According to one market seer who has been a long term gold bull, the fear of higher inflation should not be viewed as the primary factor driving gold prices higher.

According to one market seer who has been a long term gold bull, the fear of higher inflation should not be viewed as the primary factor driving gold prices higher.

In an interview with Fortune Magazine, Stephanie Pomboy explains why she likes gold despite the powerful deflationary undertones of the world economy. Ms. Pomboy is the head of MacroMavens, a firm she founded in 2002. Major institutional investors and giant money management firms have become clients of MacroMavens based on Pomboy’s successful ability to forecast major trend moves based on macroeconomic factors.

Ms. Pomboy has correctly been bearish on the U.S. economy since late 2008, predicting a long period of deleveraging due to declining incomes and the deflated housing bubble. Deflated asset bubbles, declining incomes and a slow economy are not the classic ingredients for inflation. Pomboy correctly argued that low inflation, or actual deflation, would not prevent gold prices from surging higher.

Pomboy has a superb track record predicting gold prices. In a December 2008 interview with Barron’s, Pomboy prophetically concluded that “We are going to see a secular rotation from paper assets to hard assets like gold. The whole global competitive currency devaluation, including that of the dollar, plays right into that. We are acting as though there are no consequences to basically running the money off the printing press and handing it to the Federal government to backstop financial markets or bail out homeowners or what not. There is no consequence to doing this, unless or until the rest of the world says to us, ‘We don’t like this game’ and We don’t want to have all the dollar claims we are holding debased by [Fed Chairman Ben Bernanke] running his printing press.”

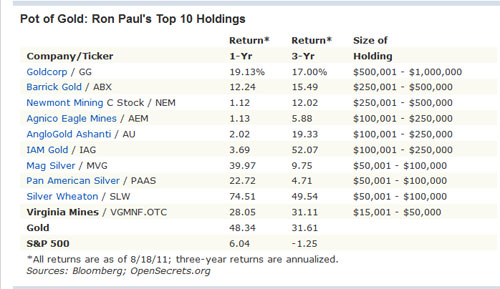

Those who heeded Pomboy’s advice have seen gains of about 100% as gold moved from the $850 range in 2008 to the current price of $1,675. As a means of protecting capital against the debasement of all major currencies, gold remains the best hard asset to own.

In a follow up interview with Barron’s in February of this year, Pomboy made another extraordinarily accurate call on both gold and bonds. Despite referring to treasury bonds as certificates of confiscation, Pomboy recommended buying U.S. government debt and gold, a seemingly contradictory stance. As Pomboy explained it to Barron’s:

My bullishness on these flimsy pieces of paper is purely opportunistic. It is based on (1) my view that the perception of the economy has run far ahead of the reality and that disappointment will find yields declining. And (2), as I discussed in the interview, my belief that this will find the Fed extending QE–a policy which involves the Fed’s outright purchase of Treasuries… Not only is the Fed now the largest holder of Treasuries, but thanks to Ben’s printing press, it has unlimited capacity to buy. So this is one market where the fundamental laws of supply and demand do not apply.

Finally, for those who can’t fathom going long gold and Treasuries in combination? it’s simple. It’s the neatest expression of a bet on continued Fed monetization which, again, entails the direct PURCHASE of Treasuries!!! The wisdom of this trade has been on full display for ?oh? the last FOUR and A HALF years! The fact that it is still viewed as some kind of oxymoron only reinforces how much farther it has to go.

The Fed’s commitment to further assets purchases was revealed today when the Fed released the minutes of their last meeting. Although the Fed temporarily stopped outright asset purchases when QEII ended, policy makers are already discussing when to resume the practice. The Fed has already purchased about $1.6 trillion in government bonds, financed via quantitative easing. As the economy slows further and government spending continues its upward spiral, anyone who thinks the Fed won’t start monetizing the public debt is delusional.

In her recent interview with Fortune Magazine, Pomboy remains bullish on gold and forecasts higher oil prices as emerging nations reduce dollar reserves. According to Pomboy, “I’m really interested in strategic resources — commodities that emerging nations like China are trying to stockpile. Oil would be at the forefront. I think it will continue to be a beneficiary of this global debasement of currency and the need for emerging nations to diversify the foreign exchange resources that they’re sitting on, which are being debased every single day. Why not take that money and spend it on building strategic oil reserves rather than watching it go up in smoke?”

Pomboy’s perfectly logical theory that emerging nations will sell dollar assets to buy oil implies that demand for U.S. treasuries will drop dramatically since emerging nations such as China have been one of the biggest purchasers of U.S. debt. The absence of sufficient bids at Treasury auctions will immediately cause the following two events to occur: 1) the Fed will be forced to monetize ever greater amounts of debt in order to keep U.S. interest rates from rising and 2) the price of gold will soar.

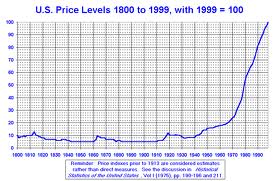

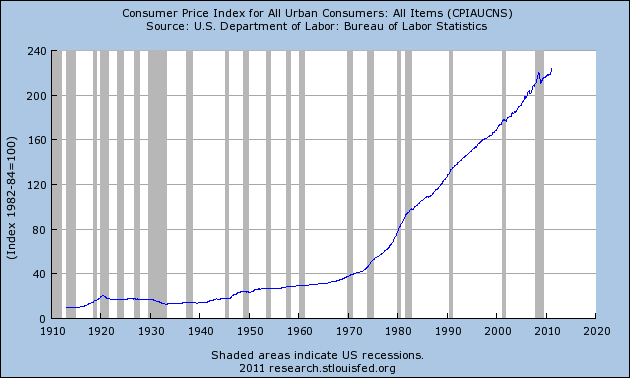

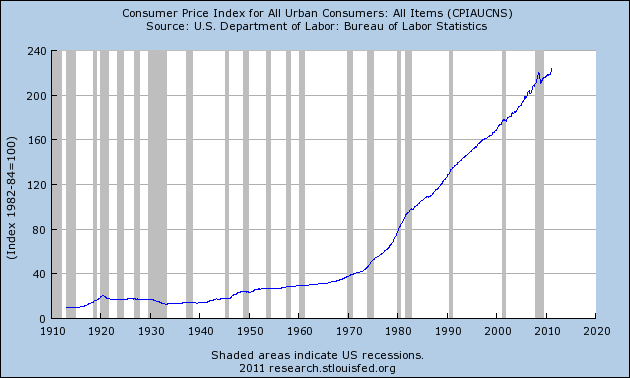

In his press conference on April 27, 2011, Federal Reserve Chairman Bernanke dismissed inflation worries, stating that “Our expectation is that inflation will come down and towards a more normal level”. Should we believe him? Not if you want to preserve your wealth and here’s why.

In his press conference on April 27, 2011, Federal Reserve Chairman Bernanke dismissed inflation worries, stating that “Our expectation is that inflation will come down and towards a more normal level”. Should we believe him? Not if you want to preserve your wealth and here’s why.

In India, the problem with inflation shows most clearly when you examine the country’s current level of gold trade and importation. Shipments have increased to 800 metric tons from 557 tons in the last year. That is an all time high and forecasts say that the number is still rising.

In India, the problem with inflation shows most clearly when you examine the country’s current level of gold trade and importation. Shipments have increased to 800 metric tons from 557 tons in the last year. That is an all time high and forecasts say that the number is still rising. So the price of gold has broken the $1,400 mark, whatever. The biggest news is that we shrug off records such as these being broken.

So the price of gold has broken the $1,400 mark, whatever. The biggest news is that we shrug off records such as these being broken.