After the furious pace of sales experienced during January for the United States Mint’s American Silver Eagle and American Gold Eagle bullion coins, the current month is progressing at a more measured pace. For the week ending February 9, 2011, the US Mint recorded sales of 847,000 ounces worth of silver and 18,000 ounces worth of gold.

After the furious pace of sales experienced during January for the United States Mint’s American Silver Eagle and American Gold Eagle bullion coins, the current month is progressing at a more measured pace. For the week ending February 9, 2011, the US Mint recorded sales of 847,000 ounces worth of silver and 18,000 ounces worth of gold.

The US Mint offers several bullion coin options in order to provide investors with a convenient and cost effective method for physical precious metals investment. The programs include 22 karat gold coins in one ounce, one-half ounce, one-quarter ounce, and one-tenth ounce sizes; 24 karat gold coins in one ounce size; .999 fine silver coins in one ounce and five ounce sizes; and platinum coins in one ounce, one-half ounce, one-quarter ounce, and one-tenth ounce size.

For the year to date, the US Mint has only offered the one ounce Silver Eagle and 22 karat Gold Eagle bullion coins. The Gold Eagles are available in one ounce size bearing the 2011 date, with some remaining amounts of the fractional weight coins bearing the 2010 date. The remaining bullion coin options have not yet been released.

US Mint Bullion Coin Program Sales 2/9/2011 (ounces)

| Prior Week | Month to Date | Year to Date | |

| American Silver Eagle | 847,000 | 897,000 | 7,319,000 |

| American Gold Eagle | 18,000 | 24,000 | 139,500 |

| America the Beautiful Silver | 0 | 0 | 0 |

| American Platinum Eagle | 0 | 0 | 0 |

| American Gold Buffalo | 0 | 0 | 0 |

Last year, the US Mint recorded sales of 34,662,500 ounces worth of American Silver Eagles and 1,220,500 ounces worth of American Gold Eagles. The amount of silver bullion sold represented an all time record.

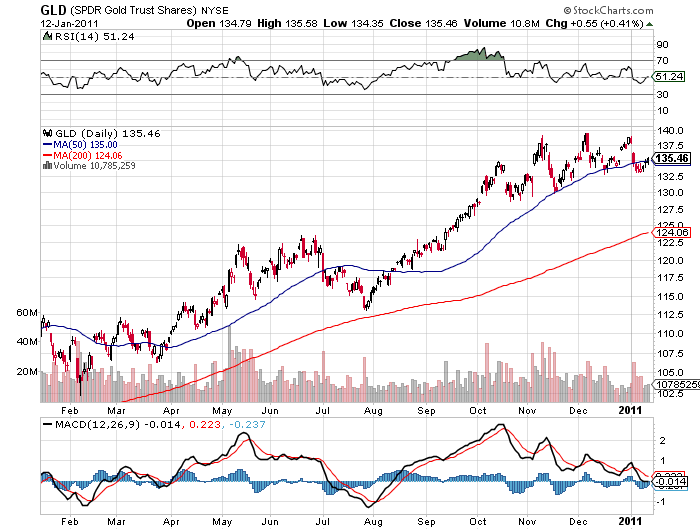

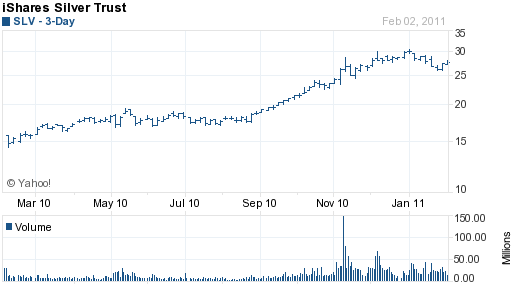

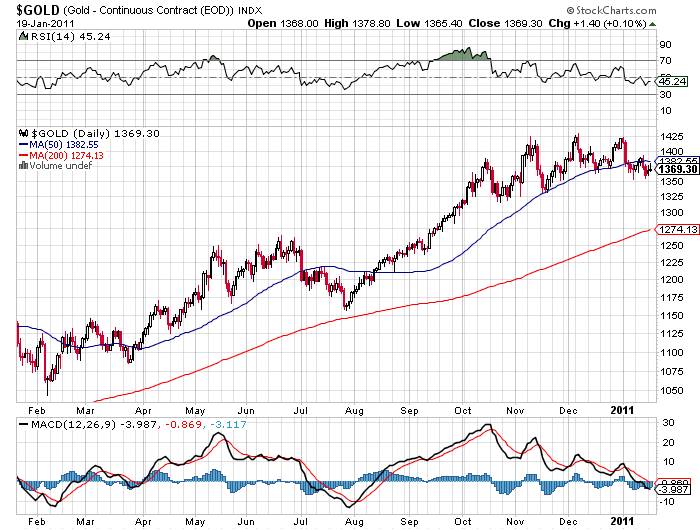

The SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV) both registered small declines over the past week as the price of gold and silver recovered some ground.

The SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV) both registered small declines over the past week as the price of gold and silver recovered some ground.

The pace of sales for the United States Mint’s American Gold Eagle and American Silver Eagle bullion coins jumped in the past week. This propelled silver bullion sales far into record territory for the month of January.

The pace of sales for the United States Mint’s American Gold Eagle and American Silver Eagle bullion coins jumped in the past week. This propelled silver bullion sales far into record territory for the month of January. Both the SPDR Gold Share Trust (GLD) and the iShares Silver Trust (SLV) registered minor declines over the past week.

Both the SPDR Gold Share Trust (GLD) and the iShares Silver Trust (SLV) registered minor declines over the past week.

After generating some mainstream media attention for the record pace of sales, United States Mint bullion coins had a quiet week. According to figures provided by the Mint, only 136,000 ounces of American Silver Eagles and 7,500 ounces of American Gold Eagles were sold in the past week.

After generating some mainstream media attention for the record pace of sales, United States Mint bullion coins had a quiet week. According to figures provided by the Mint, only 136,000 ounces of American Silver Eagles and 7,500 ounces of American Gold Eagles were sold in the past week. Given the recent pullback in the prices of gold and silver, it was not unexpected to see another decline in the holdings of both the SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV).

Given the recent pullback in the prices of gold and silver, it was not unexpected to see another decline in the holdings of both the SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV).

As gold and silver continue to trade in a narrow range, investors have reduced their holdings in both the SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV).

As gold and silver continue to trade in a narrow range, investors have reduced their holdings in both the SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV).

United States Mint bullion coin sales remained robust for the two available options. In the prior week, authorized purchasers ordered 1,322,000 ounces of American Silver Eagles and 25,000 ounces of American Gold Eagles.

United States Mint bullion coin sales remained robust for the two available options. In the prior week, authorized purchasers ordered 1,322,000 ounces of American Silver Eagles and 25,000 ounces of American Gold Eagles.