Despite the non stop rally in the price of gold for over a decade, every normal pullback has been proclaimed as “the end of the gold bull market” by the mainstream media. Will gold eventually become an over-owned and overpriced asset? Yes – but that day will not arrive until gold is many thousands of dollars higher. Long term gold investors who have stayed with the primary trend have already outperformed every other asset class over the past decade as shown in this neat infographic from the Visual Capitalist.

Is Gold The Only Protection From The Fed’s Monetary Madness?

By Axel Merk

By Axel Merk

Investors are concerned about inflation. But how can investors attempt to inflation-proof their portfolios? Buy TIPS? Short Treasury bonds? Stocks? Real Estate? Commodities? Gold? Currencies? Or should investors regard those warnings about inflation as fear mongering?

Indeed, as the Federal Reserve (Fed) announced its latest round of quantitative easing (“QE3”), gauges of future inflation expectations spiked. In our assessment, the market reacted strongly as it became apparent that the Fed is moving away from its focus on inflation to a focus on employment. We believe the Fed wants to raise the price level so as to bail out millions of homeowners that are ‘under water’, i.e. owe more on their homes than they are worth. Fed Chair Bernanke considers a healthy housing market to be key to healthy consumer spending (see our Merk Insight Don’t worry, be Happy).

Judging from the market reaction to QE3, fears about future inflation are warranted. Having said that, market fears about looming inflation have calmed down a bit since the initial flare up. Could it be this calming of the market is due to the fact that the Fed is intervening in the TIPS market? TIPS are “inflation protected” Treasury securities that are linked to the Consumer Price Index. Investors buying TIPS do so in the hope that their purchasing power might be protected. When the Fed intervenes in the market to buy TIPS (or any other security for that matter), such securities are intentionally over-priced, raising doubt as to whether investors are truly “protected” from inflation. It’s not just investors that now have more limited access to measuring inflation expectations – it’s also the Fed itself. By managing the entire yield curve (short-term through long-term interest rates), we believe the Fed has blindfolded itself, as it has taken away one of the most important gauges about the health of the economy. Aside from the Fed’s intervention in the TIPS market, the government is free to change the inflation adjustment factor employed in TIPS before the securities mature. TIPS payouts are adjusted using the consumer price index (CPI), which has seen methodology changes many times. When the recent debt ceiling impasse was discussed, both Republicans and Democrats talked in favor of changing the CPI definition so that it would nominally live up to inflation linked entitlement promises while clearly eroding the purchasing power of such payouts. Even without such gimmickry, the CPI may not be reflective of the basket of goods and services consumed by investors as they approach retirement given, for example, that healthcare may comprise an ever-increasing part of one’s spending. Alas, much of investing is about trying to preserve purchasing power and, alas, buying TIPS may not provide adequate protection.

If one is negative about the inflation outlook, why not simply short Treasuries, either directly or through ETFs? While we are pessimistic about the long-term outlook of Treasuries, it can be very costly to short them, given that – as a short seller – one has to continuously pay the interest of the securities one shorts. If one buys an ETF shorting Treasuries, the cost of the ETF is to be added. Shorting Treasuries might make sense for investors that are good at market timing. However, calling the top in major bubbles is rather difficult, just reflect on former Fed Chair Alan Greenspan’s “irrational exuberance” speech years ahead of the stock market collapse in 2000; similarly, those that saw the bubble in the housing market coming didn’t necessarily get the timing right.

