Many financial bloggers who never bought into the “yes, it’s important to own some gold” theory have been almost hysterically gloating over the recent divergence between gold and stocks. An example of this is a recent blog post comparing the performance of the SPDR Gold Trust (GLD) to the Standard & Poor’s 500 (SPY).

Many financial bloggers who never bought into the “yes, it’s important to own some gold” theory have been almost hysterically gloating over the recent divergence between gold and stocks. An example of this is a recent blog post comparing the performance of the SPDR Gold Trust (GLD) to the Standard & Poor’s 500 (SPY).

Reality cannot be ignored – owning stocks over the past two years has been a black hole for investors compared to stocks

Here’s the ugly chart proving that investors who thought that precious metals had a golden future are wrong.

Courtesy: thereformedbroker.com

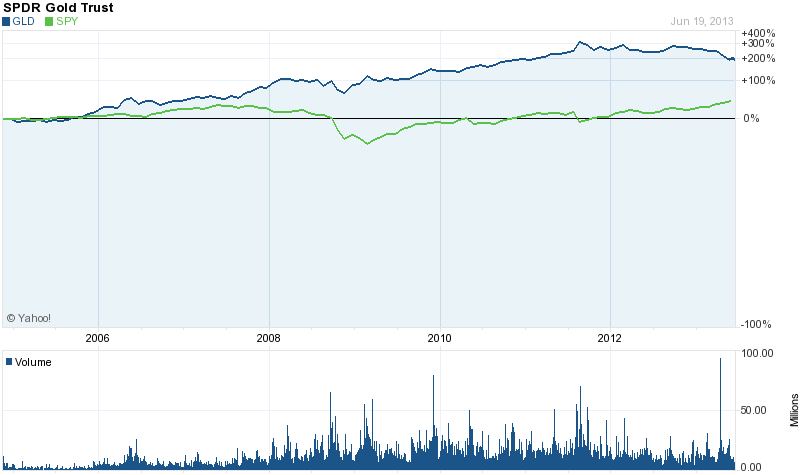

Short term views can be misleading and the biggest gains are made by making the right investment and holding for the long term. The picture of the GLD vs. the SPY looks quite different if we go back to 2005.

courtesy: yahoo finance

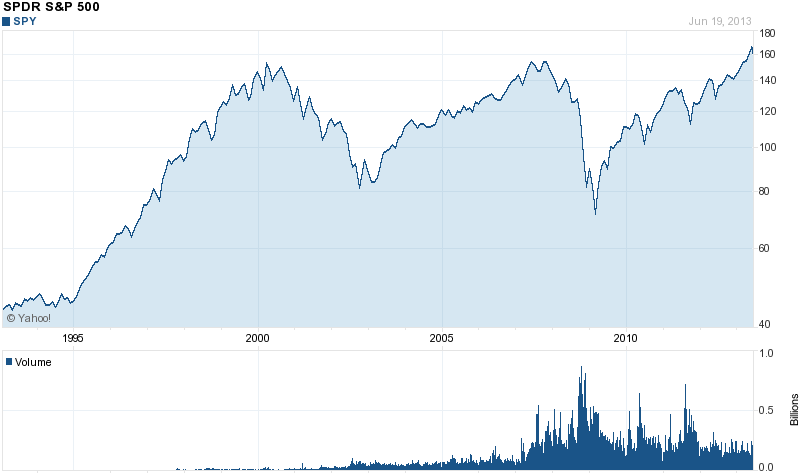

In addition, let’s not forget that the stock market as measured by the S&P 500 is just about where it was over a decade ago in 2001.

courtesy: yahoo finance

Considering the perilous state of world economic affairs and notwithstanding the recent significant drop in the price of precious metals, maintaining a position in gold and silver seems like a prudent long term option.

Great graphs that prove your point. Gold didn’t enter the thirteenth year of gains, however this doesn’t stop gold from rallying back again. The Bank of America, even after April’s dramatic gold price decline, is firm in its predictions of gold at $2,000 an ounce in the future http://bit.ly/113×731. Gold has already touched $1,800 an ounce in its recent rally and considering that as the base, the next price rally could possibly be well over the $2,000 mark.