Silver holdings in the iShares Silver Trust (SLV) continued to skyrocket, while holdings of gold in the SPDR Gold Shares Trust (GLD) experienced a modest increase.

Silver holdings in the iShares Silver Trust (SLV) continued to skyrocket, while holdings of gold in the SPDR Gold Shares Trust (GLD) experienced a modest increase.

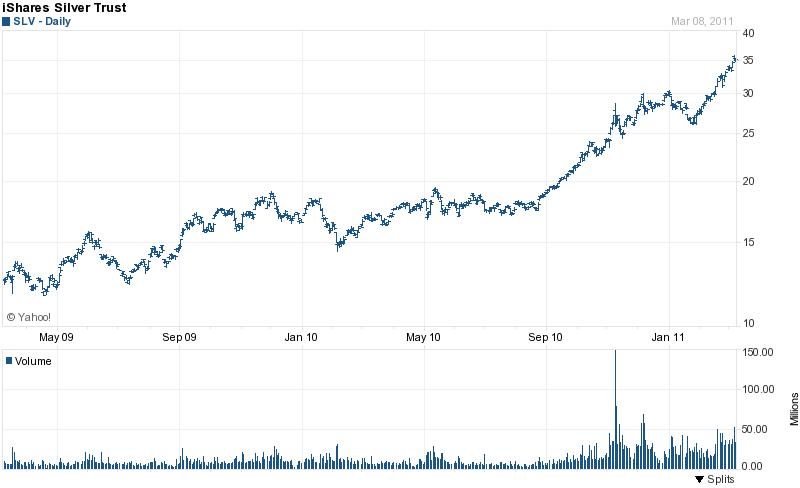

The iShares Silver Trust (SLV) holdings increased by 209.54 tonnes in the latest week. The prior two weeks have seen increases of 189.29 tonnes and 164 tonnes. Total holdings of the SLV are now 52.49 tonnes higher than at the beginning of the year. The SLV holds 352.8 million ounces of silver valued at $12.76 billion.

The holdings of silver in the iShares Silver Trust have now exceeded peak holdings reached at the beginning of the year. Silver has moved relentlessly higher in price since last August. After a brief price correction in January which brought silver down to the $26 level, silver prices have exploded to more than $36 per ounce, a gain of 38% in less than two months.

Given the huge run up in the price of silver, it is not surprising to see holdings of the SLV increase dramatically. The SLV is a proxy for investors who chose to invest in silver without the cost and inconvenience of holding physical silver. Purchasing the SLV allows an investor to take an immediate position in silver and without the markups associated with physically purchasing bars or coins.

The annual expense ratio of the SLV is only 0.5% compared to common markups of 5% to 10% when purchasing physical bullion or coins from a dealer. The SLV has been wildly popular with investors since it was launched and has provided huge returns to patient investors. The SLV has risen from below $10 in October 2008 to its closing price today of $35.27 for a gain of over 250%. A purchase of a thousand shares of the SLV at the low of $9.13 in October 2008 would have resulted in profits of $26,140.

SLV - Yahoo Finance

It has been over 30 years since silver hit its all time high price of $48.70 in January 1980. Huge investment and industrial demand as well as physical shortages of silver are all factors that could easily push silver to a new all time high. Silver has been making up for lost time and has dramatically outperformed the price movement in gold. A reversion to the centuries old gold silver ratio could easily push silver prices towards the $100 per ounce level.

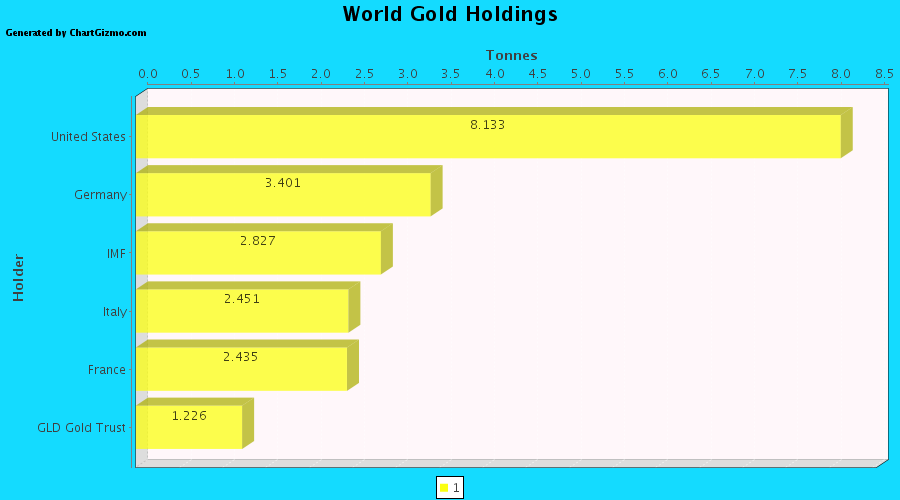

GLD and SLV Holdings (metric tonnes)

| 9-March-11 | Weekly Change | YTD Change | |

| GLD | 1,217.30 | +6.34 | -63.42 |

| SLV | 10,974.06 | +209.54 | +52.49 |

Holdings in the SPDR Gold Shares Trust (GLD) saw a jump in holdings of nearly 7 tonnes on Monday of this week, which is the largest increase in daily holdings seen in the past two months. The GLD increased holdings by over 6 tonnes for the week after modest declines in the previous two weeks. Total GLD holdings are still lower than the beginning of the year by 63.42 tonnes. The GLD currently holds 39.14 million ounces of gold valued at almost $56 billion.

Since its launch in November 2004 when gold was trading at $445 per ounce, the GLD has been an extremely profitable investment. As the price of silver broke out and hit new highs, gold has still not decisively broken through its trading range in the low $1400’s. Gold made a strong move up from $1150 last August and has been consolidating sideways since breaching the $1400 level.

The SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV) both registered small declines over the past week as the price of gold and silver recovered some ground.

The SPDR Gold Shares Trust (GLD) and the iShares Silver Trust (SLV) both registered small declines over the past week as the price of gold and silver recovered some ground.