Yahoo Finance ran a story today entitled “Gold, Silver & Copper Are All Heading Lower.” Nothing worth discussing about the specifics of the article – the real story here is that this a classic contrary headline seen at market bottoms, not tops.

Yahoo Finance ran a story today entitled “Gold, Silver & Copper Are All Heading Lower.” Nothing worth discussing about the specifics of the article – the real story here is that this a classic contrary headline seen at market bottoms, not tops.

What is the really smart money doing in the gold market as the mainstream press encourages John Q. Public to sell off his gold holdings? Here’s a nice recap from The Economic Collapse:

When men like John Paulson and George Soros start pouring huge amounts of money into gold, it is time to start becoming alarmed about the state of the global financial system.

The amount of money that these men are investing in gold is staggering….

And the central banks of the world are certainly buying gold at an unprecedented rate as well. According to the World Gold Council, the central banks of the world added 157.5 metric tons of gold last quarter. That was the biggest move into gold by the central banks of the globe that we have seen in modern financial history.

But that might just be the beginning.

According to a recent Marketwatch article, there are persistent rumors that China has plans to buy thousands of metric tons of gold….

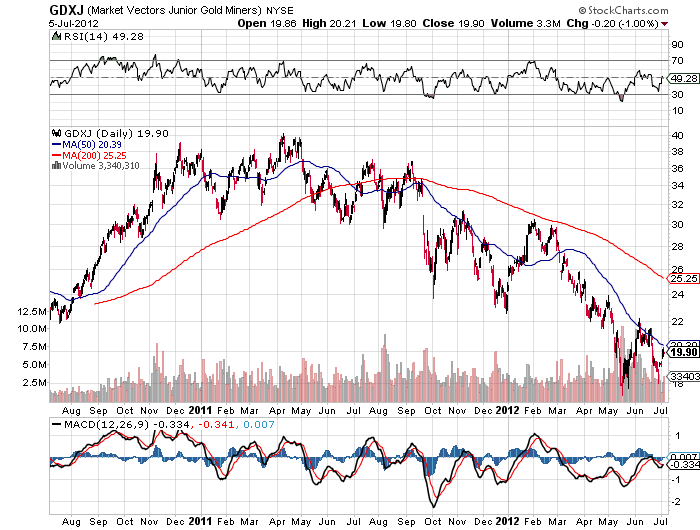

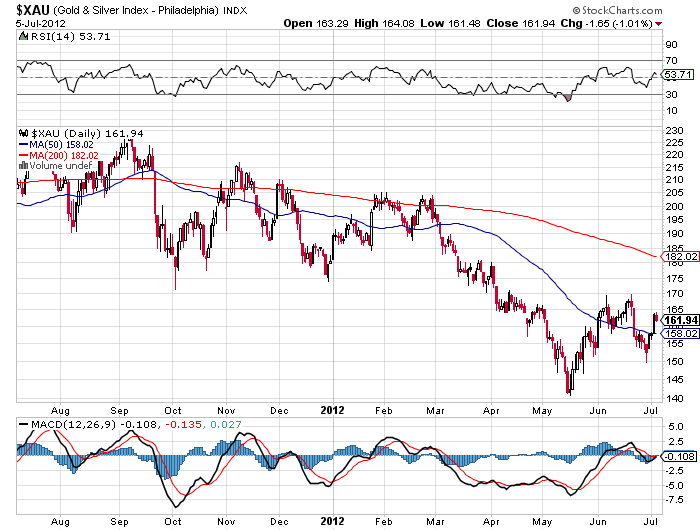

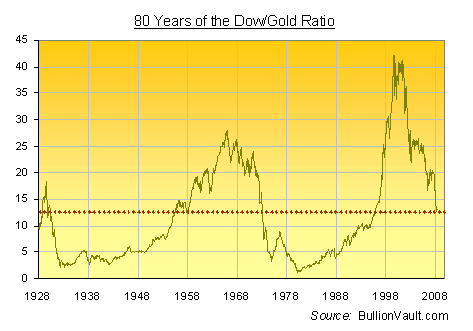

The gold bull market is far from over when two of the world’s most successful investors are increasing their gold holdings. The price correction in gold since last summer has provided another excellent buying opportunity for long term investors.

