The US Mint recently wrapped up sales of the 2009 Ultra High Relief Double Eagle Gold Coin. The sales officially ended on December 31, 2009 and more recently some final details about total sales became available.

The US Mint recently wrapped up sales of the 2009 Ultra High Relief Double Eagle Gold Coin. The sales officially ended on December 31, 2009 and more recently some final details about total sales became available.

The coin was authorized directly by the United States Secretary of the Treasury back when it was Hank Paulson. The 2009 Ultra High Relief Gold Coin recreates the design from Augustus Saint Gaudens on a one ounce 24 karat gold coin issued in 2009.

The program seemed like it might run into problems since it was being launched amidst an ongoing scarcity of precious metals blanks, but for the most part, the offering went as planned.

The coins were originally offered for sale on January 22, 2009 and were priced at $1,189 each. The coins were limited to just one per household, but that didn’t stop collectors from ordering more than 40,000 coins in the opening five days of sales. A few coins from the initial orders shipped in early February, with a greater number shipping later in the month.

During the course of sales, the price of the coins at the US Mint slowly ratcheted upwards, as the price of gold rose. On November 25, 2009, the coins reached their highest offering price of $1,539 each. This represented a $350 increase from the initial price level. The last price in effect when sales ended was $1,489 per coin.

The ordering limit was also changed during the course of sales. After holding at just one per household for about six months, the limit was raised to ten coins per household in late July. This led to some increased buying activity as dealers established a position in the coins. The limit was raised again to twenty five coins and then removed completely.

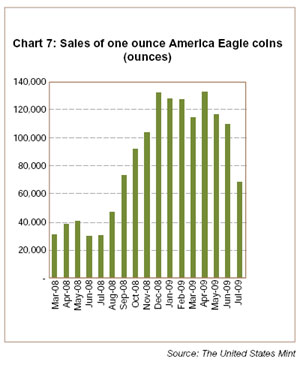

The final sales total for the Ultra High Relief Double Eagle Gold Coin recently became available. During the course of the year, the US Mint sold 115,178 coins. This level of sales was achieved during a year when Gold Eagle bullion coins were subject to rationing for more than six months on two separate occasions, collectible gold offerings were canceled, and fractional gold bullion coins were delayed until a brief window in December. Somehow there was a steady supply of blanks all year for this premium priced gold coin.

Today the US Mint began accepting orders from authorized purchasers for the 2010 Gold and Silver Eagle bullion coins. The initial ordering date this year comes a bit later than usual and carries some special stipulations.

Today the US Mint began accepting orders from authorized purchasers for the 2010 Gold and Silver Eagle bullion coins. The initial ordering date this year comes a bit later than usual and carries some special stipulations. After a year of heavy demand, the United States Mint will begin offering the 2010 American Gold Eagle bullion coin with a slight delay. Typically, authorized purchasers are able to order the coins in late December for delivery in early January. This year orders won’t be accepted until January 19, 2010.

After a year of heavy demand, the United States Mint will begin offering the 2010 American Gold Eagle bullion coin with a slight delay. Typically, authorized purchasers are able to order the coins in late December for delivery in early January. This year orders won’t be accepted until January 19, 2010. During December, the United States Mint briefly offered 2009 American Gold Eagle bullion coins in fractional weights. This included one-half ounce coins, one-quarter ounce coins, and one-tenth ounce coins.

During December, the United States Mint briefly offered 2009 American Gold Eagle bullion coins in fractional weights. This included one-half ounce coins, one-quarter ounce coins, and one-tenth ounce coins. In addition to bullion coins, the United States Mint will also be producing a collectible proof version of the 2009 American Gold Buffalo. The status of this product was uncertain for much of the year, until the tentative release of the coin on October 29, 2009 was finally announced in early October.

In addition to bullion coins, the United States Mint will also be producing a collectible proof version of the 2009 American Gold Buffalo. The status of this product was uncertain for much of the year, until the tentative release of the coin on October 29, 2009 was finally announced in early October. After nearly one year of suspension, the United States Mint recently resumed production of the 24 karat American Gold Buffalo Bullion coins. This coin series had been introduced in 2006 as the US Mint’s second gold bullion coin program. As opposed to the existing American Gold Eagle Coins, which are struck in 22 karat gold, the Gold Buffalo Coins would be struck in a composition of 24 karat gold. Numerous world mints produce bullion coins in 24 karat gold, and the composition is preferred by some investors.

After nearly one year of suspension, the United States Mint recently resumed production of the 24 karat American Gold Buffalo Bullion coins. This coin series had been introduced in 2006 as the US Mint’s second gold bullion coin program. As opposed to the existing American Gold Eagle Coins, which are struck in 22 karat gold, the Gold Buffalo Coins would be struck in a composition of 24 karat gold. Numerous world mints produce bullion coins in 24 karat gold, and the composition is preferred by some investors. The United States Mint expanded its line of collectible American Gold Eagle coins in 2006. They introduced the collectible uncirculated Gold Eagle, sometimes referred to as “Burnished Gold Eagles.” These coins are struck on specially burnished blanks and carry the “W” mint mark. As opposed to bullion coins, these were sold directly by the US Mint and not through the network of authorized bullion dealers.

The United States Mint expanded its line of collectible American Gold Eagle coins in 2006. They introduced the collectible uncirculated Gold Eagle, sometimes referred to as “Burnished Gold Eagles.” These coins are struck on specially burnished blanks and carry the “W” mint mark. As opposed to bullion coins, these were sold directly by the US Mint and not through the network of authorized bullion dealers. The United States Mint has offered proof versions of the American Gold Eagle since 1986. These collectible versions of the popular bullion coins are minted using a special process where the coin is struck multiple times with specialized dies. The resulting coins feature sharp details and a cameo contrast of frosted raised elements and mirrored fields. Typically, the proof coins have been offered in 1 oz, 1/2 ounce, 1/4 ounce, and 1/10 ounce sizes, with a complete 4 Coin Set also offered. According to an announcement from the US Mint released this week, Proof Gold Eagles will not be minted during 2009.

The United States Mint has offered proof versions of the American Gold Eagle since 1986. These collectible versions of the popular bullion coins are minted using a special process where the coin is struck multiple times with specialized dies. The resulting coins feature sharp details and a cameo contrast of frosted raised elements and mirrored fields. Typically, the proof coins have been offered in 1 oz, 1/2 ounce, 1/4 ounce, and 1/10 ounce sizes, with a complete 4 Coin Set also offered. According to an announcement from the US Mint released this week, Proof Gold Eagles will not be minted during 2009.

With the second quarter behind us, let’s take a look at the performance of gold, silver, and platinum for the second quarter of 2009 and year to date.

With the second quarter behind us, let’s take a look at the performance of gold, silver, and platinum for the second quarter of 2009 and year to date.