If TIPS don’t provide enough bang for the buck, and shorting Treasuries can be costly, what about buying stocks? Bernanke appears to use every opportunity possible to praise the benefits QE has on rising stock prices. While we agree that QE has pushed stock prices higher, it may be dangerous for the Fed to praise this link given that it raises expectations of more Fed easing whenever the markets plunge (see Merk Insight: Bernanke Put). For example, how many investors buy Cisco 1 shares because of the great management skills of CEO John Chambers as compared to those who buy because of QE3? We pose this question because stocks are rather volatile; not only are stocks volatile, but the volatility of stocks can be all over the place. Historically, the annualized standard deviation of the S&P 500 index hovers in the mid 20% range, with outbursts into the 40% range in 2008. So why are investors taking on the “noise” of the stock market, when the reason they invest is because of QE? Indeed, our analysis shows that investors appear to be ever more chasing the next perceived intervention by policy makers rather than investing based on fundamentals. That’s not only bad for capital formation (these misallocations are summarily referred to as “bubbles” these days), but also suggests that we might want to look for a more direct way to take a position on what we call the “mania” of policy makers.

Talking about policy makers: you might not agree with them, but if there is one good thing to be said about our policy makers, it is that they may be quite predictable.

What about real estate? In the U.S., depending on where one lives, the real estate market has bottomed out or appears to be bottoming out. With what appears to be the Fed’s razor sharp focus on real estate, it might be foolish to bet against the Fed. Indeed, yours truly bought a property in Palo Alto in late 2009. Unlike other real assets, keep in mind that real estate is often purchased with borrowed money; as such, it is prone to speculative bubbles such as the most recent episode. Investing in REITs might allow one to allocate a smaller share of one’s portfolio to real estate; a downside of REITs is that they tend to be highly correlated with equity markets. As policy makers steer equity prices, everything appears to be ever more highly correlated, investors may want to look for something that offers low correlation to other investments.

That brings us to commodities. In a world where policy makers appear to favor growth at just about any cost, commodity prices have been beneficiaries. As we have seen in recent weeks, it is not a one-way street, as dynamics within the market can be rather complex. The dynamics for commodities within agriculture differ from those in metals or energy. There are special considerations in storing and delivering many commodities, creating challenges for investors. We agree that commodities might do well in the long run, but urge investors to consider all the risks that come with investing in commodities. Notably, commodities can have stretches of low volatility, luring investors to jump in, only to be greeted with a jolt that can be rather hazardous to one’s wealth. As a simple rule of thumb: if you can’t sleep at night with your investment, you own too much of it.

Gold is worth singling out as the one commodity that has arguably the least industrial use. Rather than writing gold off as a barbaric relic, we like gold: its relative simplicity might make it the investment purest in reflecting monetary policy. In the medium term, we believe gold may be a good inflation hedge. But, again, keep in mind that price movements can be rather volatile. Even staunch gold bugs rarely have all their assets in gold.

This leads us to currencies as a potentially attractive way to diversify beyond gold. The Chinese have long diversified their reserves to a basket of currencies, in an effort to mitigate their U.S. dollar exposure. Some say currencies are difficult to understand. We argue that it is far easier to understand the dynamics of ten major currencies, as well as others worth monitoring, than to understand the dynamics of thousands of stocks. Importantly, we believe the currency markets might be an ideal place to take a position on the mania of policy makers. Indeed, as we believe that the Fed might want to debase the U.S. dollar (Please see Fed may want to debase dollar), why not express that view in the currency markets? Unlike their reputation, currencies are far less volatile than equities: if one does not employ leverage, a move in the euro by 1 cent is rather small on a percentage basis. The U.S. dollar index has historically had an annualized standard deviation of returns in the low teens; in 2008, that volatility rose a tad, approaching the mid-teens. For investors looking for predictability on the risks in a portfolio, the currency markets have historically shown a far more consistent risk profile than equities or many other asset classes. A corollary is that during market downturns, unlevered currency strategies may offer some downside protection given the lower risk profile. This clearly doesn’t mean an investment in currencies is safe; but managed currency risk can be seen as an opportunity given the purchasing power risk taken by holding U.S. dollars.