Why There Is No Upside Limit For Gold and Silver

Why Higher Inflation and $5,ooo Gold Are Inevitable

The Federal Reserve Can’t Produce Oil, Food or Jobs But They Will Continue To Produce Dollars

Ultimate Price of Gold Will Shock The World As Loss Of Global Confidence Leads To Economic Collapse

Gold Bull Market Could Last Another 20 Years With $12,000 Price Target

When Ron Paul retires after his current term in Congress, one of the most notable voices for a sound currency and protection of civil liberties against a despotic government will be gone from the official Washington scene. Although Paul was never able to rein in a government that assumes more power over our lives with each passing minute, his warnings gave Americans the opportunity to understand the threats to their financial future and personal liberties.

When Ron Paul retires after his current term in Congress, one of the most notable voices for a sound currency and protection of civil liberties against a despotic government will be gone from the official Washington scene. Although Paul was never able to rein in a government that assumes more power over our lives with each passing minute, his warnings gave Americans the opportunity to understand the threats to their financial future and personal liberties.

General Outlook for Gold and the Miners

General Outlook for Gold and the Miners

By Vin Maru

By Vin Maru

By

By

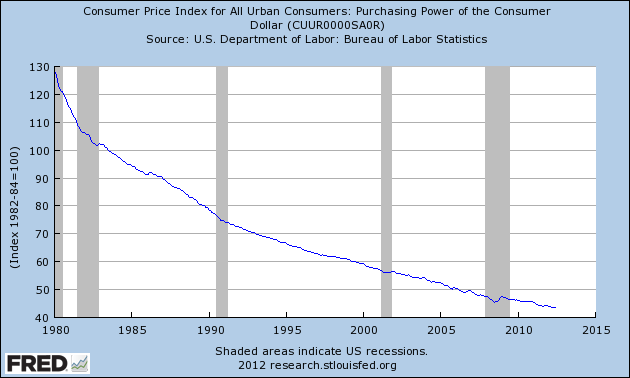

Although Federal Reserve Chairman Ben Bernanke refuses to acknowledge that gold is money, another major regulatory agency views the value of gold money as a risk free asset for calculation of Tier 1 regulatory capital by banks. Meanwhile, as Ben Bernanke dismisses the value of gold, other central banks around the world continue to increase gold reserves. As the world financial system spirals closer to a complete breakdown, it is the holders of paper currencies that are squarely placed at the highest point of the risk spectrum.

Although Federal Reserve Chairman Ben Bernanke refuses to acknowledge that gold is money, another major regulatory agency views the value of gold money as a risk free asset for calculation of Tier 1 regulatory capital by banks. Meanwhile, as Ben Bernanke dismisses the value of gold, other central banks around the world continue to increase gold reserves. As the world financial system spirals closer to a complete breakdown, it is the holders of paper currencies that are squarely placed at the highest point of the risk spectrum.

