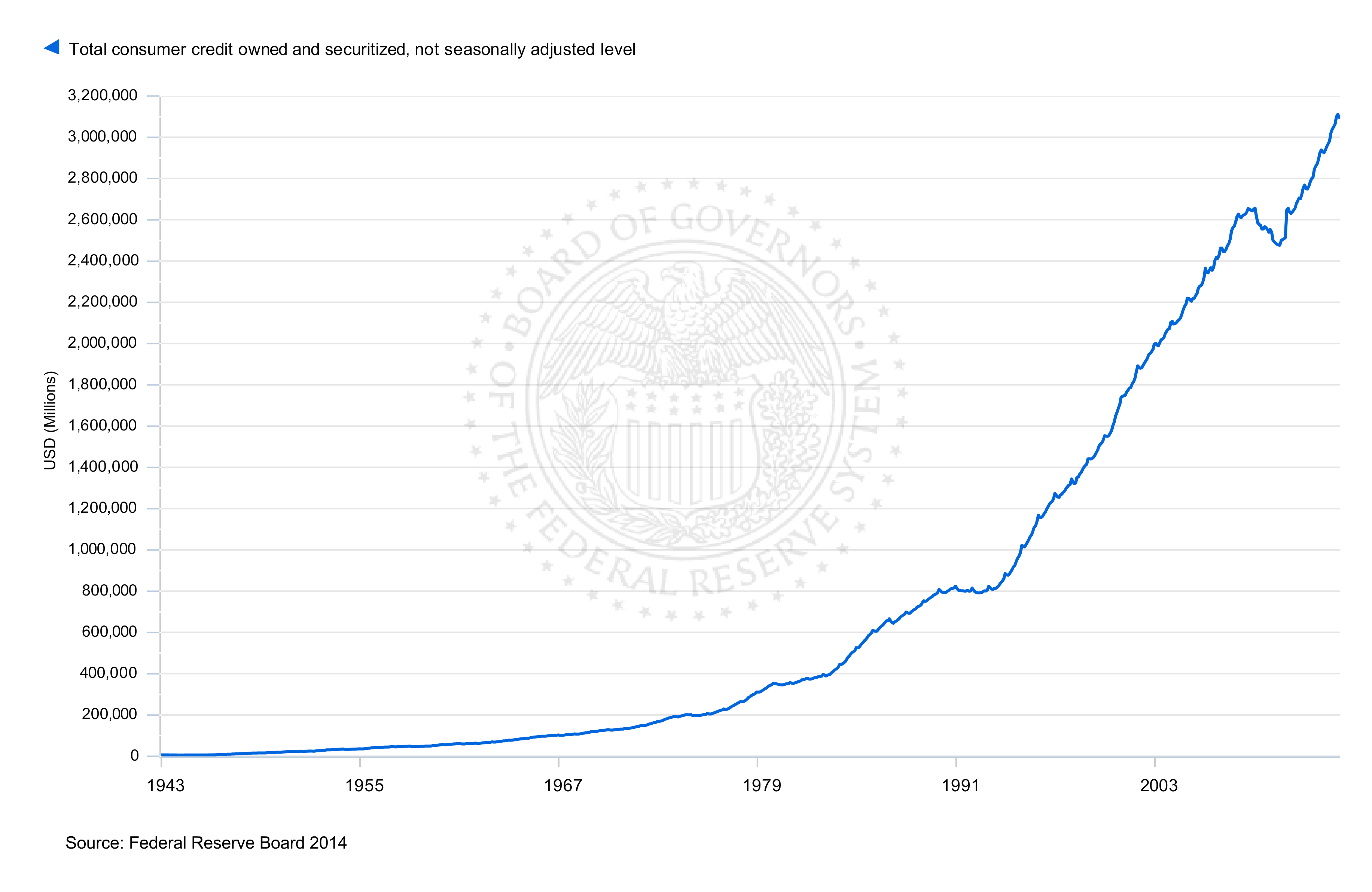

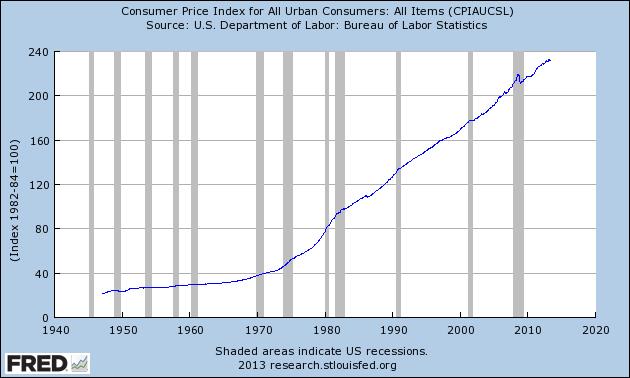

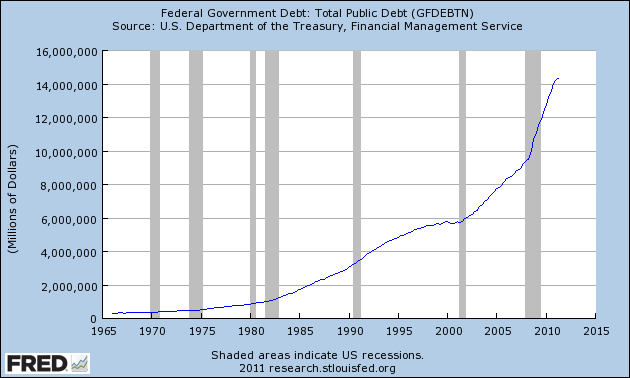

Gold and silver bullion coin sales by the U.S. Mint during April turned in mixed results with gold sales up and silver sales down. Despite the fact that gold and silver are in the bargain basement due to price declines, investment demand remains relatively subdued due to tapering of money printing by the Federal Reserve and the apparent recovery of the U.S. economy.

Gold and silver bullion coin sales by the U.S. Mint during April turned in mixed results with gold sales up and silver sales down. Despite the fact that gold and silver are in the bargain basement due to price declines, investment demand remains relatively subdued due to tapering of money printing by the Federal Reserve and the apparent recovery of the U.S. economy.

