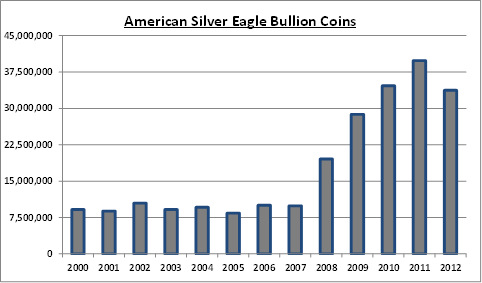

With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins.

With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins.

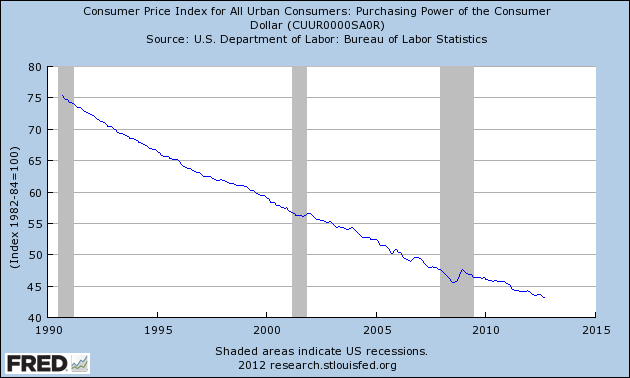

The public demand for silver seems insatiable. To put the unprecedented demand for silver into perspective, prior to the financial crisis of 2008, total yearly sales of the silver bullion coin averaged only about 9.5 million coins per year. With the Federal Reserve furiously printing money to keep the financial system glued together, investor demand for both physical silver and gold bullion is likely to increase dramatically.

The US Mint has been unable to keep up with the demand for American Silver Eagles for the past two months (see U.S. Mint Sold Out). During December, unexpectedly strong demand resulted in the suspension of silver bullion coin sales during mid December after the entire stock of 2012 coins was sold out. At the time the Mint announced that the 2013 American Silver Eagles would be available on January 7, 2013.

Opening day sales on January 7th for the 2013 American Silver Eagle bullion coins turned out to be the largest on record with sales of 3,937,000 coins. Demand for silver bullion continued to climb and by January 17th, the Mint once again announced that sales of the silver bullion coins would be suspended until the last week of January. When sales resumed this week, demand was again much higher than anticipated. Due to record demand, the Mint previously announced that they may have to institute rationing of the coins. Since the US Mint’s production schedule has been blown right out the window for two months running, it would not be surprising if rationing of the coins was implemented.

Sales of the American Eagle Gold bullion coins has also soared during the first month of the year. January sales to date of 140,000 ounces of gold bullion coins is the highest monthly sales since June 2010 when the Mint sold 151,500 ounces.

With the United States rapidly approaching the debt ceiling limit, a dysfunctional and divided Congress appears unable to agree on either spending cuts or an increase in the debt ceiling. Absent some grand Congressional compromise, America’s nonstop trillion dollar deficit spending will rapidly push the nation to the brink of default before the end of next month.

With the United States rapidly approaching the debt ceiling limit, a dysfunctional and divided Congress appears unable to agree on either spending cuts or an increase in the debt ceiling. Absent some grand Congressional compromise, America’s nonstop trillion dollar deficit spending will rapidly push the nation to the brink of default before the end of next month.

According to the latest U.S. Mint report, sales of the American Eagle Gold bullion coins for December 2012 totaled 76,000 ounces, up 16% from December 2011 when 65,500 ounces were sold. Sales for the month were down 44.3% from November sales which totaled 136,500 ounces.

According to the latest U.S. Mint report, sales of the American Eagle Gold bullion coins for December 2012 totaled 76,000 ounces, up 16% from December 2011 when 65,500 ounces were sold. Sales for the month were down 44.3% from November sales which totaled 136,500 ounces. According to the U.S. Mint, total sales of the American Silver Eagle bullion coins for December 2012 totaled only 1,635,000 ounces, down by 18.6% from 2,009,000 coins sold during December 2011. The lowest monthly sales for the year occurred in February when 1,490,000 Silver Eagle Bullion coins were sold. The highest monthly sales of the Silver Eagles occurred in January when 6,107,000 coins were sold.

According to the U.S. Mint, total sales of the American Silver Eagle bullion coins for December 2012 totaled only 1,635,000 ounces, down by 18.6% from 2,009,000 coins sold during December 2011. The lowest monthly sales for the year occurred in February when 1,490,000 Silver Eagle Bullion coins were sold. The highest monthly sales of the Silver Eagles occurred in January when 6,107,000 coins were sold. According to

According to

According to the latest report from the U.S. Mint, demand for both gold and silver bullion coins during September surged to the highest levels since January.

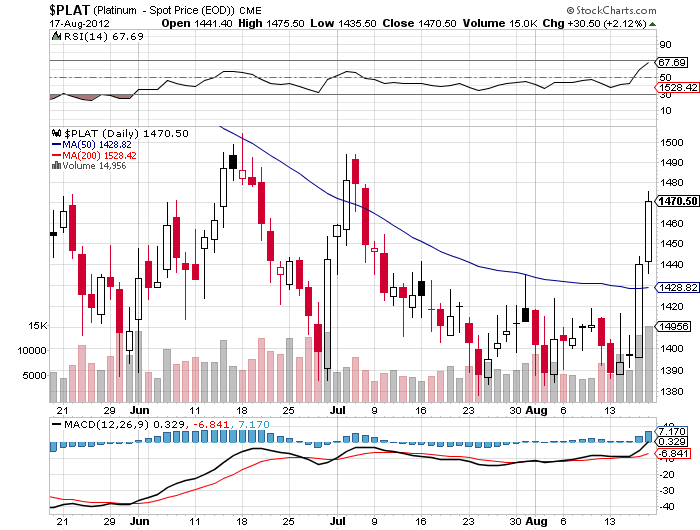

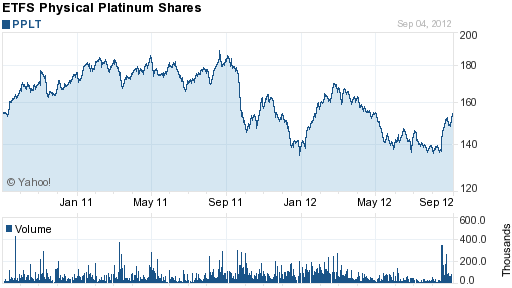

According to the latest report from the U.S. Mint, demand for both gold and silver bullion coins during September surged to the highest levels since January. Since establishing multiple chart bottoms at $1,400 during June and July, platinum has soared along with other precious metals. Based on the London Fix Price, platinum has soared 16.5% from a low of $1,390 on August 3, 2012 to a September 20 closing price of $1,620.

Since establishing multiple chart bottoms at $1,400 during June and July, platinum has soared along with other precious metals. Based on the London Fix Price, platinum has soared 16.5% from a low of $1,390 on August 3, 2012 to a September 20 closing price of $1,620.

The latest sales figures from the U.S. Mint for August show a significant increase in sales of both gold and silver bullion coins.

The latest sales figures from the U.S. Mint for August show a significant increase in sales of both gold and silver bullion coins.

South Africa continues to be wracked by violence as striking platinum mine workers clash with police. In a confrontation between police and striking mine workers, a gunbattle resulted in the shooting deaths of 34 miners.

South Africa continues to be wracked by violence as striking platinum mine workers clash with police. In a confrontation between police and striking mine workers, a gunbattle resulted in the shooting deaths of 34 miners.