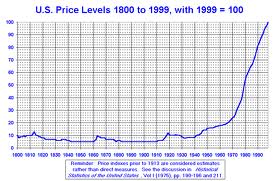

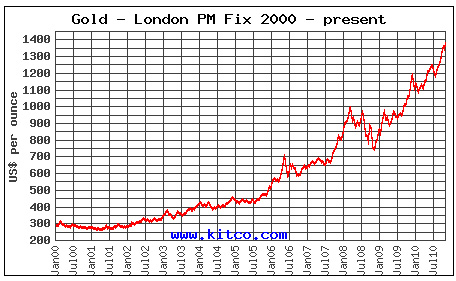

Until quite recently, the gold market has been experiencing a strong rise in prices. This has been due to factors such as concerns regarding weak currencies and unstable foreign governments. Gold has been viewed as a safe haven investment and has been attracting an increasing share of investment dollars. Despite the recent cool down, many market experts are predicting a continued rise in prices over the long term.

Until quite recently, the gold market has been experiencing a strong rise in prices. This has been due to factors such as concerns regarding weak currencies and unstable foreign governments. Gold has been viewed as a safe haven investment and has been attracting an increasing share of investment dollars. Despite the recent cool down, many market experts are predicting a continued rise in prices over the long term.

The Most Recent Market Reports

As of November 26, SPDR Gold Trust (GLD) stated that its holdings remained unchanged from the previous trading day at 41,316,740 ounces. The IShares Silver Trust (SLV) stated that its holdings declined by 5,865,684 ounces to 344.374 million ounces. Market experts have suggested that the holding pattern, as well as the slightly lowered prices indicate a decrease in safe haven demand. Recent data on the economic situation in the US has at least temporarily arrested some of the more pressing fears about the economy, and the price of gold has typically risen and fallen inversely to the strength of the dollar.

Other Gold Related News

There are other potential considerations. For example: a major French gold supplier is launching a range of mini bars. There has been a growing interest in precious metal investments in the French market and this new approach is aimed to capture some of this market. In addition, Canadian company Infinito Gold Ltd has lost its gold concession after a Costa Rican court ruled that their mining was harmful to the local environment. Finally, the central bank in Vietnam is actively attempting to cool domestic gold market prices by granting additional quotas for domestic companies importing gold between now and year end.

Sales of the recently released 2010 Proof American Gold Eagle already account for more than 74,000 ounces of gold. The collector offerings were first available for sale from the United States Mint on October 7, 2010.

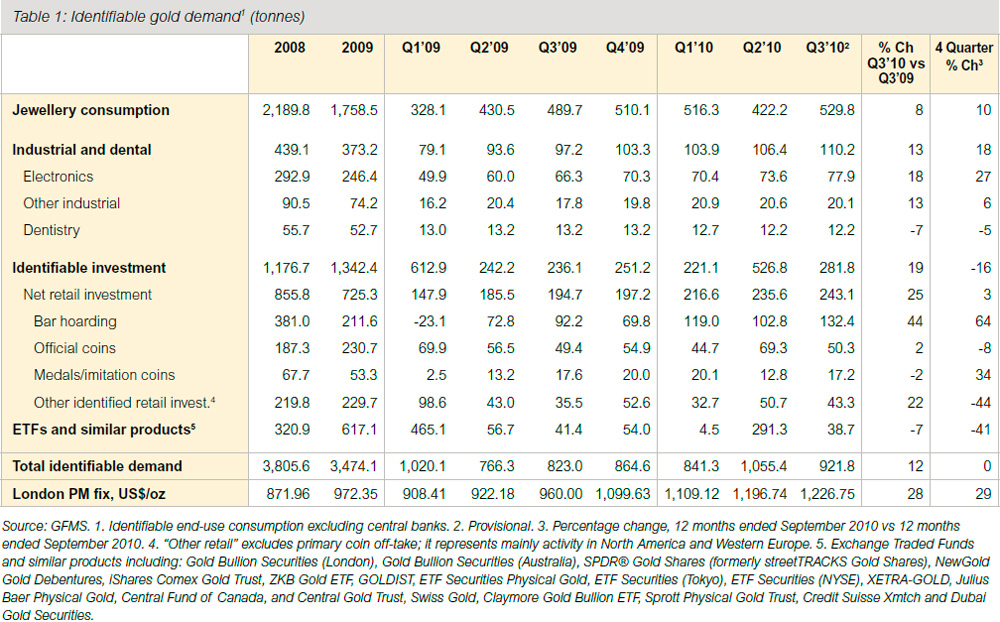

Sales of the recently released 2010 Proof American Gold Eagle already account for more than 74,000 ounces of gold. The collector offerings were first available for sale from the United States Mint on October 7, 2010. Total identifiable gold demand for the third quarter showed an increase of 12% above year ago levels at 921.8 tonnes. Increases in demand from jewelry consumption, industrial sectors, and net retail investment more than offset a decline in demand from electronically traded funds, according to information published by the

Total identifiable gold demand for the third quarter showed an increase of 12% above year ago levels at 921.8 tonnes. Increases in demand from jewelry consumption, industrial sectors, and net retail investment more than offset a decline in demand from electronically traded funds, according to information published by the

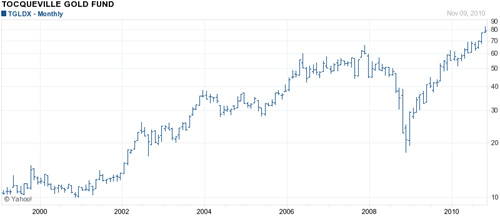

Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.

Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.

The United States Mint has

The United States Mint has  The United States Mint’s “on again, off again” rationing of American Gold and Silver Eagle bullion coins is “off again”.

The United States Mint’s “on again, off again” rationing of American Gold and Silver Eagle bullion coins is “off again”.