By: GE Christenson

By: GE Christenson

Crude Oil bottomed (weekly data) about 12/25/1998 at $10.75. It rose erratically for several years, hit another low on 8/24/2007 at $68.70, and then rallied dramatically to an all-time high of $147.20 on 7/11/2008. Subsequently, crude collapsed to $35.35 on 12/26/2008.

High to Low Ratio: 147.20 / 10.75 = 13.69

Total time: 12/25/98 to 7/11/08 = 9.55 years

Final blow-off Ratio: 147.20 / 68.70 = 2.14

Time for Blow-off: 8/24/07 to 7/11/08 = 0.88 years

Collapse Ratio: 35.35 / 147.20 = 0.24

Collapse time: 7/11/2008 to 12/26/2008 = 0.46 years

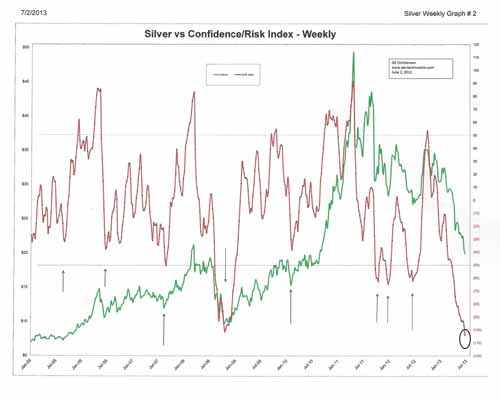

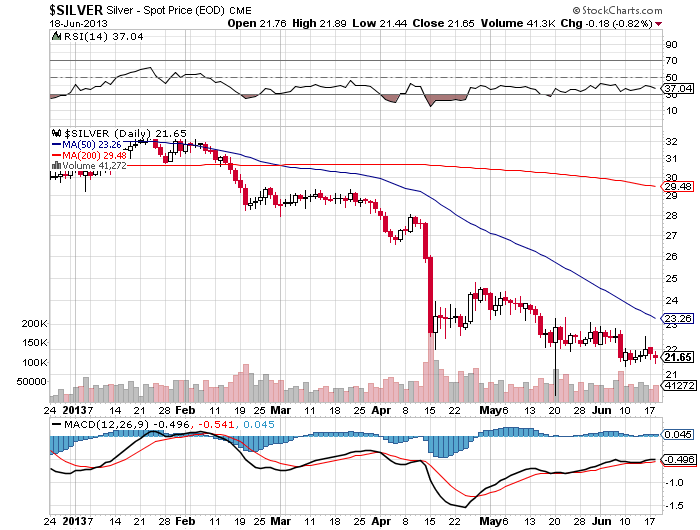

Silver bottomed (weekly data) about 11/23/2001 at $4.01. It rose erratically for several years, hit another low on 2/5/10 at $14.78, and then rallied dramatically to a nearly all-time high of $48.58 on 4/29/2011. Subsequently, silver collapsed to $18.53 on 6/28/2013.

High to Low Ratio: 48.58 / 4.01 = 12.11

Total time: 11/23/01 to 4/29/11 = 9.44 years

Final blow-off Ratio: 48.58 / 14.78 = 3.29

Time for Blow-off: 2/05/10 to 4/29/11 = 1.23 years

Collapse Ratio: 18.53 / 48.58 = 0.38

Collapse time: 4/29/11 to 6/28/13 = 2.17 years

So What?