If investors agree that the Fed: a) may want to have – or at least accept – higher inflation; and b) may not readily see the warning signs of higher inflation, then it appears to us prudent to take the risk of higher inflation into account. Indeed, for those managing money on behalf of others, it might be their fiduciary duty to take that risk into account. Those that ignore the risk of inflation might do so at their own peril. Many investors might feel they can take action once inflation is obvious. “Obvious” is in the eye of the beholder: just as we preferred to be early in warning about the crisis in 2008, it appeared rather challenging to reposition one’s portfolio in October 2008. Gold has gone up by a factor of about 7 since its lows. The dollar has fallen relative to a basket of currencies over the past 10, 30 and 100 years: in our assessment, we simply have the better printing press. Hedging inflation risk isn’t about being right about the future; it’s about the risk of being right.

Axel Merk

Axel Merk is President and Chief Investment Officer, Merk Investments

Merk Investments, Manager of the Merk Funds

Platinum Has Soared 17% Since Early August – What Now?

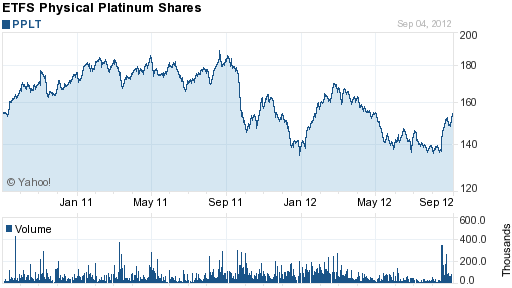

Since establishing multiple chart bottoms at $1,400 during June and July, platinum has soared along with other precious metals. Based on the London Fix Price, platinum has soared 16.5% from a low of $1,390 on August 3, 2012 to a September 20 closing price of $1,620.

Since establishing multiple chart bottoms at $1,400 during June and July, platinum has soared along with other precious metals. Based on the London Fix Price, platinum has soared 16.5% from a low of $1,390 on August 3, 2012 to a September 20 closing price of $1,620.

In early August, Gold and Silver Blog examined the ostensibly poor fundamentals which had driven down the price of platinum and concluded that, based on the widely held bearish consensus and chart action, platinum had already fully discounted all bearish news. In addition, the gold to platinum ratio had reached a low not seen since 1985, another signal that platinum was undervalued. (See Platinum Perspectives – Time To Buy or Will The Bears Win?)

Despite the recent normal consolidation in platinum, prices are likely to move substantially higher over time along with the rest of the precious metals complex.

As noted in early August, Platinum can be purchased from the U.S. Mint in the form of Proof Platinum Eagles.

The U.S. Mint has been producing the Proof American Platinum Eagle since 2009. According to MintNewsBlog, the entire 2009 production of 8,000 Proof Platinum Eagles sold out in a week. During 2010, the U.S. Mint produced 10,000 Proof Platinum coins which also quickly sold out. During 2011, the mintage was set at 15,000 coins but the sales pace slowed considerably with pricing set at $2,092 and the coin has still not sold out with total sales of 14,760 as of the last U.S. Mint report. On August 9th, the U.S. Mint announced that production of the 2012 Proof American Platinum Eagles will be set at 15,000 coins. Orders are limited to 5 per household with initial pricing at $1,692.

For investors disinclined to hold physical platinum, positions can be easily established through the purchase of the ETFS Physical Platinum Shares (PPLT) which holds physical platinum. The PPLT holds a relatively small amount of platinum reflecting the lack of broad investor participation in the platinum sector. The PPLT recently held about 5,000 ounces of platinum valued at $79.6 million. Gold remains the premier investment choice in precious metals but a position in platinum could add some luster to an investor’s precious metals portfolio.

More on this topic:

Closed Platinum Mines Offset By Stockpile Surplus – Is A Surprise Platinum Rally Coming?

Platinum Soars $78 On Week As Bodies Pile Up In South Africa

Why The Fed Is Committed To Higher Inflation

By Axel Merk

Is the Fed’s goal to debase the U.S. dollar? The Federal Reserve’s announcement of a third round of quantitative easing (QE3) might have been the worst kept secret, yet the dollar plunged upon the announcement. Here we share our analysis on what makes the FOMC tick, to allow investors to position themselves for what may be ahead.

