By: GE Christenson

You want to buy silver and gold. There is much to consider!

- Physical metal or paper promises?

- From which supplier will you buy it? Price is not the only consideration.

- Where do you store it? Your sock drawer, a safe, insured and secure vault, or in another country?

- How do you sell it and when?

- IRS Rules

Physical, ETF, or Paper?

Do you want actual physical silver and gold that you can hold in your hand? If you do, then buy coins or bars and skip ahead.

If you want to buy and sell easily without taking delivery of actual metal, then perhaps you should invest in an ETF (Exchange Traded Fund) for gold and silver. The fees are minimal; ETFs are convenient and good for frequent trading. The two most popular are GLD and SLV. They are also criticized by many analysts, so I encourage you to also consider PHYS, PSLV, GTU, and others.

If you want paper, then buy options or futures contracts and be careful. When elephants fight, the grass gets trampled – and most of us are merely grass in the world of futures trading.

You Want to Buy Physical Gold and Silver Coins and Bars. Good! Where?

There are many dealers who will sell over the internet and ship to your home or to a secure storage vault. Their prices will vary slightly and so will their terms for payment and delivery. See the partial list and brief comments at the end of this article to get started. There are many other fine dealers in addition to the few examples I have listed.

Storage

More important than where you buy is whether you will buy for delivery to your home, delivery to a secure domestic storage facility, or for delivery to a vault outside of the United States.

Your home – Convenient and close but vulnerable to fire and theft. Your sock drawer is not recommended – buy a safe, hide it, and tell very few.

Safe deposit box at local bank – Secure, less convenient, probably not insured, and vulnerable to a search warrant, court order, and banking shutdown. Use a local bank, not a branch of a huge mega-bank.

Secure storage in the USA – Very secure and safe but may not be close or convenient. Are you comfortable with such storage? If so, then this is an excellent choice. Choose a vault OUTSIDE the banking system.

International Storage – You can store in commercial vaults in London, Canada, Switzerland, Hong Kong, Singapore, Australia, and other locations. The IRS MAY want to be told what you are storing and its value if you are an American citizen and storing internationally. See IRS Rules.

How Do you Sell Your Gold and Silver?

If you are buying for insurance against devaluing paper currencies, perhaps you intend to hold it for a long time or expect to will it to your family. In either case, don’t sell it.

If your gold and silver coins are in your possession, then you can sell via the internet or take them to a local coin store. Most companies that will sell to you via the Internet or a phone call will also buy back at a slight discount to sales price (they have to sell at a mark-up to stay in business). You can also sell on eBay or to private individuals. There probably will be tax implications, so consult with your tax advisor.

When to Sell Gold and Silver?

Again, there is no right answer for everyone. Some will argue that gold and silver are essential insurance against unbacked paper currencies and so should never be sold. Investors may want to hold until they see some large price, say $150 silver and $4,000 gold. Others wish to trade in and out, buying low and selling high. Your choice will help determine if you want paper silver, an ETF, coins, or bars, stored domestically or offshore. It is easy to sell paper or an ETF. It may be less convenient to sell coins and bars that you have stored in a safe deposit box. It probably will be easy to sell gold stored in Switzerland.

Jim Sinclair, legendary gold trader and investor, says buy “fish lines” and sell “rhino horns.” What he means is that markets, especially gold and silver markets, often move too far, too fast, both up and down. The down moves – the fish lines – scare out leveraged speculators and “weak hands” and usually indicate good buy points for long-term investors. When leveraged speculators, hot money, and the public drive the market higher in a parabolic spike upward, the chart looks like a rhino horn, and that often indicates a good time to sell. There will be many more signals, but most of us are overwhelmed by greed and fear, especially panic, and we often miss the signals. In 1929 the “signal” was to sell when shoeshine boys were giving stock tips. Something similar will happen at the next panic high in gold and silver, but that may be years away.

IRS Rules

The IRS has instituted new rules for United States taxpayers. We are now required to report holdings of foreign assets on form 8938 (Statement of Specified Foreign Financial Assets) and form TD F 90-22.1. Consult with your tax attorney and financial advisor, but the simple interpretation is this:

If you own financial assets in another country worth more than certain amounts, usually you must report these assets on form 8938 with your federal tax return and on form TD F 90-22.1 due June 30 of each year. It is wise to comply with IRS requirements as the penalties can be severe. There may be exceptions that your professional advisor can discuss, but these relatively new requirements may influence your choice of investments and their storage locations.

Alphabetical (partial) list of gold and silver vendors with brief comments on each.

Please do your own research before making a purchase.

