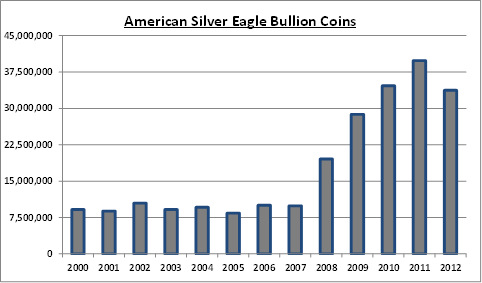

The American public’s love affair with the U.S. Mint American Eagle silver bullion coin continues unabated. Ever since the financial meltdown of 2008 there has been an explosion in demand for the silver coins. Average yearly sales of the silver bullion coins have increased by almost 500% since 2008 and sales for 2013 are on the verge of shattering all previous yearly sales records.

The American public’s love affair with the U.S. Mint American Eagle silver bullion coin continues unabated. Ever since the financial meltdown of 2008 there has been an explosion in demand for the silver coins. Average yearly sales of the silver bullion coins have increased by almost 500% since 2008 and sales for 2013 are on the verge of shattering all previous yearly sales records.

According to the U.S. Mint, sales of the American Eagle silver bullion coins totaled 3,087,000 ounces for October up slightly from September monthly sales. Demand for the silver coins has remained robust throughout the year and total annual sales at the end of October reached 39,175,000 million ounces.

The all time yearly sales record for American silver bullion coins was 2011 when sales hit 39,868,500 ounces. Based on current monthly sales the total number of silver coins sold in 2013 should be in the neighborhood of 45,000,000 ounces or almost 13% higher than the record hit in 2011.

Total yearly sales of the American Eagle silver bullion coins are shown in the chart below with the 2013 total through the end of October.

The market value of all silver bullion coins purchased since 2000 is $5.9 billion. We know that silver prices will fluctuate over the years. We also know that the “all mighty government” cannot produce silver coins by the trillions like they do with the U.S. dollar. Based on the irresponsible financial conduct of both the Federal Reserve and the Federal government, is it any wonder that citizens are voting with their pocketbooks and moving into real stores of value such as silver?

The American Eagle silver bullion coins cannot be purchased by individuals directly from the U.S Mint. The coins are sold only to the Mint’s network of authorized purchasers who buy the coins in bulk based on the market value of silver and a markup by the U.S. Mint. The authorized purchasers sell the silver coins to coin dealers, other bullion dealers and the public. The Mint’s rationale for using authorized purchasers is that this method makes the coins widely available to the public with reasonable transaction costs.

The American Eagle silver bullion coins cannot be purchased by individuals directly from the U.S Mint. The coins are sold only to the Mint’s network of authorized purchasers who buy the coins in bulk based on the market value of silver and a markup by the U.S. Mint. The authorized purchasers sell the silver coins to coin dealers, other bullion dealers and the public. The Mint’s rationale for using authorized purchasers is that this method makes the coins widely available to the public with reasonable transaction costs.

The U.S. Mint American Eagle silver bullion coins remain a popular method of building wealth with periodic purchases. The American public can’t seem to get enough of the bullion coins and the desperate actions of global central banks to keep the financial system afloat with a deluge of paper money can only cause more financial anxiety and more silver purchases going forward.

Although sales totals vary from month to month, annual sales of the U.S. Mint American Eagle gold bullion coins are running at triple the levels prior to 2008 when the wheels came off the world financial system and central banks began an orgy of money printing.

Although sales totals vary from month to month, annual sales of the U.S. Mint American Eagle gold bullion coins are running at triple the levels prior to 2008 when the wheels came off the world financial system and central banks began an orgy of money printing.

Demand for American Eagle gold and silver bullion coins remained sluggish in September according to the latest figures from the U.S. Mint.

Demand for American Eagle gold and silver bullion coins remained sluggish in September according to the latest figures from the U.S. Mint. There is no denying that it has been a really tough year for silver investors with silver dropping from $32.23 in January to a yearly low of $18.61 in June. Is the silver price correction finally over? The ridiculously low price of silver has resulted in a strong surge of demand worldwide and the price of silver has soared by 23% since the June low.

There is no denying that it has been a really tough year for silver investors with silver dropping from $32.23 in January to a yearly low of $18.61 in June. Is the silver price correction finally over? The ridiculously low price of silver has resulted in a strong surge of demand worldwide and the price of silver has soared by 23% since the June low. The exploding demand for physical gold and silver has become a worldwide phenomenon. Shortly after the price plunge of early April buyers rushed in to take advantage of bargain prices. Dealers and mints worldwide have reported off the charts demand for physical gold and silver.

The exploding demand for physical gold and silver has become a worldwide phenomenon. Shortly after the price plunge of early April buyers rushed in to take advantage of bargain prices. Dealers and mints worldwide have reported off the charts demand for physical gold and silver. We have probably all heard enough already from the mainstream nitwits who are forecasting the end of the gold bull market and further price declines. Funny thing though, most precious metal investors don’t need advice from self proclaimed experts on how to invest their money. The explicitly stated goal of central banks to increase the rate of inflation through currency debasement is blatantly obvious. Investors are acting accordingly by taking advantage of the recent decline in precious metal prices.

We have probably all heard enough already from the mainstream nitwits who are forecasting the end of the gold bull market and further price declines. Funny thing though, most precious metal investors don’t need advice from self proclaimed experts on how to invest their money. The explicitly stated goal of central banks to increase the rate of inflation through currency debasement is blatantly obvious. Investors are acting accordingly by taking advantage of the recent decline in precious metal prices.

Prior to the financial crisis, sales of the one ounce American silver eagles averaged about 10 million coins per year. The near collapse of the financial system in 2008 raised profound questions about the integrity of the financial system and the rush to precious metals was on. Since 2008, annual sales of the American Eagle silver bullion coins have soared with average annual sales of over 31 million coins.

Prior to the financial crisis, sales of the one ounce American silver eagles averaged about 10 million coins per year. The near collapse of the financial system in 2008 raised profound questions about the integrity of the financial system and the rush to precious metals was on. Since 2008, annual sales of the American Eagle silver bullion coins have soared with average annual sales of over 31 million coins.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012.