The United States Mint unceremoniously ended the allocation programs which had been limiting the number of Gold and Silver Eagle bullion coins that authorized purchasers could order. The announcement came in the form of a memorandum sent to authorized purchasers on Monday.

June 15, 2009

MEMORANDUM TO ALL AMERICAN EAGLE GOLD AND SILVER BULLION

AUTHORIZED PURCHASERSSUBJECT: American Eagle Gold and Silver One Ounce Bullion Coin Allocations

Effective immediately, the United States is lifting the allocation process.

You may place your orders under the standard ordering procedures. The ordering minimum and incremental quantities apply.

Thank you for your patience during this past year. We appreciate your continued support.

Amidst high demand for precious metals and a constrained supply of precious metals blanks, the US Mint had implemented allocation programs for Gold and Silver Eagle bullion coins. The allocation program for the American Silver Eagle began on April 21, 2008 when the price of silver was $17.88 per ounce. The allocation program for American Gold Eagle began on August 15, 2008 when the price of gold was $786.50.

The United States Mint had also taken other measures to deal the physical precious metals shortage. First, they had restricted production to only one ounce gold and one ounce silver bullion coin options. Typically a range of fractional bullion coins including 1/2 ounce, 1/4 ounce, and 1/10 ounce coins is offered. Second, they had announced the temporary delay of production for platinum bullion coins and 24 karat Gold Buffalo coins. Third, they delayed the production of gold and silver coins produced for collectors in order to divert all precious metals blanks to the production of bullion coins.

The US Mint has not announced whether production fractional bullion coins, 24 karat gold bullion coins, platinum bullion coins, and gold and silver collector coins has resumed.

For countless months, authorized purchasers of US Mint gold and bullion coins have been subject to a rationing process, which limited the number of coins they could purchase. The rationing program had been put into place after the demand for gold and silver coins exceeded the US Mint’s ability to supply them. In a few recent posts I have provided some indications that the shortage of American Silver Eagles and American Gold Eagles

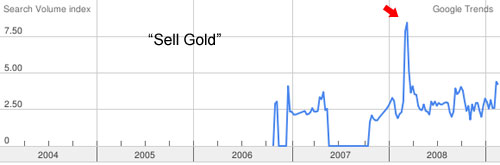

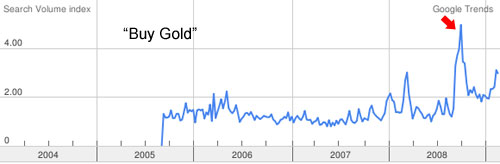

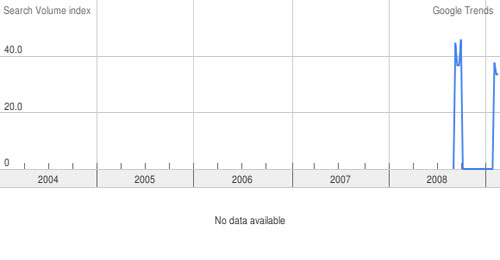

For countless months, authorized purchasers of US Mint gold and bullion coins have been subject to a rationing process, which limited the number of coins they could purchase. The rationing program had been put into place after the demand for gold and silver coins exceeded the US Mint’s ability to supply them. In a few recent posts I have provided some indications that the shortage of American Silver Eagles and American Gold Eagles  Late last year and early this year, a continual observation of the gold and silver markets was the disconnect between the prices quoted on paper markets and the prices that you would actually need to pay to buy physical precious metals. In the past few weeks premiums for physical gold and silver have declined as the prices quoted on the paper market have risen, basically bringing the two markets back into alignment.

Late last year and early this year, a continual observation of the gold and silver markets was the disconnect between the prices quoted on paper markets and the prices that you would actually need to pay to buy physical precious metals. In the past few weeks premiums for physical gold and silver have declined as the prices quoted on the paper market have risen, basically bringing the two markets back into alignment. The World Gold Council recently announced their plans to attempt to popularize half gram gold coins. The plan seems mostly targeted towards consumers in India, in advance of the upcoming festival.

The World Gold Council recently announced their plans to attempt to popularize half gram gold coins. The plan seems mostly targeted towards consumers in India, in advance of the upcoming festival. With the first quarter at an end, let’s take a look at the performance of gold, silver, and platinum so far this year.

With the first quarter at an end, let’s take a look at the performance of gold, silver, and platinum so far this year.

Gold’s recent move above $900 has analysts scrambling to increase their price targets.

Gold’s recent move above $900 has analysts scrambling to increase their price targets. In the past week, gold quietly marked two important milestones.

In the past week, gold quietly marked two important milestones.