The SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV) both registered small declines over the past week as the price of gold and silver recovered some ground.

The SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV) both registered small declines over the past week as the price of gold and silver recovered some ground.

Holdings in the GLD declined by .71 tonnes compared to a decline of 2.43 tonnes in the previous week. Total holdings have now declined by 4.2% or 54.28 tonnes since the start of the new year. The GLD currently holds 1,226.44 tonnes or 39.4 million ounces of gold valued at $53.8 billion.

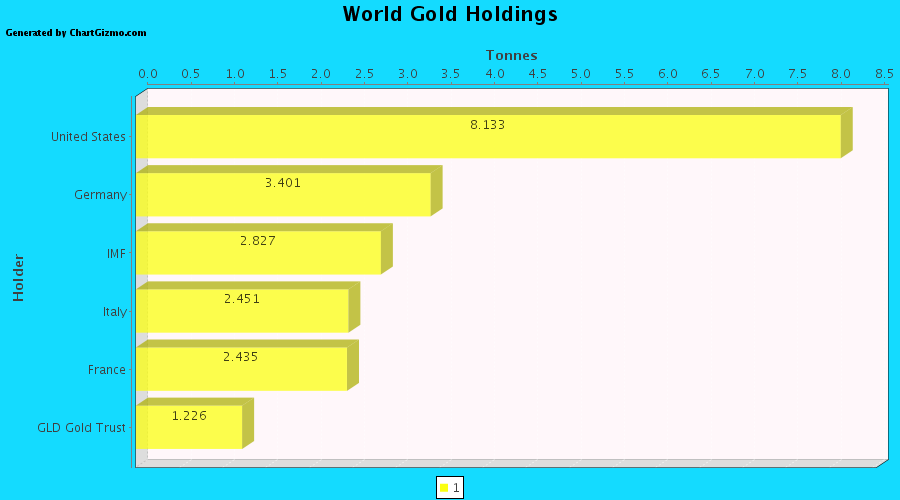

Since launching in November 2004, the Gold Shares Trust has grown very rapidly and is now one of the largest gold holders in the world. The latest stats show the GLD holding 172.34 more tonnes of gold than China at 1,054.1 tonnes. From zero at its inception, the GLD has become the world’s sixth largest holder of gold in less than seven years.

The GLD came into existence at a very auspicious moment in financial history. As the worst financial crisis since the Depression unfolded, some of the country’s largest banks failed. The entire financial system seemed to be heading for collapse. Trillions of dollars in government aid stabilized the banking industry but there were plenty of nervous investors who viewed gold as the last monetary refuge.

Gold does not have the inherent counter-party risk that exists with paper financial assets. An investor purchasing gold does not have to worry about being bailed out of a gold investment. Gold and silver have intrinsic value that rapacious governments cannot destroy.

The SPDR Gold Share Trust opened the market to a flood of new buyers who were enticed by a very easy and low cost purchase process. Prior to the GLD, it took a dedicated gold buyer to search for a dealer, check credentials, physically drive to the dealer to pick up a gold purchase, followed by another trip to the safe deposit box. Commissions on the GLD were minimal compared to the markup at dealers. The GLD made buying gold simple with low markups and little transaction friction. Investors, many of whom had never before owned gold, rushed into the GLD which became the fastest growing ETF in history.

The GLD launched in November 2004 when gold was trading at approximately $445 per ounce. Shortly afterward, gold entered a long term rise concurrent with the geometric increase in GLD gold holdings. The price of bullion tripled to the current level of $1361.

GLD and SLV Holdings (metric tonnes)

| 9-Feb-11 | Weekly Change | YTD Change | |

| GLD | 1,226.44 | -0.71 | -54.28 |

| SLV | 10,370.22 | -30.38 | -551.35 |

Silver holdings in the iShares Silver Trust (SLV) declined by 30.38 tonnes over the past week compared to a decline in the previous week of 47.10 tonnes. The year to date decline of 551.35 tonnes represents a 5% drop in silver holdings. The SLV has declined by a very modest 2.5% from its high of $30.40 at the beginning of the year. After a huge gain of 67% in the price of silver since late last year, it is normal to see price consolidation before another advance.