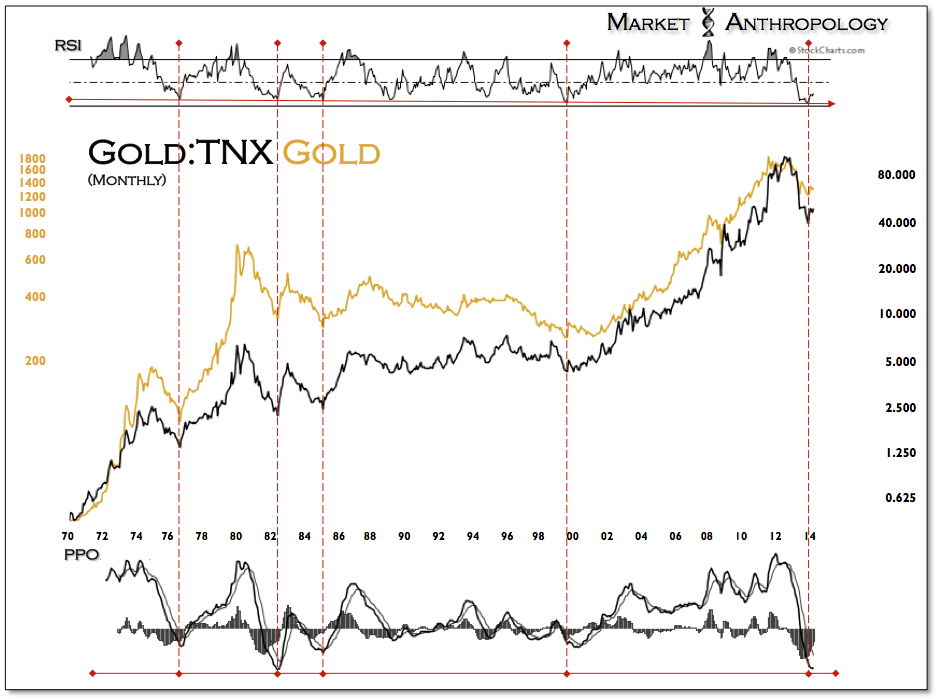

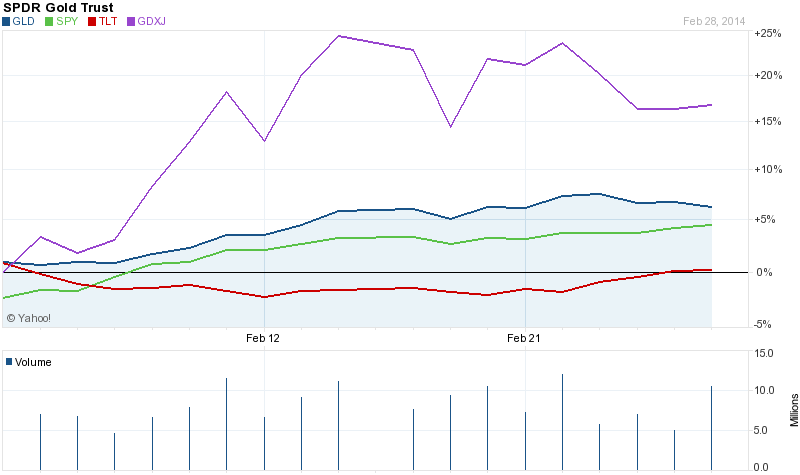

Investor perceptions of precious metals as a safe haven appear diminished despite the ongoing and unprecedented monetary easing by central banks and unrestrained government borrowings. Gold began the year selling for $1,225 per ounce. After reaching a high of $1,385 on March 14 gold declined to a current price of $1,281.25 leaving it up on the year by 4.6%.

The U.S. Mint reported that sales of the American Eagle gold bullion coin in April totaled 38,500 ounces up 83% from 21,000 ounces sold in the previous month but down by a substantial 81.6% from April of 2013 when the Mint sold 209,500 ounces. After dropping for three years in a row since 2009, sales of the American Eagle gold bullion coins increased in 2013 to 856,500 ounces up by 13.7% from total sales of 753,000 ounces in 2012.

(Sales figures for gold bullion coins on the charts below are as of April 30, 2014.)

| Gold Bullion U.S. Mint Sales Since 2000 | ||

| Year | Ounces Sold | |

| 2000 | 164,500 | |

| 2001 | 325,000 | |

| 2002 | 315,000 | |

| 2003 | 484,500 | |

| 2004 | 536,000 | |

| 2005 | 449,000 | |

| 2006 | 261,000 | |

| 2007 | 198,500 | |

| 2008 | 860,500 | |

| 2009 | 1,435,000 | |

| 2010 | 1,220,500 | |

| 2011 | 1,000,000 | |

| 2012 | 753,000 | |

| 2013 | 856,500 | |

| 2014 | 182,000 | |

| TOTAL | 9,041,000 | |

