Is there any hope for a recovery in gold and silver prices by year end?

Is there any hope for a recovery in gold and silver prices by year end?

Precious metals analyst Suki Coper discuses the prospects for the gold and silver markets in an interview with Bloomberg Television.

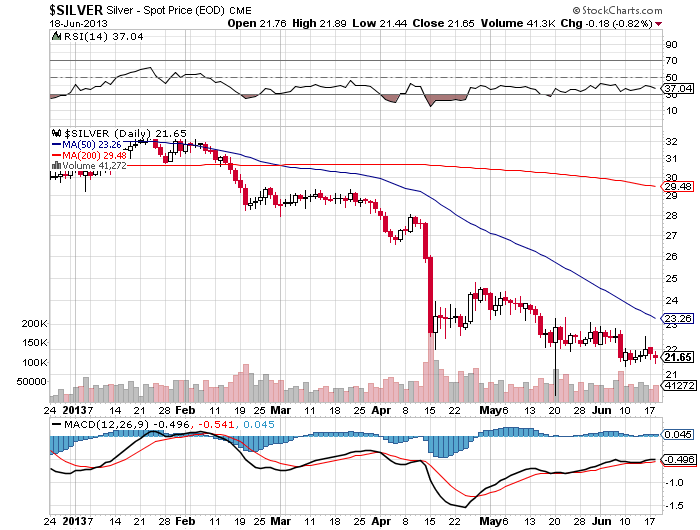

Ms. Coper notes that silver tends to follow the gold market but should show more price weakness relative to gold. In order for the price of silver to stabilize, the precious metal needs investment support from both the industrial and investment side. Economic weakness in both China and Europe currently portend weak industrial demand for silver.

Despite the current weakness in both gold and silver, Ms. Coper sees the price of gold approaching $1,500 by the end of the year.

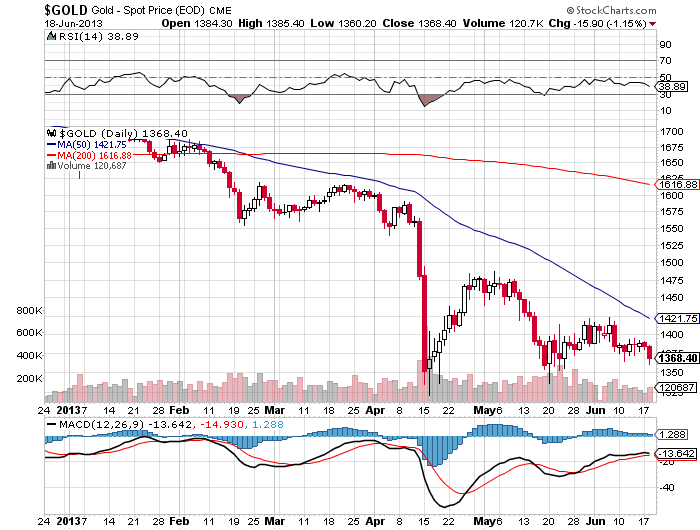

Since the beginning of the year, the price of gold has dropped by $303 per ounce or 18%, to a closing price of $1,378.50 at the close of Tuesday’s trading in London.

courtesy: kitco.com

Silver’s price decline has been even steeper than gold with a drop of $9.07 per ounce or 29.4% since the beginning of the year.

courtesy: kitco.com

By: GE Christenson

By: GE Christenson

Rick Rule

Rick Rule Anything that sound too good to be true, well, you know how that ends.

Anything that sound too good to be true, well, you know how that ends.

April was a brutal month for precious metal investors. Gold ended the month down almost 8% and silver prices tumbled almost 13%. The sell off continued in May with gold down another $60 per ounce to $1,412 and silver down $1.55 to $22.87 per ounce at mid month.

April was a brutal month for precious metal investors. Gold ended the month down almost 8% and silver prices tumbled almost 13%. The sell off continued in May with gold down another $60 per ounce to $1,412 and silver down $1.55 to $22.87 per ounce at mid month.

By: GE Christenson

By: GE Christenson

By GE Christenson

By GE Christenson The exploding demand for physical gold and silver has become a worldwide phenomenon. Shortly after the price plunge of early April buyers rushed in to take advantage of bargain prices. Dealers and mints worldwide have reported off the charts demand for physical gold and silver.

The exploding demand for physical gold and silver has become a worldwide phenomenon. Shortly after the price plunge of early April buyers rushed in to take advantage of bargain prices. Dealers and mints worldwide have reported off the charts demand for physical gold and silver.