APMEX – Large gold and silver bullion and coins dealer operating out of Oklahoma. They maintain a sizeable inventory and will buy and sell online in several currencies with reasonable commissions. Apmex will “lock-in” a purchase price online and accept a personal check in payment (with delayed delivery). If you wish, they will also arrange for secure storage with a subsidiary company and ship directly to that insured storage facility. Apmex will assist with the purchase of silver and gold for investment in your qualified IRA.

Bullion Vault – Secure insured vault storage in London, Zurich, and New York for both gold and silver. Purchases can be arranged quickly and online in different currencies with low costs for storage and insurance. It is easy to sell or take delivery of your metals.

Global Gold – Secure insured vault storage in Switzerland, Hong Kong, and Singapore for both gold, silver, platinum, and palladium. Purchases can be arranged quickly and online with low costs for storage and insurance. It is easy to sell or take delivery of your metals. Ownership is physical and fully allocated.

GoldMoney – Secure insured storage in the UK, Switzerland, Hong Kong, Canada, and Singapore for both gold and silver. Purchases can be arranged quickly and online in different currencies with low costs for storage and insurance. It is easy to sell or take delivery of your metals.

GoldSilver.com – Large gold and silver coin and bullion dealer operating out of California. They maintain a sizeable inventory and will buy and sell online with reasonable commissions. GoldSilver.com will arrange storage in Singapore, Hong Kong, Canada, or the USA. You can easily sell your gold and silver holdings or take delivery. They also will assist with purchasing gold and silver coins and bullion for your retirement accounts. If you have time, watch their instructional videos.

Hard Assets Alliance – This is a relatively new company that attempts to meet many needs including convenient gold and silver purchases with secure insured and allocated storage for gold and silver. Silver can be stored in the US but currently only gold can be stored offshore in several countries. Their downloadable information booklet states:

“Exempt from US reporting requirements. As a domestic institution, GBI’s US customers are exempt from both the FBAR and Form 8938 filing requirements if offshore metal storage is elected.”

In some circumstances, this exemption from US reporting requirements may be important in your decision-making process.

Lear Capital – Large gold and silver coin and bullion dealer operating out of California. They maintain a sizeable inventory and will buy and sell online with reasonable commissions. Lear Capital will assist with purchasing gold and silver coins and bullion for IRA and 401k retirement accounts.

Liberty Gold and Silver – A smaller gold, silver, and platinum coin and bullion dealer operating out of Oregon. Liberty Gold and Silver will assist with purchasing gold and silver coins and bullion for IRA accounts and can arrange secure allocated storage in the USA, Canada, Germany, Switzerland, and Singapore.

Perth Mint – Located in Australia, the Perth Mint has been in business for over 100 years and is owned by the Government of Western Australia. The mint refines and produces a variety of products, special coins, and commemoratives in gold, silver, and platinum. The Mint receives over 70,000 visitors each year. You can purchase coins and bullion for delivery and arrange for allocated or pooled storage of your metals.

SilverSaver – Secure insured storage in the USA for gold and silver. You can make convenient periodic purchases by direct withdrawal from your checking account. This allows for a signup and forget “dollar-cost averaging” purchase plan. You can also take delivery of your gold and silver or easily sell it back to SilverSaver.

The Ultimate Gold Trust – Gold can be purchased and held in Switzerland. This storage solution is recommended by Julian D. W. Phillips, a frequent commentator on gold and gold storage options. Read his latest article on the safety of offshore storage.

GE Christenson

aka Deviant Investor

By: Mike McGill of

By: Mike McGill of  Sales of both the American Eagle gold and silver bullion coins soared in February compared to the previous year.

Sales of both the American Eagle gold and silver bullion coins soared in February compared to the previous year.

One of the best methods for protecting wealth against a constantly depreciating paper currency is to own precious metals.

One of the best methods for protecting wealth against a constantly depreciating paper currency is to own precious metals. Last Wednesday, with New York gold down over $40 per ounce, even long time gold bulls were advising caution before committing to further investment. Some precious metals dealers reported a flood of panic selling by anxious investors who were unloading physical coin and bar.

Last Wednesday, with New York gold down over $40 per ounce, even long time gold bulls were advising caution before committing to further investment. Some precious metals dealers reported a flood of panic selling by anxious investors who were unloading physical coin and bar.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012. Every gold and silver investor owes a debt of gratitude to the

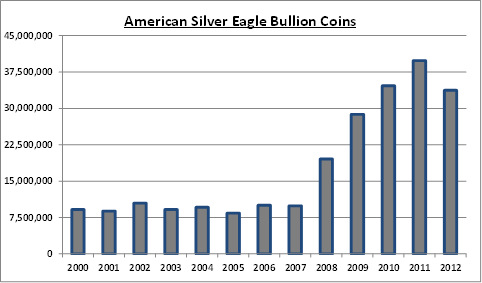

Every gold and silver investor owes a debt of gratitude to the With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins.

With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins. By GE Christenson:

By GE Christenson: