How Congress Stifles Innovative Coin Designs By U.S. Mint

Ever wonder why the U.S. Mint shows a lack of innovation in coin design compared to other world mints? Here’s part of the reason as detailed by Mint News Blog:

Many coin related bills are introduced each year, but only a small number become law. In order for a bill to become law, it must be passed by both the House and Senate and then signed into law by the President. Under Congressional rules, two-thirds of each body must co-sponsor a bill before it is even put up to a vote, which is the hurdle that many bills cannot meet. Another rule limits the number of commemorative coin programs to only two per year.

The most recent bill to become law was the National Baseball Hall of Fame Commemorative Coin Act. The bill H.R. 2527 was introduced on July 14, 2011, passed in the House of Representatives on October 26, 2011, passed by the Senate on July 12, 2012, and signed by the President on August 3, 2012.

The program calls for the minting and issuance of up to 50,000 $5 gold coins, 400,000 silver dollars, and 750,000 clad half dollars in recognition and celebration of the National Baseball Hall of Fame. These coins will be issued only during the one-year period beginning on January 1, 2014.

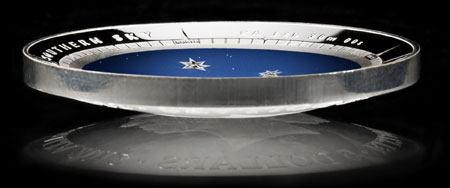

Mint New Blog goes on to discuss how the coin design will be unique with the reverse of the coin made convex and the obverse concave to enhance the resemblance to a baseball. The coin may resemble a recently produced dome shaped coin issued by the Royal Australian Mint as shown below.

The commemorative baseball coin would represent the first innovation in coin design by the U.S. Mint since 2000 when the Library of Congress $10 coin was produced, which was the first and only US Mint bimetallic coin. While the new baseball coin will certainly increase public interest in precious metal coins, Congress should grant the U.S. Mint more latitude to produce a wide variety of innovative coins without an onerous legislative process.

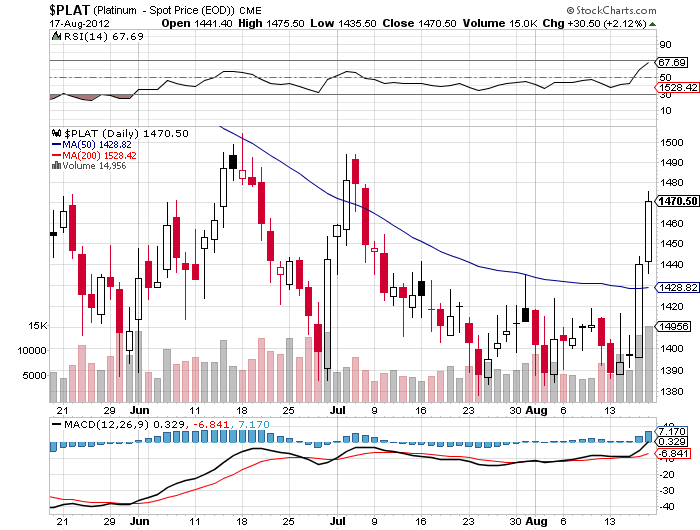

South Africa continues to be wracked by violence as striking platinum mine workers clash with police. In a confrontation between police and striking mine workers, a gunbattle resulted in the shooting deaths of 34 miners.

South Africa continues to be wracked by violence as striking platinum mine workers clash with police. In a confrontation between police and striking mine workers, a gunbattle resulted in the shooting deaths of 34 miners.

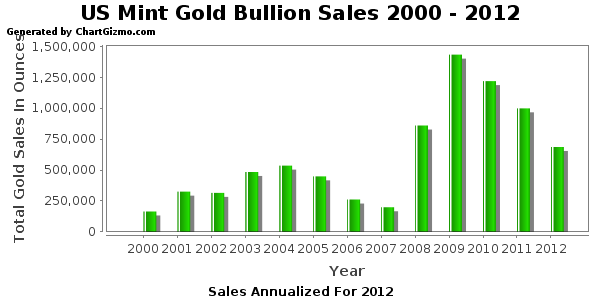

The latest sales figures from the U.S. Mint show that sales of both gold and silver bullion coins declined dramatically during July. While sales of silver bullion coins have remained at historically high levels, sales of the gold bullion coins have been in a steep decline since 2009.

The latest sales figures from the U.S. Mint show that sales of both gold and silver bullion coins declined dramatically during July. While sales of silver bullion coins have remained at historically high levels, sales of the gold bullion coins have been in a steep decline since 2009.

According to the latest report from the U.S. Mint, sales of gold bullion coins increased by over 13% during June, while total sales of the silver bullion coins were essentially unchanged from May.

According to the latest report from the U.S. Mint, sales of gold bullion coins increased by over 13% during June, while total sales of the silver bullion coins were essentially unchanged from May.

According to the latest report from the U.S. Mint, sales of both gold and silver bullion coins rebounded strongly during May.

According to the latest report from the U.S. Mint, sales of both gold and silver bullion coins rebounded strongly during May. The latest sales figures from the U.S. Mint show a continuing trend of lower gold bullion coin sales. Sales of American Gold Eagle bullion coins hit an all time high in 2009 when the Mint sold 1,435,000 ounces. During 2010, sales declined to 1.2 million ounces and in 2011 only 1 million ounces of gold bullion coins were sold.

The latest sales figures from the U.S. Mint show a continuing trend of lower gold bullion coin sales. Sales of American Gold Eagle bullion coins hit an all time high in 2009 when the Mint sold 1,435,000 ounces. During 2010, sales declined to 1.2 million ounces and in 2011 only 1 million ounces of gold bullion coins were sold.