We have heard policy makers justify bailouts and monetary activism because, as we are told, these are no ordinary times: extraordinary times require extraordinary measures. Acronyms are needed, as we are told that things are complicated. We respectfully disagree. It’s quite simple: we have had a credit driven boom; we have had a credit bust; and Fed Chairman Bernanke thinks monetary policy can fix it. Merk Senior Economic Adviser and former St. Louis Fed President William Poole points us to the fact that the Soviet Union, Cuba and North Korea have one thing in common: monetary policy could not have compensated for the shortcomings of the respective regimes. The successor nations to the Soviet Union, as well as China had economic booms because they opened up, not because of printing presses being deployed. Monetary policy affects nominal price levels, not structural deficiencies. In the U.S., the economy may be held back because of uncertainty over future taxes (the “fiscal cliff”) and regulation; monetary policy cannot fix these.

But the above experiences have something else in common: they refer to lessons of recent decades. Bernanke, in contrast, is a student of the Great Depression, the 1930s. Bernanke firmly believes that tightening monetary policy too early during the Great Depression was a grave mistake, prolonging the Depression. Never mind that there had been major policy blunders by the Roosevelt administration that might have been driving factors; Bernanke’s research squarely focuses on how history would have evolved differently had his prescription for monetary policy been implemented.

The reason why Bernanke thinks tightening too early after a credit bust is a grave mistake is because a credit bust unleashes deflationary market forces. Left untamed, a deflationary spiral may ensue driving many otherwise healthy businesses into bankruptcy. Nowadays, we hear “it’s a liquidity, not a solvency crisis.” With easy money, the Fed can stem the tide. Whenever the Fed has the upper hand, the glass is half full, “risk is on” as traders like to say; but then it appears that not quite enough money has been printed and, alas, the glass is half empty, “risk is off.” The high correlation across asset classes is, in our assessment, a direct result of the heavy involvement of policy makers. Sure, markets may move up when money is printed; the trouble is everything moves up in tandem, making it ever more difficult to find diversification, so that on the way down, investors find protection. It’s for that reason, by the way, that we focus on currencies: why bother taking on the noise of the equity markets if investors buy or sell securities merely because they try to front-run the next perceived intervention of policy makers? In our assessment, the currency markets are a great place to take a position on the “mania” of policy makers. Note that if one does not employ leverage, currencies are historically less risky than equities.

So we know Bernanke wants low interest rates. But there’s more to it: as we saw earlier this year, a string of good economic indicators sent the bond market into a nosedive. Treasuries were bailed out by subsequent mediocre economic news, allowing bond prices to recover. The challenge here, in our assessment of Bernanke’s thinking, is that the bond market can do the tightening for you. When Bernanke bragged in his Jackson Hole speech in late August that a well-behaved bond market is proof that his policies are well received, we had a more somber interpretation: the reason the bond market is well behaved is because the economy is in the doldrums. Let all the money that has been printed “stick”, i.e. let this economy kick into high gear. Sure, Bernanke says he can raise rates in 15 minutes (he can pay interest on deposits at the Fed), but given the leverage in the economy, any tightening that comes too early might undo all the “progress” that has been achieved so far. Differently said – and we are putting words into Bernanke’s mouth here – Bernanke has to err on the side of inflation.

But how do you err on the side of inflation, without the bond market throwing a fit? A central banker is most unlikely to ever call for higher inflation. You do it with “communication strategy”, a commitment to keeping interest rates low; you do it with quantitative easing, i.e. buying Mortgage-Backed and Treasury securities; you do it with Operation Twist, depressing yields by buying longer dated Treasury securities. But, “when inflation is already low…” as Bernanke stated in his 2002 “Helicopter Ben” speech, “the central bank should act more preemptively and more aggressively than usual.” How do you do that? First, you create an open-ended buying program, so that the market cannot price in all easing within moments of the announcements. And more importantly, you break the link between monetary policy and inflation. Bernanke wants to make sure investors realize that policy is now tied to a “substantial improvement in the labor market” rather than its inflation target. It’s only then that the Fed can go all out on promoting growth without having the bond market sell off.