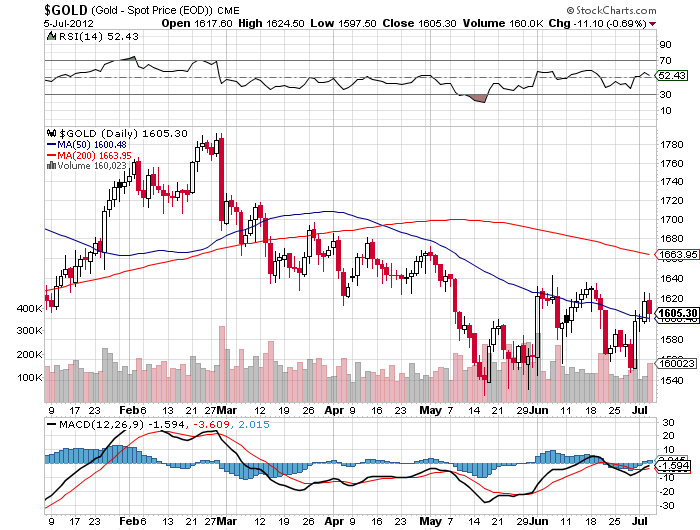

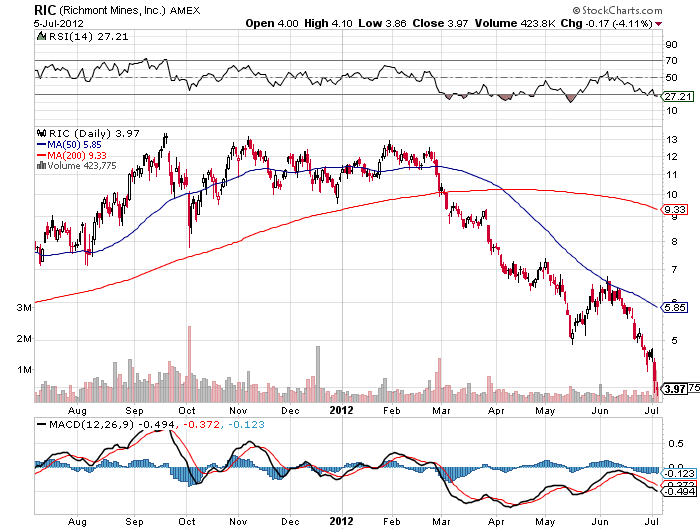

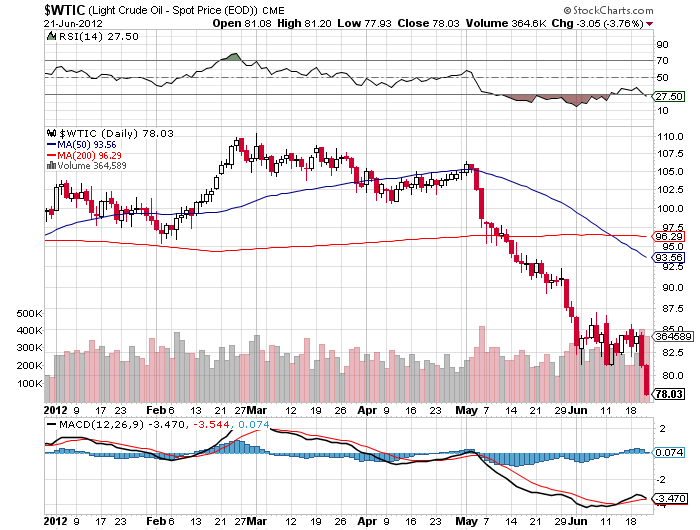

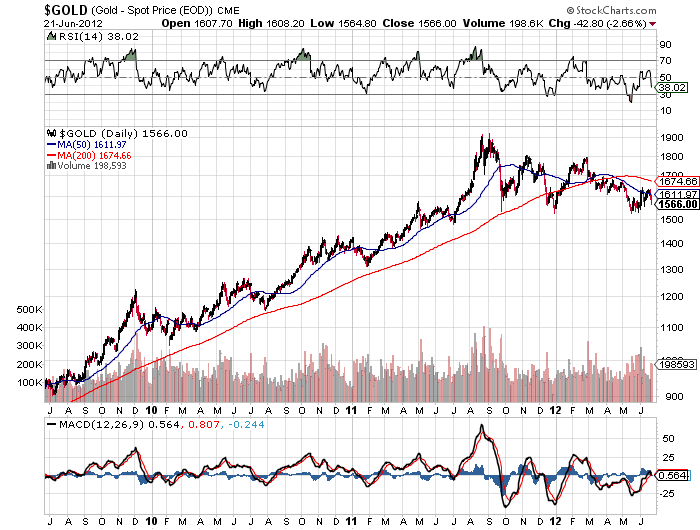

The combination of increasingly ominous economic reports along with the Fed’s failure to announce bold new monetary initiatives resulted in a brutal reassessment of risk by investors. Stock, commodity and precious metal markets all plunged with the Dow down 250 points, gold down by $41.60 per ounce to $1,566 and silver off by 4.4% to $26.98. Crude oil in New York trading was off 4%, dropping below $80 a barrel for the first time in eight months.

The combination of increasingly ominous economic reports along with the Fed’s failure to announce bold new monetary initiatives resulted in a brutal reassessment of risk by investors. Stock, commodity and precious metal markets all plunged with the Dow down 250 points, gold down by $41.60 per ounce to $1,566 and silver off by 4.4% to $26.98. Crude oil in New York trading was off 4%, dropping below $80 a barrel for the first time in eight months.

It is no secret that the price of gold has been declining since reaching almost $2,000 per ounce last year. After rallying in the early part of the year, gold prices have now fallen to $1,556, representing a decline of $42 per ounce or 2.6% below the closing price on the first trading day of 2012.

It is no secret that the price of gold has been declining since reaching almost $2,000 per ounce last year. After rallying in the early part of the year, gold prices have now fallen to $1,556, representing a decline of $42 per ounce or 2.6% below the closing price on the first trading day of 2012.