After the recent volatility in precious metals, let’s take a look at the year to date performance of gold, silver, platinum and palladium. The new year started off with a strong rally across the entire precious metals group which erased some of the losses seen in the second half of 2011.

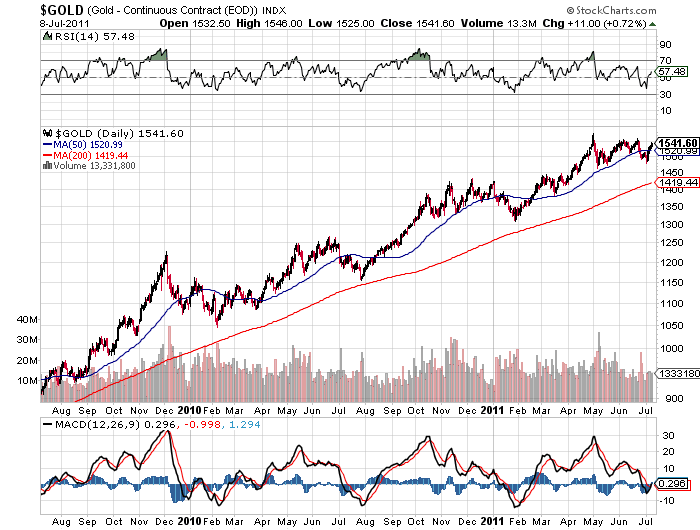

The across the board rally in precious metals came to an abrupt halt in early March after serial dollar printer Fed Chairman Bernanke made comments suggesting that further quantitative easing was unnecessary (see The Flash Crash In Gold). Gold, which had closed at $1781 on February 28, sold off sharply, losing $136.75 per ounce by March 14. Silver, platinum and palladium also sold off and are currently below the highs of the year seen in late February.

The precious metal with the largest gain to date for 2012 is platinum with an impressive 19% gain. Silver is up 12.72% on the year, followed by palladium with a 5.72% gain and gold is now in last place with a year to date gain of 4.5%.

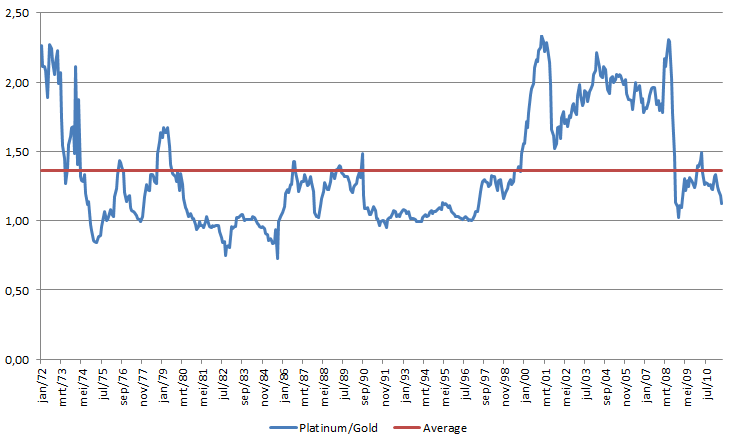

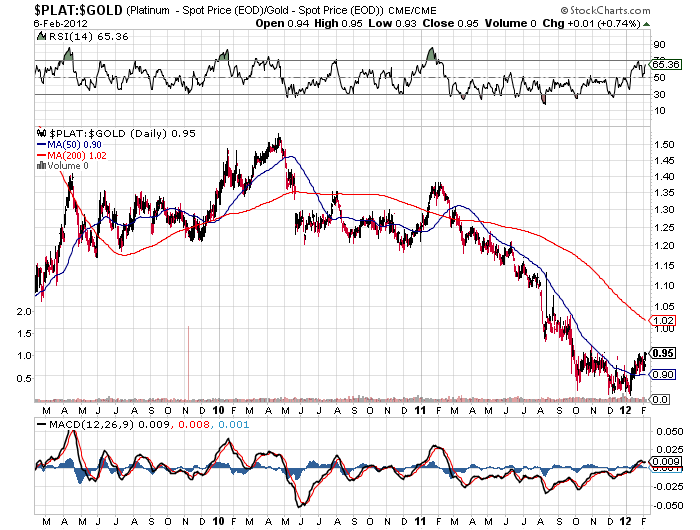

Platinum may be the most undervalued of all the precious metals based on the fact that the platinum to gold ratio is at levels not seen since 1986 (see Platinum To Gold Ratio Plunges – Buy Signal or New Metric?).

| GOLD | SILVER | PLATINUM | PALLADIUM | |

| JAN 3RD | $1,590.00 | $28.78 | $1,406.00 | $664.00 |

| MARCH 19TH | $1,661.50 | $32.44 | $1,673.00 | $702.00 |

| $ GAIN | $71.50 | $3.66 | $267.00 | $38.00 |

| % GAIN | 4.50% | 12.72% | 19.00% | 5.72% |

Based on previous history, serious precious metal investors probably gave little credence to Bernanke’s suggestion that further Fed monetary easing was not in the cards. Indeed, barely a week passed before the Fed Chairman was again discussing a new version of quantitative easing known as “sterilized bond-buying.” The always astute James Grant of Grant’s Interest Rate Observer, dismissed the notion that central bank money printing was about to end anytime soon. In a recent interview with Bloomberg Television, Grant had this to say.

The price of gold is the reciprocal of the world’s faith in the deeds and words of the likes of Ben Bernanke. The world over, central banks are printing money as it has never been printed before. The European Central Bank has increased the size of its balance sheet at the annual rate of 89%. It’s amazing. The Fed is far behind at only 15%. The Bank of England 67% over the past few months. These are rates of increases in the production of paper currencies we have never seen in the modern age. It takes no effort at all. They simply tap the computer screen.

The full interview with Grant is well worth listening to and can be accessed below.

Where do we go from here in what could turn out to be a very interesting year for precious metals? Here’s a brief roundup of interesting thoughts and analysis from around the web.

The Golden Trader discusses paper trading and manipulation of precious metal prices along with a technical assessment of gold and silver.

Mint State Gold explains why “all the major signs are showing that the quality rare coin market is starting its long awaiting rally. Let me explain why we could see a 30% move higher by year end.”

Why financial repression should be the focus of investor attention.

The Standard & Poors 500 stock index is still below the level it reached more than 10 years ago in early 2000. Interest rates on traditional bank savings have barely exceeded zero percent since the Fed instituted its zero interest rate policies in 2008. Meanwhile, incomes are stagnant and the cost of items we use everyday have been inexorably increasing.

The Standard & Poors 500 stock index is still below the level it reached more than 10 years ago in early 2000. Interest rates on traditional bank savings have barely exceeded zero percent since the Fed instituted its zero interest rate policies in 2008. Meanwhile, incomes are stagnant and the cost of items we use everyday have been inexorably increasing.