Does it work? Judging from the initial market reaction, no. Bond prices have fallen, inflation expectations as expressed in the spreads between inflation protected Treasury securities (TIPS) and underlying Treasuries have shot higher. It might be because the dust from the Fed’s bombshell hasn’t settled; or it might be that the Fed hasn’t had time to intervene in the market by buying TIPS (while not extensively, the Fed has been buying TIPS on occasion) depressing inflation indicators.

Either way, however, many observers have wondered whether lowering interest rates a tad further is really the panacea the economy needs. Part of it is that mortgage rates aren’t falling at this stage, if for no other reason than banks have such dramatic backlogs, that they have little incentive to open the floodgates even more for further refinancing activity. But even without such backlogs, how many more projects are worth financing with the 10-year bond trading at 1.6% versus 1.8%? Interest rates are low, no matter how one slices it.

That leaves one other interpretation open. Don’t take our word for it, but read the 2002 Helicopter Ben speech: “Although a policy of intervening to affect the exchange value of the dollar is nowhere on the horizon today [in 2002], it’s worth noting that there have been times when exchange rate policy has been an effective weapon against deflation.” The argument here is that a lower dollar boosts exports and thus the economy. Ignored is the fact that Vietnam might try to compete on price, but an advanced economy should work hard to compete on value added. As such, we are only providing a dis-incentive to invest in competitiveness if the Fed’s printing press provides the illusion of competitiveness. We use the term printing press because it is Bernanke in the aforementioned 2002 speech that refers to the Fed’s buying of securities (QEn) as the electronic equivalent of the printing press.

So don’t let anyone fool you. Things are not complicated. In our assessment, the Fed may be out to debase the dollar. Investors may want to get rid of the textbook notion of a risk-free asset, as the purchasing power of the U.S. dollar may increasingly be at risk. There is no risk-free alternative, but investors may want to consider a managed basket of currencies including gold, akin to how some central banks manage their reserves, as a way to mitigate the risk that the Fed is getting what we think it is bargaining for.

Please sign up to our newsletter to be informed as we discuss global dynamics and their impact on gold and currencies. Engage with me directly at Twitter.com/AxelMerk to comment on Merk Insights and to receive provide real-time updates on the economy, currencies, and global dynamics.

Axel Merk

President and Chief Investment Officer, Merk Investments

Merk Investments, Manager of the Merk Funds

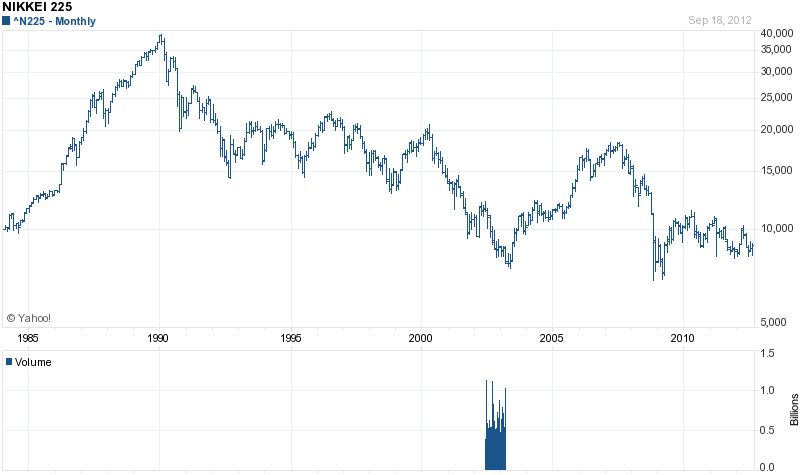

Japan Joins The QE Race – Who Can Print The Most Money?

