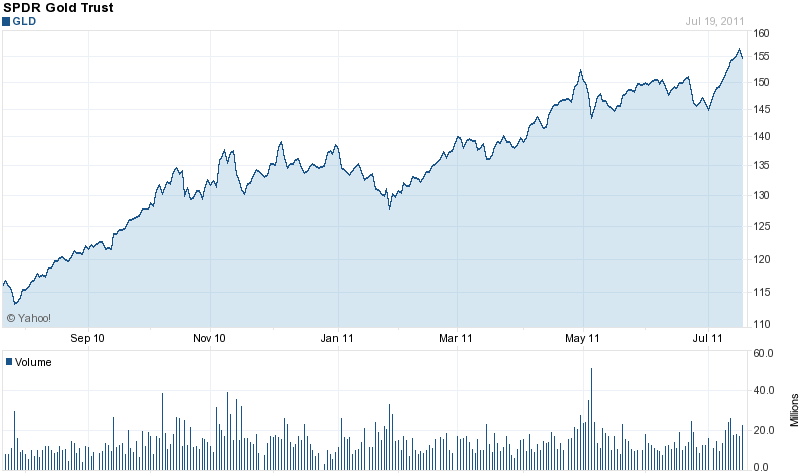

Gold has been in a steady uptrend during July as the debt crises in Europe and the United States continue to expand. As measured by the London PM Fix Price, gold has gained $103 since July lst. Gold has gained $197.50 per ounce since the first of the year when the price was $1,388.50.

Since July lst, total gold holdings of the GLD have increased by 40.21 tonnes and the value of the trust has increased by $6 billion to $63.5 billion. At July 20, the Gold Trust held 40.1 million ounces of gold bullion, up from 38.8 million ounces on the lst of July.

Shares of the GLD hit an all time high this week along with the price of gold.

The iShares Silver Trust (SLV) increased its holdings by 169.76 on the week after a gain of 101.55 tonnes in the previous week. Silver holdings of the trust since the beginning of the year have declined by 1,178.86 tonnes when the Trust held 10,921.57 tonnes. The record holdings of the SLV occurred on April 25th when the Trust held 11,390.06 tonnes.

Silver has surged in price along with gold since the beginning of July. Based on the closing London PM Fix Price, silver has increased from $33.85 on July 1st to $38.59 at the July 20th close, for a gain of $4.74 or 14.0%.

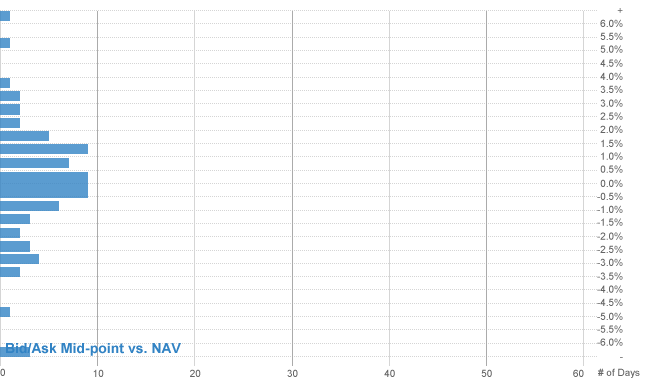

The SLV Trust currently holds 315.2 million ounces of silver valued at $12.2 billion. As of July 20th, the net asset value of the Trust was $37.61 according to the Trust’s website. The price of the SLV closed on July 20th at $39.12 or a 4% premium to the Trust’s net asset value. The current premium of the SLV to the Trust’s net asset value is higher than usual, reflecting investor demand for the SLV. The all time high premium on the SLV to the underlying net assets of the Trust occurred on April 27, 2011 at 6.3%.

Precious metals have advanced strongly after suggestions by the Federal Reserve that it might initiate another round of quantitative easing if economic conditions continue to deteriorate. Meanwhile, the debt crisis in Europe continues to expand with many believing that the only “solution” is to imitate the U.S. Central Bank and print money.

GLD and SLV Holdings (metric tonnes)

| July 20-2011 | Weekly Change | YTD Change | |

| GLD | 1,246.01 | +20.60 | -34.70 |

| SLV | 9,803.71 | +169.76 | -1,117.86 |

Speak Your Mind