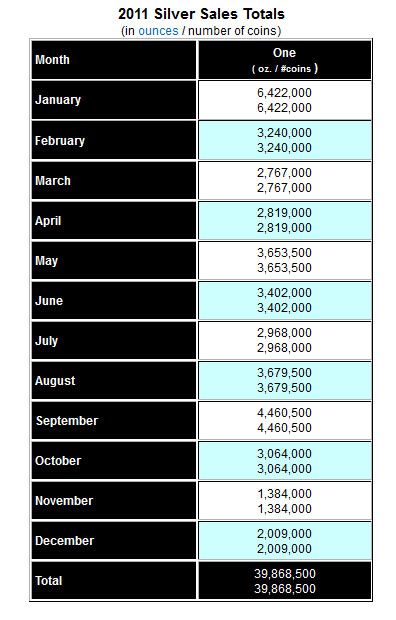

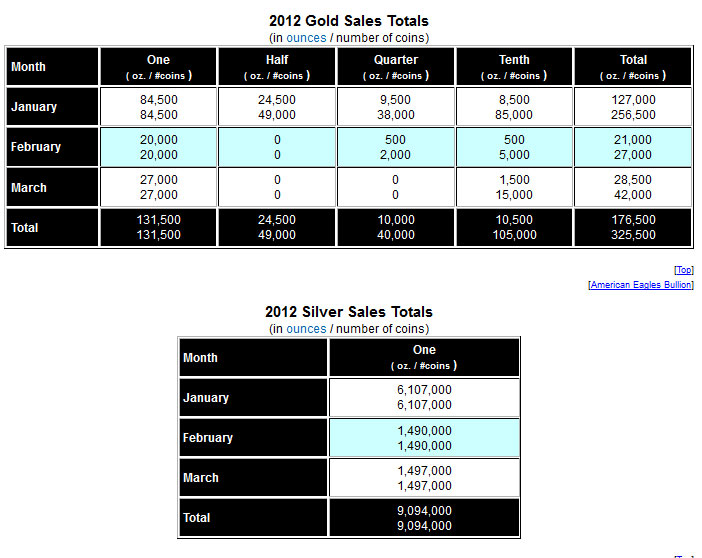

The U.S. Mint reports that March sales of the American Eagle Gold and Silver Bullion coins are on track to more than double from February sales levels. Sales during February were unusually low with gold bullion sales down 77.3% and silver bullion sales down 54% from the prior year. Shown below are the U.S. Mint sales figures for gold and silver bullion coins through March 15, 2012.