After what appeared to be a coordinated effort by Europe and the U.S. to print their way to prosperity, Japan quickly joined the race to eternal QE with the surprise announcement of additional monetary easing.

After what appeared to be a coordinated effort by Europe and the U.S. to print their way to prosperity, Japan quickly joined the race to eternal QE with the surprise announcement of additional monetary easing.

TOKYO—The Bank of Japan took surprisingly strong steps to further ease its monetary policy on Wednesday, following similar steps by the Federal Reserve, as it tries to tackle entrenched deflation, an export-sapping strong yen and the impact of slowing global growth.

The central bank’s policy board decided at the end of a two-day meeting to increase the size of its asset-purchase program—the main tool for monetary easing with near-zero interest rates—to ¥80 trillion ($1.01 trillion) from ¥70 trillion.

The move came after the Fed introduced another round of quantitative easing last week, which put renewed upward pressure on the yen.

“These measures in pursuit of powerful monetary easing will make financial conditions for such economic entities as firms and households even more accommodative by further encouraging a decline in longer-term market interest rates and a reduction in risk premiums,” the central bank said in a statement released together with the rate decision.

Board members voted unanimously to expand the scope of the asset-purchase program. The BOJ also decided to leave its policy rate, or the unsecured overnight call loan rate, unchanged in a 0.0%-0.1% range.

Japan has been in an endless loop of money printing ever since stocks and real estate crashed in the early 1990’s after one of the biggest financial bubbles in history. Twenty years of quantitative easing and monetary stimulus have resulted in stagnant wages, the largest debt to GDP ratio in the world and a stock market that is still off 75% from its high. Except for printing additional money, Japan seems flat out of options for reviving its economy.

Does anyone really expect this desperation tactic to cure Japan’s problems?

It Should Be A Very Merry Christmas For Gold Investors

In an interview with Bloomberg TV, Greg Smith, chairman of Global Commodities, is forecasting $2,000 gold by Christmas.

Long term investors in gold would have a very merry Christmas since a price of $2,000 would equate to a 2012 price gain of over 25% from gold’s opening price on January 3, 2012.

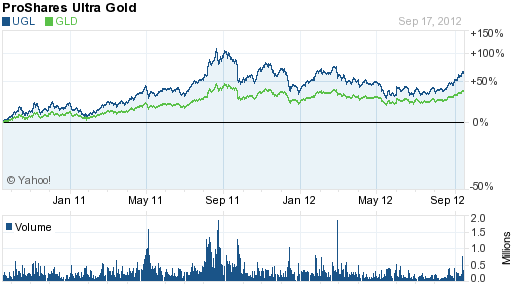

From today’s closing gold price, a $2,000 per ounce price by year end equates to a gain of $241 per ounce or 13.7%. Aggressive investors have many different ways to leverage gains on a potential run up in gold by year end. For example, a position in Pro Shares Ultra Gold (UGL) would yield a gain of about 27% if gold hits $2,000 by year end.

The UGL does not hold physical gold but rather invests in futures, forward contracts, options and swap agreements designed to yield gains of 200% of the daily performance of gold bullion. Last summer when gold soared to an all time high, the UGL returned twice the gains of the SPDR Gold Shares ETF (GLD). Keep in mind that leverage works both ways – if gold declines, an investment in the UGL would produce twice the losses compared to holding physical gold or shares in the GLD.

Courtesy: yahoo finance

$10,000 Gold Possible As Fed Ramps Up Money Printing

In the wake of the near death of the financial system in 2008, the Federal Reserve engaged in two rounds of quantitative easing and pumped trillions of dollars into banks and other financial institutions. Ben Bernanke insists that such drastic actions by the central bank were necessary to prevent a depression, a claim that economists will no doubt be debating for decades.

