As predicted many times in this blog, the over indebted and over leveraged world financial system is starting to unravel at warp speed. Massive amounts of borrowing by governments during the financial meltdown of 2008 has effectively put many sovereign states at the limits of their borrowing ability.

As predicted many times in this blog, the over indebted and over leveraged world financial system is starting to unravel at warp speed. Massive amounts of borrowing by governments during the financial meltdown of 2008 has effectively put many sovereign states at the limits of their borrowing ability.

A rapidly contracting economy and job losses will result in a flood of defaults in the private sector by both businesses and individuals. A vicious self reinforcing cycle of defaults will cause major banking failures that a bankrupt FDIC will be unable to contain. Banking holidays will become routine, the jobless rate will triple, the middle class will face financial destruction and social unrest will explode across the country.

Crushing levels of debt will be the trigger that causes an economic depression that will make the 1930’s look like a minor recession. Eventually, the creative destruction of capitalism (as described by economist Joseph Schumpeter) will extinguish debt burdens through defaults, allow for economic recovery and the creation of new wealth. The downside to recovery through creative destruction, however, is that existing wealth is mercilessly devalued as paper based asset wealth is destroyed. At this point, which would you prefer to own – a pile of paper dollars or a stack of American Gold Eagles?

The ultimate restructuring of a fiat based monetary system to one backed by more than promises is inevitable. The timing of the event is the only open question since governments will use every power, legal or otherwise, to prevent the scenario described above. Unfortunately, for holders of paper financial assets, the only viable option available for governments at this point are the printing presses. The ocean of paper currencies that will be printed to “save the system” will debase paper financial assets, reducing their purchasing power to virtually nothing.

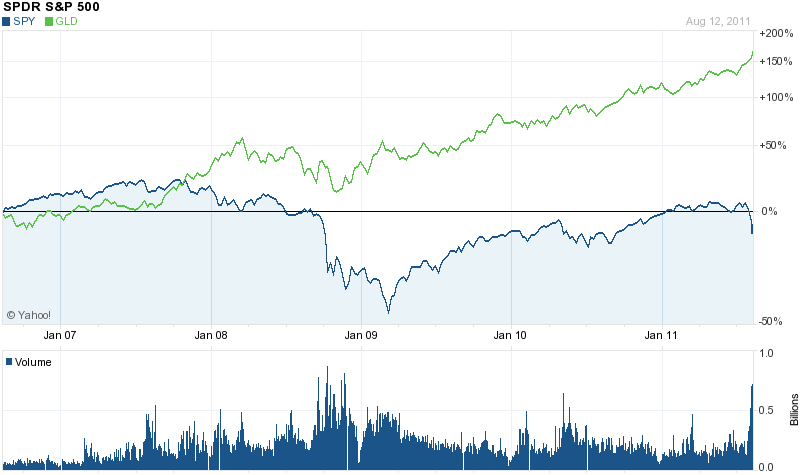

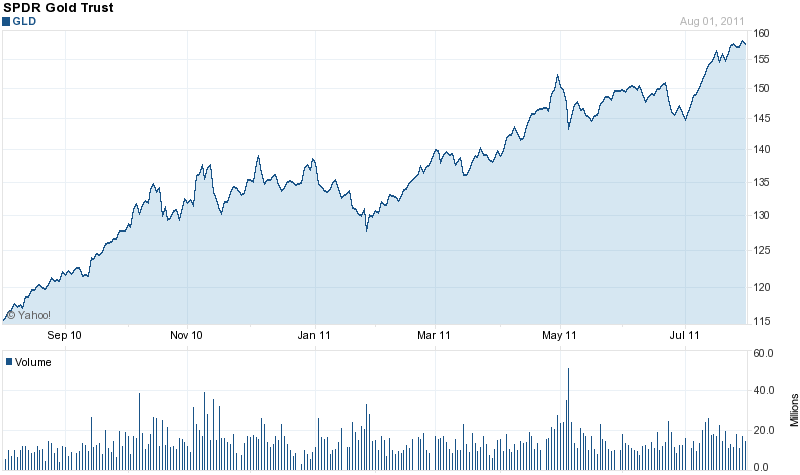

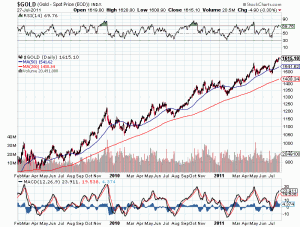

Gold, the only enduring currency, has been forecasting a financial crisis for the past decade and especially since 2008. As economic Armageddon looms, however, most Americans remain tragically under invested in gold and silver. Conventional financial planners and investment advisers recommend a zero or minor position in precious metals even as gold steadily outperforms stocks, bank savings and other financial assets.

Making matters worse, many Americans are selling the little amount of gold and silver that they do own as the conventional press publishes “gold bubble” articles every time gold hits a new high. As reported in coinupdate.com, one major dealer reports that:

As for the general public, they have been selling jewelry by the droves this past week. On Tuesday, my companies set a record going back more than 30 years for the most number of purchases from the public in a single day. We broke that record Wednesday and weren’t that far from another all-time record on Thursday. The main pieces that customers have brought to us have been gold jewelry. The amount of silver and platinum jewelry has remained steady.

We talk with dozens of coin dealers around Michigan and the country every day. They are reporting the exact same pattern of activity as we are experiencing.

Perhaps many of these sellers are dumping their gold jewelry due to economic duress, but if they were expecting gold to continue to soar higher, they would not be selling. The bull market in gold and silver is just beginning and those who hold significant positions will preserve and expand their wealth.