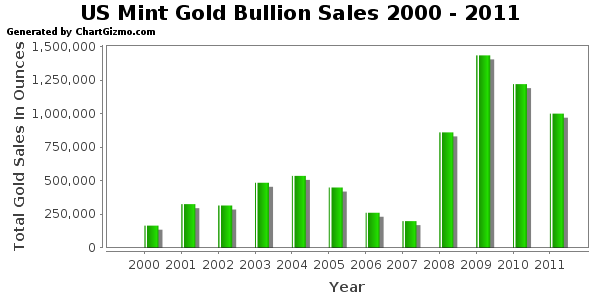

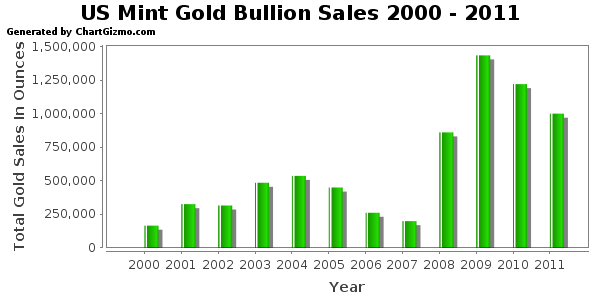

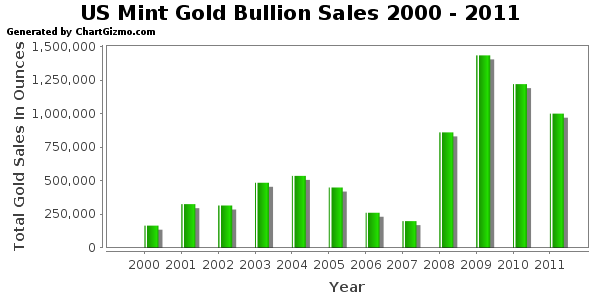

The U.S. Mint bullion program has been extremely popular with the public and sales of the bullion coins has soared since 2007. The gold and silver American Eagle bullion coins are sold by the U.S. Mint to authorized purchasers who pay the U.S. Mint for the cost of the metal plus a mark up to cover operating costs. The dealers, who are required to maintain a market for the coins, sell to the general public at the market price of the coin plus a premium to cover operating costs. The weight, purity and content of each bullion coin is guaranteed by the United States Mint.

The U.S. Mint bullion program has been extremely popular with the public and sales of the bullion coins has soared since 2007. The gold and silver American Eagle bullion coins are sold by the U.S. Mint to authorized purchasers who pay the U.S. Mint for the cost of the metal plus a mark up to cover operating costs. The dealers, who are required to maintain a market for the coins, sell to the general public at the market price of the coin plus a premium to cover operating costs. The weight, purity and content of each bullion coin is guaranteed by the United States Mint.

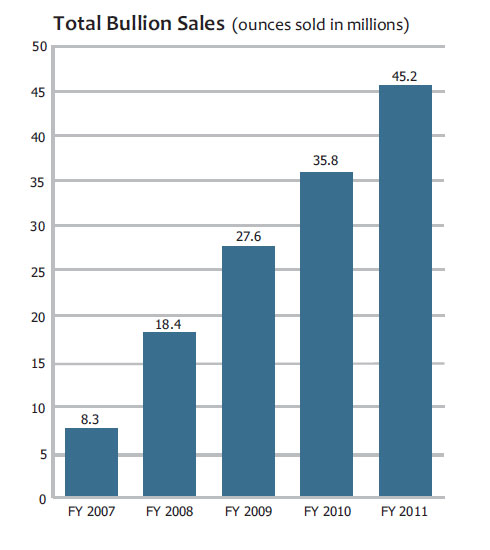

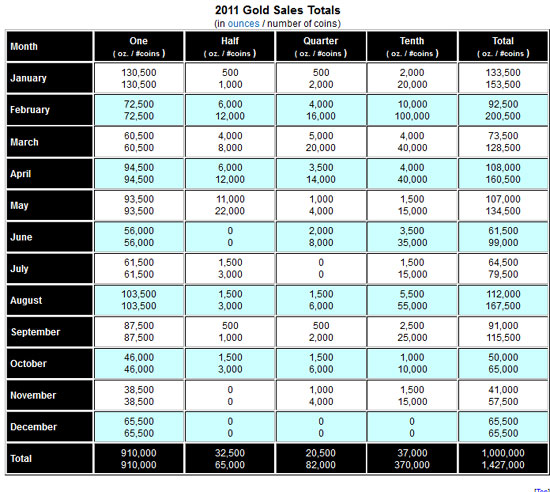

During the U.S. Mint’s fiscal year 2011, demand for bullion coins reached all time highs with sales of 45.2 million ounces of silver and gold bullion coins, up 26.2% from the prior year. Total U.S. Mint revenue from the sale of the bullion coins also hit an all time record high of $3.5 billion. Demand for the American Eagle Silver Bullion Coin was especially robust with sales more than doubling from the previous year’s total. Last year’s sales of the American Eagle Gold Bullion coins, however, declined by 22.7% due to the higher price of gold and a change in the product release schedule for the American Gold Buffalo Bullion coin.

The U.S. Mint also produces numismatic proof versions of the American Gold and Silver Eagles coins which are sold by the Mint directly to the public. Due to unprecedented demand for gold and silver, the U.S. Mint was unable to offer the proof coins during fiscal year 2009.

The top selling numismatic coin for the past two years was the American Eagle Silver Proof 1 ounce coin with sales of 850,000 coins in 2010 and 751,000 coins in 2011.

The 2012 American Silver Eagle Proof coin is scheduled to go on sale April 12, 2012 at an expected price of $59.95.