In the wake of the near death of the financial system in 2008, the Federal Reserve engaged in two rounds of quantitative easing and pumped trillions of dollars into banks and other financial institutions. Ben Bernanke insists that such drastic actions by the central bank were necessary to prevent a depression, a claim that economists will no doubt be debating for decades.

What may not be open to debate, however, is the wisdom of the Fed’s decision to engage in non stop money printing with the announcement of QE3. A policy tool previously applied to prevent a financial collapse has now become a routine operation in a desperate attempt to ramp up economic growth. The Federal Reserve seems oblivious to the fact that no nation in history has ever increased its wealth and real economic growth by resorting to the printing presses.

Three most probable outcomes of the Fed’s open ended money printing operations:

1. Continued decline in economic growth.

Following the Fed’s announcement of another round of permanent QE, Egan-Jones Cuts U.S. Rating.

Egan-Jones Ratings Co. cut its credit rating for the U.S. one level to AA-, citing the potential for the Federal Reserve’s third round of large-scale asset purchases to weaken the dollar and drive up inflation.

U.S. debt to gross-domestic-product has risen to 104 percent from 66 percent in 2006, Egan-Jones said today in a report. The firm lowered the U.S. to AA in April. Yields on 10- year Treasuries have fallen five basis points since the end of that month to 1.86 percent.

The Fed’s latest program will “stoke the stock market and commodity prices, but in our opinion will hurt the U.S. economy and, by extension, credit quality,” Egan-Jones said. “The increased cost of commodities will pressure profitability of businesses, and increase the costs of consumers, thereby reducing consumer purchasing power.”

The Fed yesterday announced its third round of large-scale asset purchases since 2008, saying it will buy $40 billion of mortgage debt a month. The central bank didn’t set any limit on the ultimate amount it would buy or the duration of the program. Policy makers also extended the prospect of near-zero interest rates until mid-2015 and said policy will stay accommodative “for a considerable time” even after the economy strengthens.

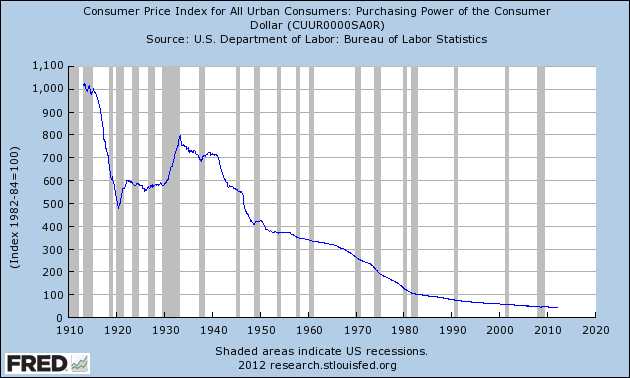

2. Continued destruction of the purchasing power of the U.S. dollar.

Federal Reserve policies have contributed to a dramatic decline in the purchasing power of the U.S. dollar for decades, resulting in a lower standard of living for Americans. Expanded money printing will accelerate this trend.

3. Continued increase in the price of gold.

The decade long rally in gold will dramatically accelerate. A Barron’s interview asks Could Fed Miscalculations Lead to $10,000 Gold?

These are times that try an asset manager’s soul. The world’s economy is a soft-paste porcelain vase set on a wobbly plant stand in the heart of an active earthquake zone. The Middle East is sending out foreshocks of war. The South China Sea is a smoking caldera of tension. Social unrest in the EU threatens tidal waves. And, according to the agitated rats and snakes of the financial press, China is headed into a recession.

Hedging against the most pessimistic case without crippling the upside potential of a better or even miraculous case appears to be as unsolvable as the proverbial Gordian knot. Alexander the Great “solved” the intellectually challenging knot riddle by severing it with his sword. Scott Minerd, chief investment officer of Guggenheim Partners, offers a more reasoned but equally simple solution to the hedging conundrum: gold. In extreme circumstances—like miscalculations regarding inflation by the Federal Reserve—the metal could hit $10,000 per troy ounce, he asserts. Thursday, after the Fed disclosed its latest financial-stimulus scheme, the metal rose about 2% to $1,768.

