Demand for American Eagle gold and silver bullion coins remained sluggish in September according to the latest figures from the U.S. Mint.

Demand for American Eagle gold and silver bullion coins remained sluggish in September according to the latest figures from the U.S. Mint.

Sales of the American Eagle gold bullion coin totaled 13,000 ounces in September, off a considerable 77% from the previous year but up 13% from last month. Sales of the gold bullion coin in August were only 11,500 ounces, the lowest monthly sales of the year.

The slowdown in gold coin sales marks a turnaround from the beginning of the year when demand for physical gold seemed insatiable. April sales of the American Eagle gold coins came in at 209,500 ounces which was the largest sales month since December 2009 when 231,500 ounces were sold.

Despite the frenzy of money printing by banks around the world, gold bullion coin sales have declined every year since 2009 as the financial system stabilized. Gold sales soared during the financial panic in 2009 to an all time high as nervous buyers sought safe haven in gold.

Yearly sales of the gold bullion coins are shown below. The 2013 total is through September 3o.

Sales of the American Eagle silver bullion coins declined for the second month in a row. During September the U.S. Mint sold 3,013,000 silver coins, down 7.4% from last year and down 16.9% from August.

Despite the soft sales in September, demand for the silver bullion coins has been robust this year. If sales continue at the 3 million coins per month rate through year end, 2013 will turn out to be a record sales year with annual estimated silver bullion coin sales of 45 million.

Sales of the American Eagle silver bullion coins by year are shown below. The 2013 sales total is through September 30.

The case has been conclusively settled. All those paranoid people who have been claiming manipulation of the silver market are wrong according to the Commodities Futures Trading Commission (CFTC).

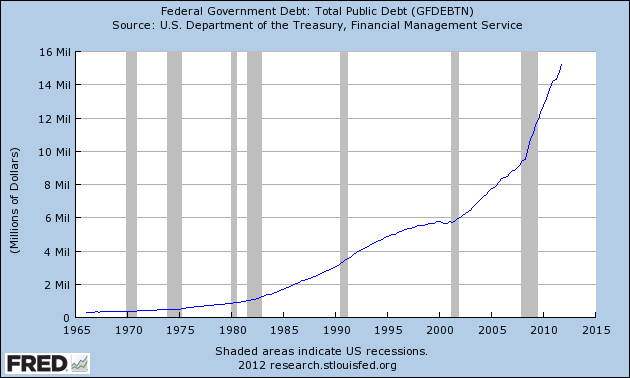

The case has been conclusively settled. All those paranoid people who have been claiming manipulation of the silver market are wrong according to the Commodities Futures Trading Commission (CFTC). Bridgewater’s Ray Dalio, one of the world’s most successful hedge fund investors, has put out a neat video explaining how the economic system works and how the suffocating burden of unmanageable debts can be reduced without propelling the world into uncontrollable inflation or a deflationary depression.

Bridgewater’s Ray Dalio, one of the world’s most successful hedge fund investors, has put out a neat video explaining how the economic system works and how the suffocating burden of unmanageable debts can be reduced without propelling the world into uncontrollable inflation or a deflationary depression. By: GE Christenson

By: GE Christenson

The months long guessing game on whether or not the Fed would start tapering its $85 billion per month of treasuries and mortgage securities came to a conclusion today as the Fed promised to keep the printing presses going full blast.

The months long guessing game on whether or not the Fed would start tapering its $85 billion per month of treasuries and mortgage securities came to a conclusion today as the Fed promised to keep the printing presses going full blast.

By:

By:  By: GE Christenson

By: GE Christenson

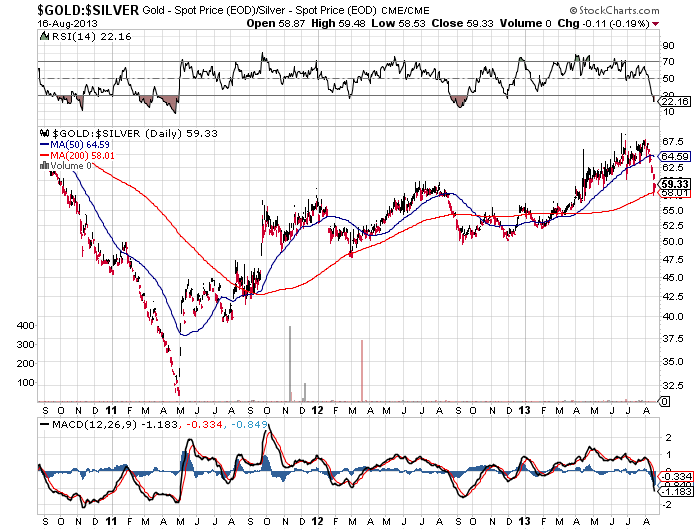

There is no denying that it has been a really tough year for silver investors with silver dropping from $32.23 in January to a yearly low of $18.61 in June. Is the silver price correction finally over? The ridiculously low price of silver has resulted in a strong surge of demand worldwide and the price of silver has soared by 23% since the June low.

There is no denying that it has been a really tough year for silver investors with silver dropping from $32.23 in January to a yearly low of $18.61 in June. Is the silver price correction finally over? The ridiculously low price of silver has resulted in a strong surge of demand worldwide and the price of silver has soared by 23% since the June low. A Fun Look at Silver’s Looong Correction and a Positive Look Ahead

A Fun Look at Silver’s Looong Correction and a Positive Look Ahead