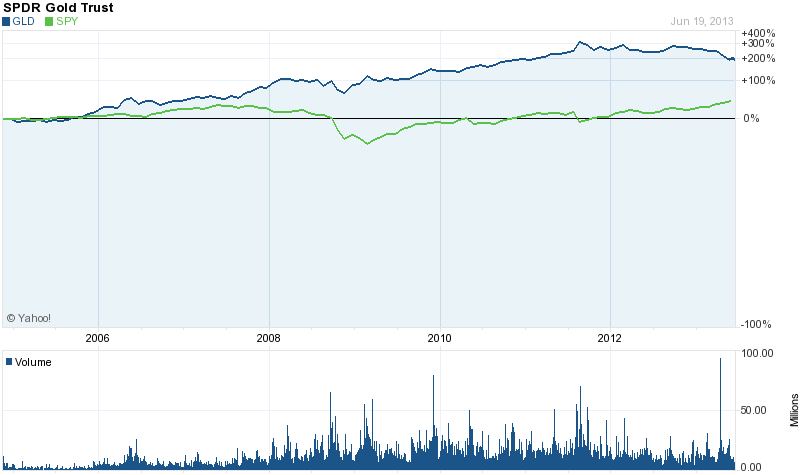

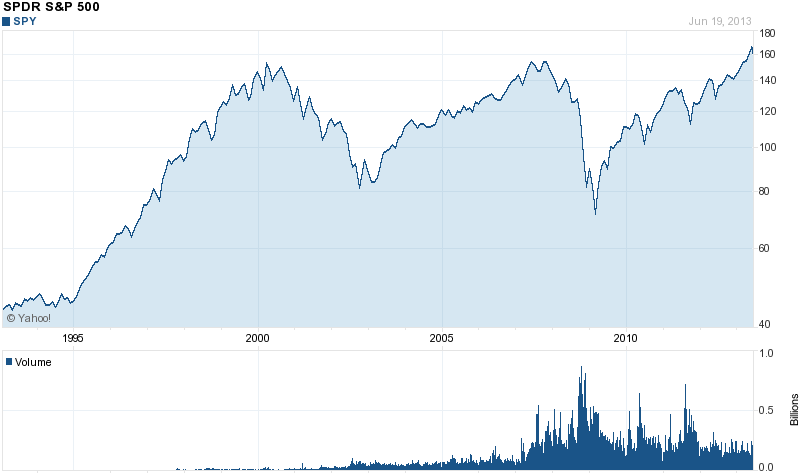

Both crude and silver took about 9.5 years to rally from a significant low to an important high. The high to low ratios were similar – over 13 and over 12. Both collapsed after their blow-off highs and fell 76% and 62% from their highs. Crude rallied during the next four years and is now over triple its crash low. Silver, a much smaller and more volatile market, seems likely to do something even more dramatic.

Questions

Assume market prices for crude oil are based on supply and demand of physical crude oil. Do you think supply and demand for physical crude oil changed sufficiently between the crude low in August of 2007 to the high in July 2008 to the low in December 2008 to justify a rise from $68.70 to $147.20 and then a fall to $35.35?

Answer one: Obviously it did; the market price changed and the market price is always correct.

Answer two: Perhaps politics, High Frequency Trading (HFT), and derivatives also affected the supply and demand of paper contracts for crude such that the price of crude more than doubled and then collapsed by 76% in about 1.3 years.

You choose the best answer.

Assume market prices for silver are based on supply and demand. Do you think supply and demand for physical silver metal changed sufficiently between the silver low in February 2010 to the high in August 2011 to the low in June 2013 to justify a rise from $14.78 to $48.55 and then a fall to $18.53?

Answer one: Obviously it did; the market price changed and the market price is always correct.

Answer two: Perhaps politics, High Frequency Trading, and derivatives also affected the supply and demand of paper contracts for silver such that the price of silver more than tripled and then collapsed by 62% in about 3.4 years.

You choose the best answer.

Why Discuss This Parallel?

