With all of the positive articles on gold, one reliable way of getting attention is to publish an article forecasting an impending plunge in the price of gold. Two recently published articles caught my attention for their decidedly negative stances on gold.

With all of the positive articles on gold, one reliable way of getting attention is to publish an article forecasting an impending plunge in the price of gold. Two recently published articles caught my attention for their decidedly negative stances on gold.

I previously wrote a post exploring bullish analyst opinions on gold. I guess this post will present the flip side.

IMF Gold Dump Theory

The first article examines the opinions of a so-called “interventional analyst” who sees the price of gold plunging on December 10. He sees the initial plunge and subsequent declines bringing the price of gold 40% lower to around $455 per ounce. All of this would take place in a matter of weeks. The plunge would be caused by the IMF dumping 3,000 tonnes of gold, flooding the market and destroying prices.

Even though his current prediction seems a bit ridiculous, apparently he has previously called this year’s collapse in the Dow, the plunge in oil prices, and the current recession. Of note, his gold track record is much less spectacular. According to a quote from the article, he has been advocating shorting gold since it was $413.

Since December 10 is tomorrow, at least we won’t have to wait very long to see if his most recent prediction is correct.

Gold is for Barbarians Theory

Alternate Title: I Like Getting Attention

The second article was published on Seeking Alpha. The author wrote a previous piece that called gold a “sucker’s bet.” He stated that gold should trade below $600, predicted “a lot of sources of selling.” He also questioned gold’s historical status as a store of value (he prefers oil) and denied gold’s ability to protect against inflation. The article was well circulated, resoundingly ridiculed, and received over 100 comments.

He’s back for more in his second article. First he mentions that gold has “plunged” since his first article. Gold is really down about 10% and has been climbing back daily. The decline also corresponded with a horrific decline in world stock markets, which probably had more to do with gold’s weakness than the author’s reasons. Next, he repudiates all of the negative comments received on his prior article in three short sentences, and finally rehashes his prior arguments against gold. He slips in a quip about gold not being used as currency since the time of nomadic herders.

As unremarkable as the article was, it still attracted nearly 100 comments. I guess the moral of the story is that if you want to get the most attention, just make bold claims that are the opposite of the prevailing opinion and common sense.

For much of the year, the United States Mint has been touting the upcoming recreation of what they have called the “nation’s most beautiful coin.” Augustus Saint Gaudens’ design for the

For much of the year, the United States Mint has been touting the upcoming recreation of what they have called the “nation’s most beautiful coin.” Augustus Saint Gaudens’ design for the  Recently published commentary from analysts at Citigroup and JP Morgan both paint a bright picture for the future of gold. Citigroup specifically mentions the $2,000 level as attainable. JP Morgan recommends buying gold for the run into the holidays.

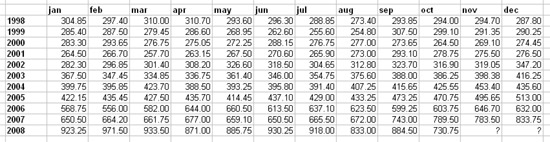

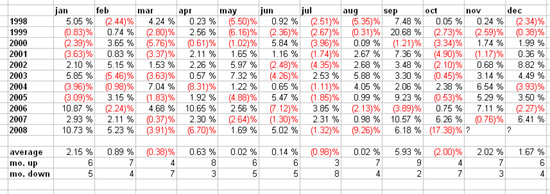

Recently published commentary from analysts at Citigroup and JP Morgan both paint a bright picture for the future of gold. Citigroup specifically mentions the $2,000 level as attainable. JP Morgan recommends buying gold for the run into the holidays. At the beginning of November, I took a look at the seasonal

At the beginning of November, I took a look at the seasonal  The United States Mint recently released a memo to authorized bullion purchasers regarding the remaining 2008-dated bullion coins and the upcoming 2009-dated bullion coins.

The United States Mint recently released a memo to authorized bullion purchasers regarding the remaining 2008-dated bullion coins and the upcoming 2009-dated bullion coins. Today the United States Mint announced some sweeping cuts to the number of products that they will offer to coin collectors. The deepest cuts take place in the US Mint’s offerings of collectible versions of gold and platinum bullion coins.

Today the United States Mint announced some sweeping cuts to the number of products that they will offer to coin collectors. The deepest cuts take place in the US Mint’s offerings of collectible versions of gold and platinum bullion coins.

A few weeks back the US Mint announced that they would be taking unprecedented actions to deal with the demand for bullion coins. This included production halts for some bullion coins and limited production for others until existing blank inventories were depleted. Read the full

A few weeks back the US Mint announced that they would be taking unprecedented actions to deal with the demand for bullion coins. This included production halts for some bullion coins and limited production for others until existing blank inventories were depleted. Read the full