Gold holdings of the SPDR Gold Trust (GLD) declined slightly on the week by 24.54 tonnes after a gain of 10.22 tonnes in the previous week. GLD gold holdings have declined by 8.74 tonnes since the beginning of the year. The all time high holdings of the GLD occurred on June 29, 2010 when the Trust’s holdings reached 1,320.47 tonnes.

Gold holdings of the SPDR Gold Trust (GLD) declined slightly on the week by 24.54 tonnes after a gain of 10.22 tonnes in the previous week. GLD gold holdings have declined by 8.74 tonnes since the beginning of the year. The all time high holdings of the GLD occurred on June 29, 2010 when the Trust’s holdings reached 1,320.47 tonnes.

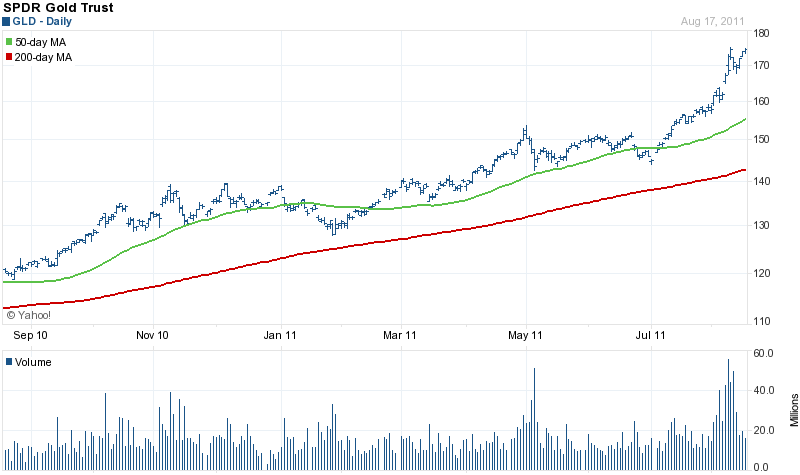

As measured by the closing London PM Fix Price, gold started the year at $1,388.50. Gold closed in Wednesday trading at $1,790.00 for a gain of $401.50 or 28.9% on the year. Gold has been in a steady, virtually uninterrupted uptrend since late 2008. At the beginning of July, the price trend of gold entered an accelerated uptrend.

Although a pullback is possible after an almost vertical rise of $256 since July 1st, it is just as likely that gold could confound the skeptics and continue to rise. The increase in gold prices for the past decade has reflected widespread apprehension over the value of paper currencies. The world economy never recovered from the financial crisis starting in 2008 despite the borrowing and printing of trillions of dollars by world central banks and governments. The increase in the price of gold is reflecting the growing realization that governments and central banks no longer have the ability to contain a second full blown financial crisis. Under this scenario, gold effectively has no ceiling price.

The GLD is the largest gold exchange traded fund with 40.9 million ounces of gold. According to Bloomberg, the total holdings of all major gold ETFs worldwide amount to 70.7 million ounces of gold. Holdings of all gold ETFs worldwide have increased by 4.1 million ounces or 6.2% since the beginning of the year.

The SPDR Gold Trust currently holds 40.9 million ounces of gold valued at $73.2 billion. For perspective, the entire value of the GLD would fund less than 18 days of US Government deficit spending which is projected to exceed $1.5 trillion this year.

The GLD closed the day at $174.42, fractionally below its all time high of $175.13

GLD and SLV Holdings (metric tonnes)

| August 17-2011 | Weekly Change | YTD Change | |

| GLD | 1,271.98 | -24.54 | -8.74 |

| SLV | 9,727.10 | -45.46 | -1,194.47 |

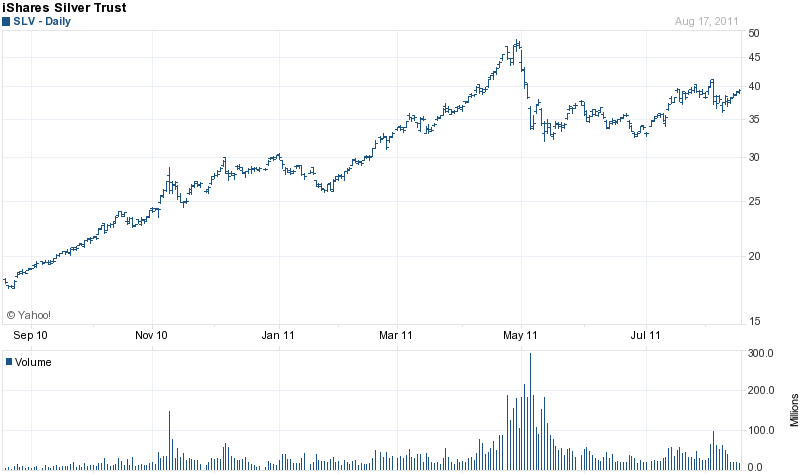

Holdings of the iShares Silver Trust declined by 45.46 tonnes on the week after a decline of 86.36 tonnes in the previous week. Since July 1st, the SLV has gained 190.95 tonnes.

After a price correction in early May, silver has recovered in price and is building a base in the $40 range before the next move up. Silver has gained $6.17 or 18.2% since July 1st, rising from $33.85 to $40.02.

The SLV currently holds 312.7 million ounces of silver valued at $12.5 billion. Investors in the SLV have had an annual rate of return of 25% over the past three years.

Speak Your Mind