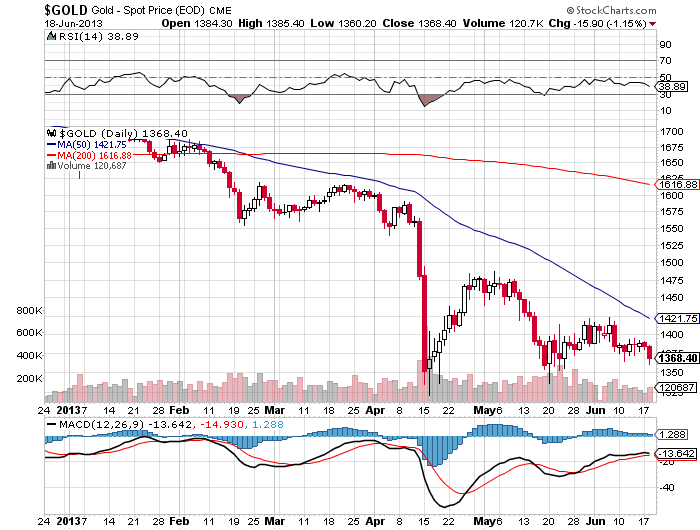

Sentiment for silver and gold was (June 2013) exceptionally low – at multi-year or multi-decade lows depending on who is measuring sentiment. As of the end of June 2013 there seemed to be “no light at the end of the tunnel” for silver bulls and there was no joy in “silver-ville.” Most people I know wanted nothing to do with silver or gold.

It was about the same with the crash low in crude 4.5 years ago in December of 2008 and the S&P500 crash low in early 2009. But the world economies demanded crude oil while the supply was flat or declining. Consequently the price rallied back to over $105 this month – about triple its collapse low price.

I think it is quite reasonable to expect that silver will also rally substantially from here. In fact an explosive rally would not be surprising. What seems likely is a multi-year rally (that culminates in another price blow-off) to four or six (or ten) times the low price in June, the inevitable price collapse, and then some months or years in a trading range at prices that make sub-$20 silver look like an absolute bargain. I suppose that if the US congress balances the budget AND world peace is confirmed, then silver prices are unlikely to rally… but I would rather bet on higher silver prices.

How are crude oil and silver similar?

Both had a nine plus year rally to a blow-off peak, collapsed, and rose again. Crude began its rally about three years before silver, and peaked about three years earlier. Both are essential for modern economies and their prices on the paper exchanges are heavily influenced by politics, HFT, and derivatives. The supply of crude is probably declining and the supply of silver is growing quite slowly. The world-wide demand for crude is likely to increase, even with slowly growing economies. The world-wide demand for silver is likely (my opinion) to dramatically increase due to increasing industrial demand and potentially explosive investor demand. There is good reason and good historical precedent to expect the price for both commodities to increase substantially, with great volatility.

Do you remember when crude was priced under $5.00 per barrel and silver was priced under $2.00? Given the penchant for governments around the world to run huge deficits, amass unpayable debt, and increase the money supply (monetize bonds) in seemingly unlimited quantities, do you think either $250 crude or $100 silver is unlikely in the next several years?

Neither do I!

We will see $250 crude, $10 gasoline, and $100 silver, unless the world’s economies and governments become responsible and accountable.

Have you purchased your Silver Eagles today?

Read: Silver – Keep It Simple

Read: Gains In Silver Will Be Historic

GE Christenson

aka Deviant Investor

By: GE Christenson

By: GE Christenson

Precious metals analyst Suki Coper at Barclays takes a look at the silver market in an interview with Bloomberg Television.

Precious metals analyst Suki Coper at Barclays takes a look at the silver market in an interview with Bloomberg Television.

Is there any hope for a recovery in gold and silver prices by year end?

Is there any hope for a recovery in gold and silver prices by year end?

By: GE Christenson

By: GE Christenson

Rick Rule

Rick Rule Anything that sound too good to be true, well, you know how that ends.

Anything that sound too good to be true, well, you know how that ends.

April was a brutal month for precious metal investors. Gold ended the month down almost 8% and silver prices tumbled almost 13%. The sell off continued in May with gold down another $60 per ounce to $1,412 and silver down $1.55 to $22.87 per ounce at mid month.

April was a brutal month for precious metal investors. Gold ended the month down almost 8% and silver prices tumbled almost 13%. The sell off continued in May with gold down another $60 per ounce to $1,412 and silver down $1.55 to $22.87 per ounce at mid month.