Minerd frets about the Fed’s ability to reduce its swollen $2.9 trillion balance sheet if rates suddenly were to rise. Because the assets have longer-term durations, their market value immediately would tumble. If rates rose 1%, the Fed would have a $150 billion capital deficit, he says. This would have negative ramifications for the dollar. Minerd says the über-wealthy have been migrating toward hard assets like gold, real estate, and art. Every portfolio should be partially composed of such assets, he asserts. Is yours?

Gold and Silver Blog has long argued that gold would eventually advance to at least $5,000. The latest Fed actions make that price target seem conservative.

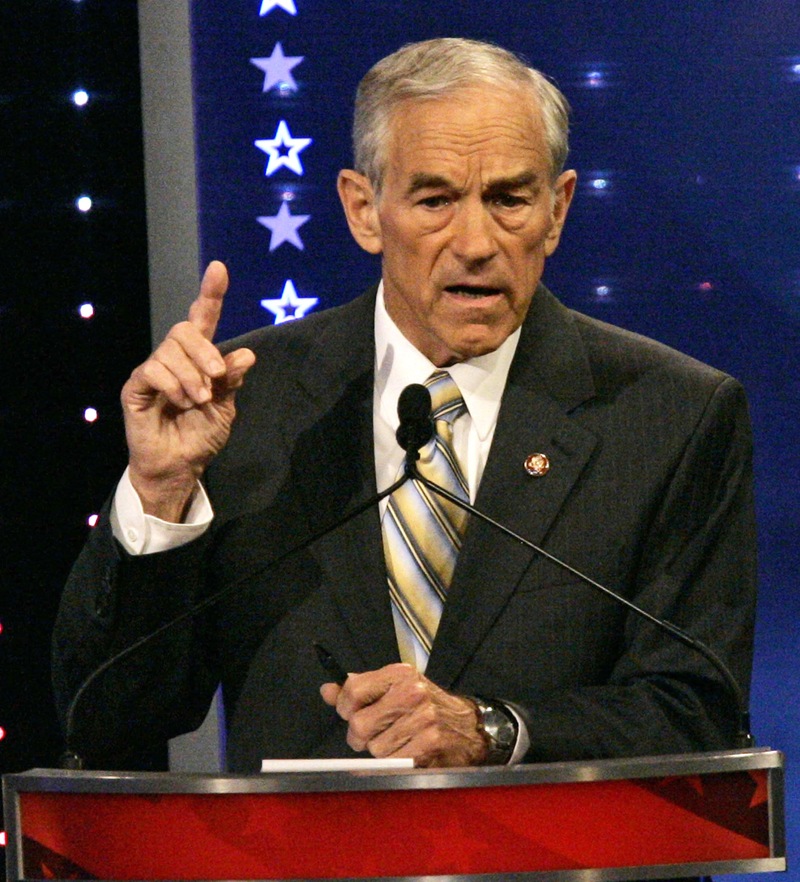

While Wall Street cheers the Federal Reserve’s decision to engage in perpetual quantitative easing, Congressman Ron Paul says the Fed is devastating the U.S. economy through its blatant manipulation of interest rates. According to Ron Paul, manipulating interest rates to the zero bound level has caused a massive misallocation of capital, destroyed the purchasing power of the U.S. dollar and will eventually lead to another financial crisis.

While Wall Street cheers the Federal Reserve’s decision to engage in perpetual quantitative easing, Congressman Ron Paul says the Fed is devastating the U.S. economy through its blatant manipulation of interest rates. According to Ron Paul, manipulating interest rates to the zero bound level has caused a massive misallocation of capital, destroyed the purchasing power of the U.S. dollar and will eventually lead to another financial crisis.

By

By

By Axel Merk

By Axel Merk