Total sales of gold bullion coins year to date total 182,000 ounces. Based on the current sales rate through April 30th, annualized sales of gold bullion coins would come in at 546,000 ounces, the lowest amount of sales since 2007 when only 198,500 ounces were sold.

Silver Bullion Coin Sales Could Reach Another Record in 2014

Sales of the American Eagle silver bullion coins remained strong in April with a total of 4,590,500 coins sold, down slightly from the previous month’s sales of 5,354,000.

The one ounce American Eagle silver bullion coin remains extremely popular with investors. Total coin sales during 2013 reached an all time high of 42,675,000. The previous record sales year going back to 2000 occurred in 2011 when investors scooped up 39,868,500 coins. If the current sales pace continues, total sales of the silver bullion coin during 2014 could reach a record breaking 55 million ounces.

After almost a three year bear market in gold and silver it’s safe to conclude that most of precious metal bears have sold out and moved on. As gold and silver prices corrected sharply over the past three years, the chorus of bearish sentiment in the mainstream press has become endemic, thus setting the stage for a powerful and unexpected contra rally.

After almost a three year bear market in gold and silver it’s safe to conclude that most of precious metal bears have sold out and moved on. As gold and silver prices corrected sharply over the past three years, the chorus of bearish sentiment in the mainstream press has become endemic, thus setting the stage for a powerful and unexpected contra rally.